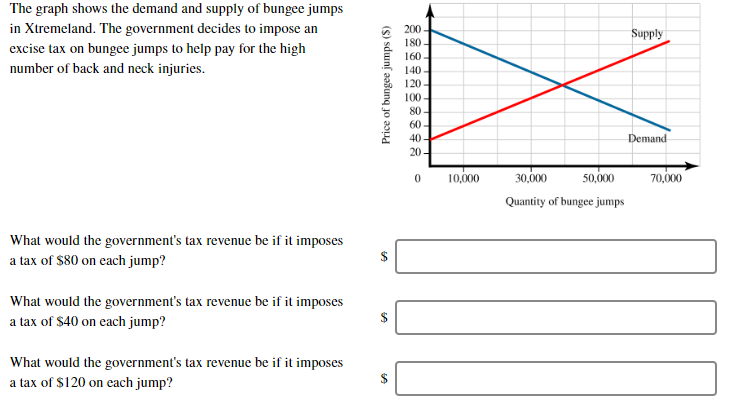

The graph shows the demand and supply of bungee jumps in Xtremeland. The government decides to impose an 200 Supply 180 excise tax on bungee jumps to help pay for the high 160 number of back and neck injuries. 140 120- 100- 80 60- 40 Demand 20- 50,000 0 10,000 30,000 70,000 Quantity of bungee jumps What would the government's tax revenue be if it imposes a tax of $80 on each jump? What would the government's tax revenue be if it imposes a tax of $40 on each jump? What would the government's tax revenue be if it imposes a tax of $120 on each jump? Price of bungee jumps (S) What principle of taxation does the graph help demonstrate? the higher the tax rate, the higher the revenue the lower the tax rate, the lower the revenue setting too high a tax rate can reduce tax revenue the higher the tax rate, the lower the deadweight loss

The graph shows the demand and supply of bungee jumps in Xtremeland. The government decides to impose an 200 Supply 180 excise tax on bungee jumps to help pay for the high 160 number of back and neck injuries. 140 120- 100- 80 60- 40 Demand 20- 50,000 0 10,000 30,000 70,000 Quantity of bungee jumps What would the government's tax revenue be if it imposes a tax of $80 on each jump? What would the government's tax revenue be if it imposes a tax of $40 on each jump? What would the government's tax revenue be if it imposes a tax of $120 on each jump? Price of bungee jumps (S) What principle of taxation does the graph help demonstrate? the higher the tax rate, the higher the revenue the lower the tax rate, the lower the revenue setting too high a tax rate can reduce tax revenue the higher the tax rate, the lower the deadweight loss

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter8: Application: The Cost Of Taxation

Section: Chapter Questions

Problem 5CQQ

Related questions

Question

Transcribed Image Text:The graph shows the demand and supply of bungee jumps

in Xtremeland. The government decides to impose an

200

Supply

180

excise tax on bungee jumps to help pay for the high

160

number of back and neck injuries.

140

120-

100-

80

60-

40

Demand

20-

50,000

0

10,000

30,000

70,000

Quantity of bungee jumps

What would the government's tax revenue be if it imposes

a tax of $80 on each jump?

What would the government's tax revenue be if it imposes

a tax of $40 on each jump?

What would the government's tax revenue be if it imposes

a tax of $120 on each jump?

Price of bungee jumps (S)

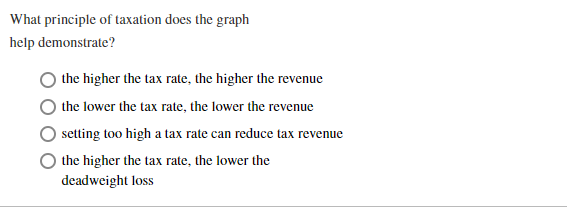

Transcribed Image Text:What principle of taxation does the graph

help demonstrate?

the higher the tax rate, the higher the revenue

the lower the tax rate, the lower the revenue

setting too high a tax rate can reduce tax revenue

the higher the tax rate, the lower the

deadweight loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning