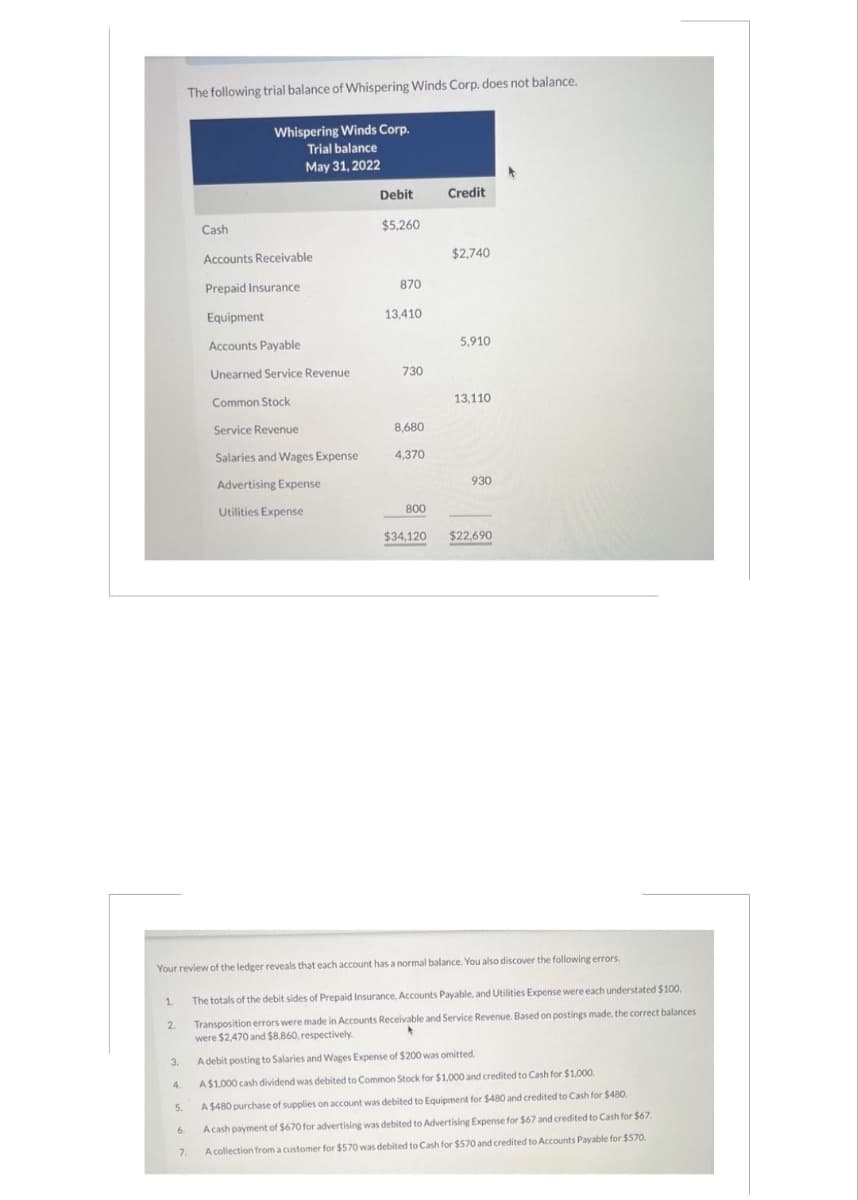

The following trial balance of Whispering Winds Corp. does not balance.

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter14: Activities Required In Completing A Quality Audit

Section: Chapter Questions

Problem 65RSCQ

Related questions

Question

Don't give answer in image format

Transcribed Image Text:1.

2.

3.

4.

5.

The following trial balance of Whispering Winds Corp. does not balance.

Whispering Winds Corp.

Trial balance

May 31, 2022

6.

Cash

Accounts Receivable

Prepaid Insurance

Equipment

Accounts Payable

Unearned Service Revenue

Common Stock

Service Revenue

Salaries and Wages Expense

Advertising Expense

Utilities Expense

7.

Debit

$5,260

870

13,410

730

8,680

4,370

800

Your review of the ledger reveals that each account has a normal balance. You also discover the following errors.

The totals of the debit sides of Prepaid Insurance, Accounts Payable, and Utilities Expense were each understated $100,

Transposition errors were made in Accounts Receivable and Service Revenue. Based on postings made, the correct balances

were $2,470 and $8,860, respectively.

Credit

$2,740

5,910

13,110

930

$34,120 $22,690

A debit posting to Salaries and Wages Expense of $200 was omitted.

A $1,000 cash dividend was debited to Common Stock for $1,000 and credited to Cash for $1,000.

A $480 purchase of supplies on account was debited to Equipment for $480 and credited to Cash for $480.

A cash payment of $670 for advertising was debited to Advertising Expense for $67 and credited to Cash for $67.

A collection from a customer for $570 was debited to Cash for $570 and credited to Accounts Payable for $570.

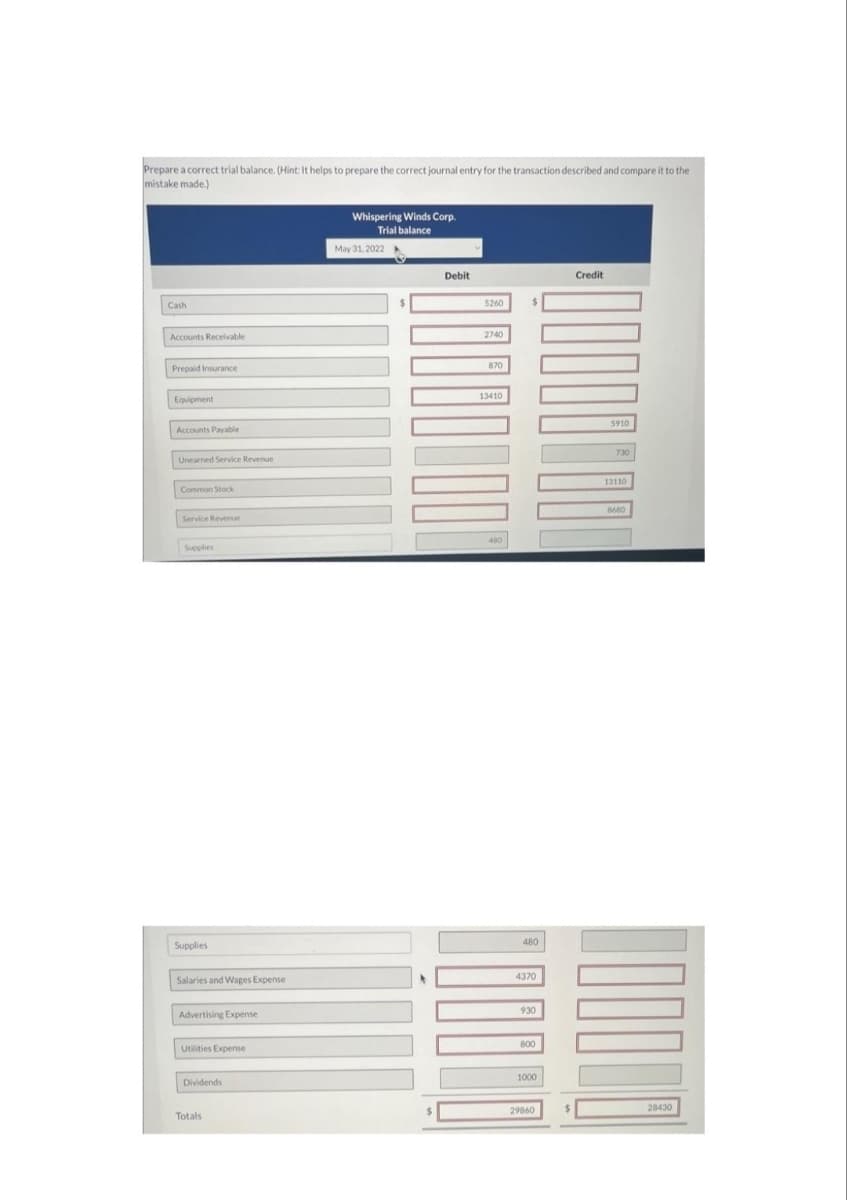

Transcribed Image Text:Prepare a correct trial balance. (Hint: It helps to prepare the correct journal entry for the transaction described and compare it to the

mistake made.)

Cash

Accounts Receivable

Prepaid Insurance

Equipment

Accounts Payable

Unearned Service Revenue

Common Stock

Service Revenue

Supplies

Supplies

Salaries and Wages Expense

Advertising Expense

Utilities Expense

Dividends

Totals

Whispering Winds Corp.

Trial balance

May 31, 2022

Debit

5260

2740

870

13410

480

$

480

4370

930

800

1000

29860

$

Credit

5910

730

13110

8680

28430

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning