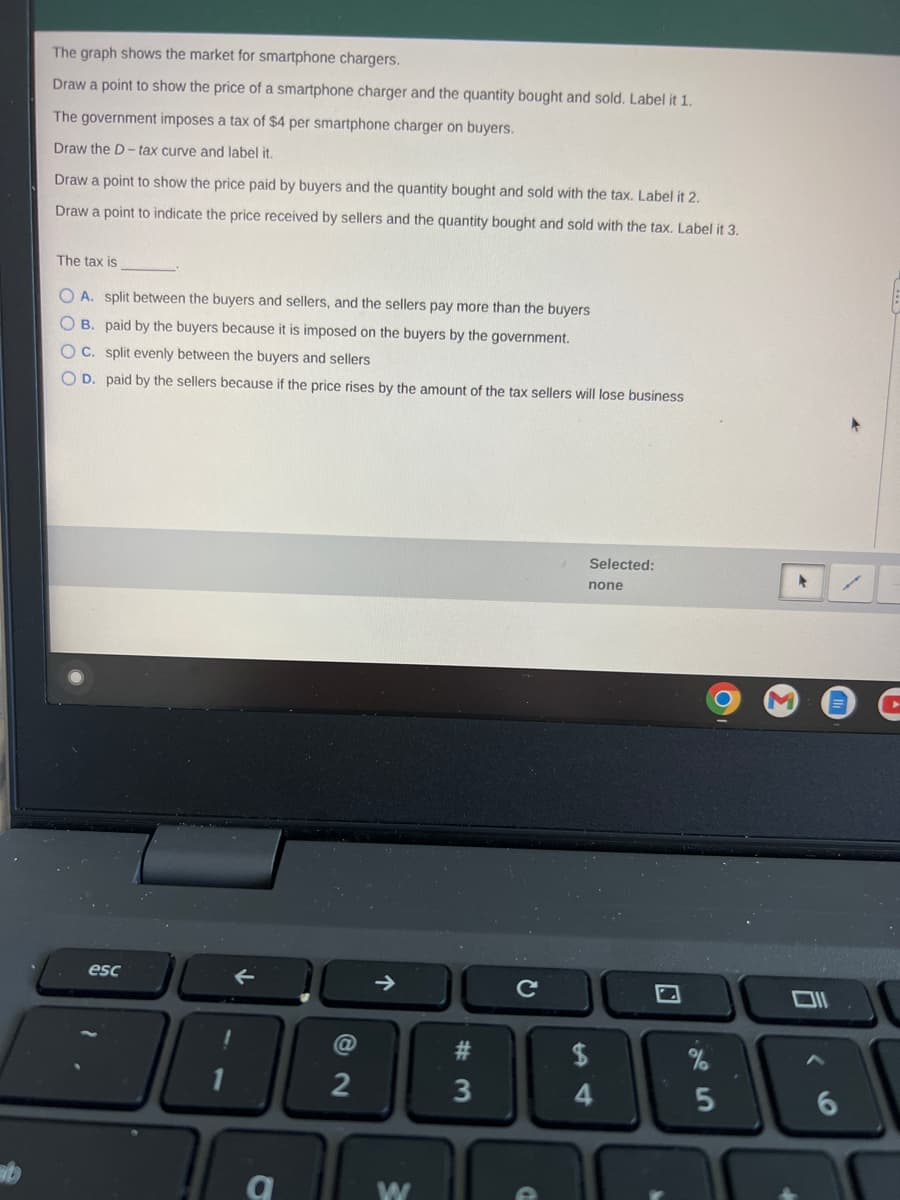

The graph shows the market for smartphone chargers. Draw a point to show the price of a smartphone charger and the quantity bought and sold. Label it 1. The government imposes a tax of $4 per smartphone charger on buyers. Draw the D-tax curve and label it. Draw a point to show the price paid by buyers and the quantity bought and sold with the tax. Label it 2. Draw a point to indicate the price received by sellers and the quantity bought and sold with the tax. Label it 3. The tax is OA. split between the buyers and sellers, and the sellers pay more than the buyers

The graph shows the market for smartphone chargers. Draw a point to show the price of a smartphone charger and the quantity bought and sold. Label it 1. The government imposes a tax of $4 per smartphone charger on buyers. Draw the D-tax curve and label it. Draw a point to show the price paid by buyers and the quantity bought and sold with the tax. Label it 2. Draw a point to indicate the price received by sellers and the quantity bought and sold with the tax. Label it 3. The tax is OA. split between the buyers and sellers, and the sellers pay more than the buyers

Microeconomics: Principles & Policy

14th Edition

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:William J. Baumol, Alan S. Blinder, John L. Solow

Chapter17: Taxation And Resource Allocation

Section: Chapter Questions

Problem 2DQ

Related questions

Question

Transcribed Image Text:The graph shows the market for smartphone chargers.

Draw a point to show the price of a smartphone charger and the quantity bought and sold. Label it 1.

The government imposes a tax of $4 per smartphone charger on buyers.

Draw the D-tax curve and label it.

Draw a point to show the price paid by buyers and the quantity bought and sold with the tax. Label it 2.

Draw a point to indicate the price received by sellers and the quantity bought and sold with the tax. Label it 3.

The tax is

O A. split between the buyers and sellers, and the sellers pay more than the buyers

OB. paid by the buyers because it is imposed on the buyers by the government.

OC. split evenly between the buyers and sellers

OD. paid by the sellers because if the price rises by the amount of the tax sellers will lose business

esc

个

@

2

W

#

3

C

Selected:

none

4

%

5

6

Transcribed Image Text:Delete Clear

?

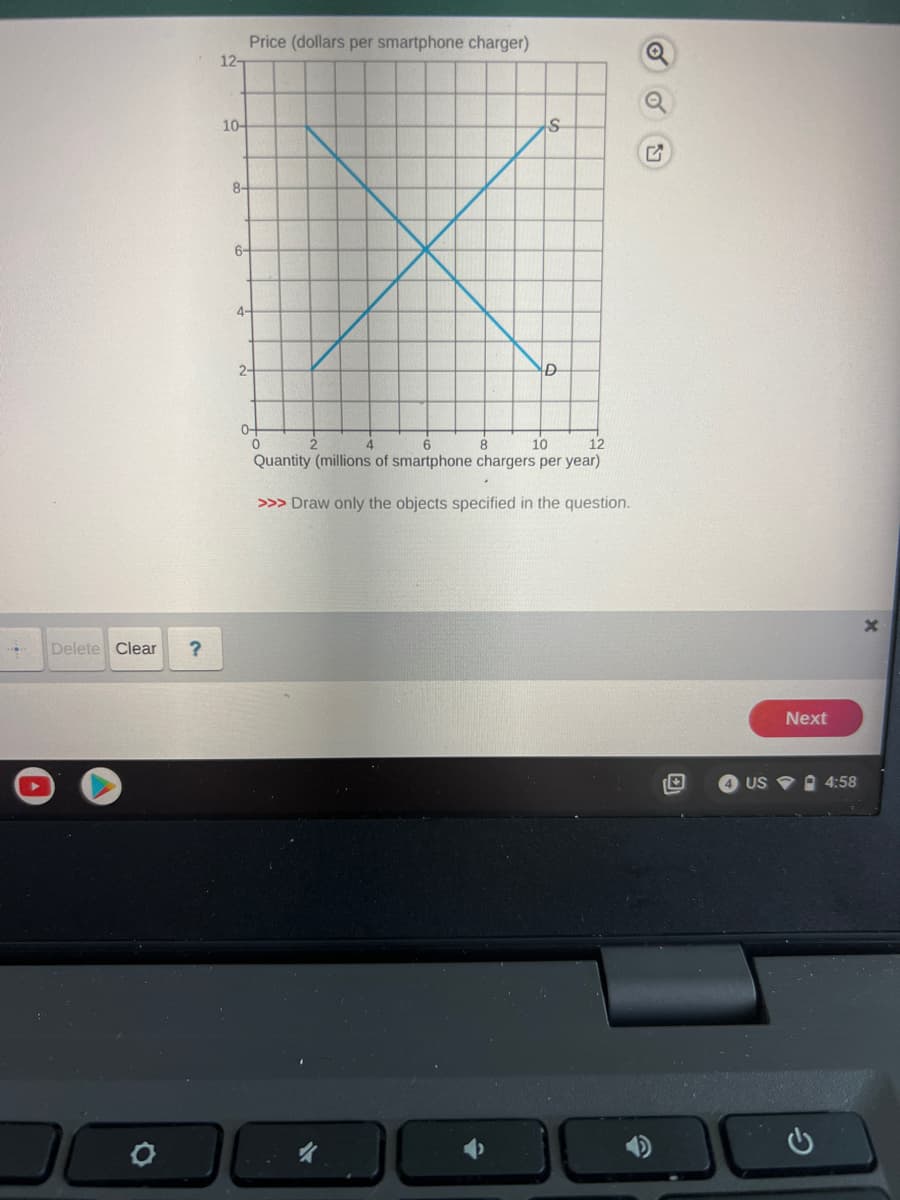

12-

10-

8-

Price (dollars per smartphone charger)

6-

4-

2-

0-

0

2

S

D

6

8

10

12

Quantity (millions of smartphone chargers per year)

>>> Draw only the objects specified in the question.

o

57

Next

4 US 4:58

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning