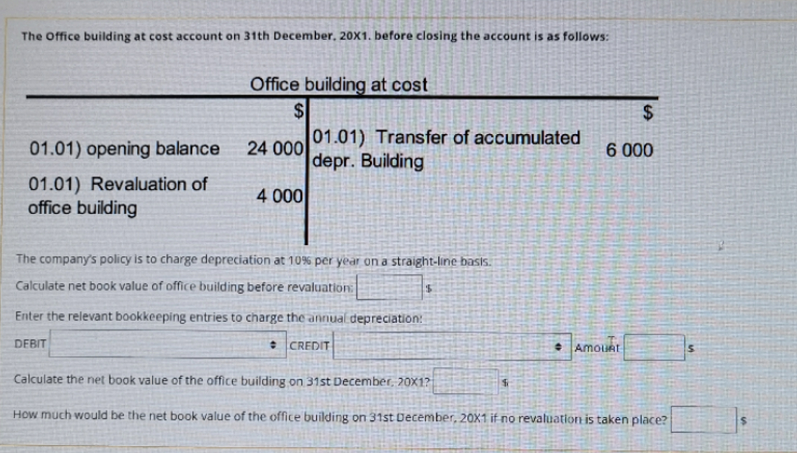

The Office building at cost account on 31th December, 20X1. before closing the account is as follows: Office building at cost $ 01.01) Transfer of accumulated 24 01.01) opening balance 24 000 depr. Building 6 000 01.01) Revaluation of office building 4 000 The company's policy is to charge depreciation at 10% per year on a straight-line basis. Calculate net book value of office building before revaluation: Enter the relevant bookkeeping entries to charge the annual depreciation: DEBIT CREDIT AmouAt Calculate the net book value of the office building on 31st December, 20X1? How much would be the net book value of the office building on 31st December, 20X1 if no revaluation is taken place?

The Office building at cost account on 31th December, 20X1. before closing the account is as follows: Office building at cost $ 01.01) Transfer of accumulated 24 01.01) opening balance 24 000 depr. Building 6 000 01.01) Revaluation of office building 4 000 The company's policy is to charge depreciation at 10% per year on a straight-line basis. Calculate net book value of office building before revaluation: Enter the relevant bookkeeping entries to charge the annual depreciation: DEBIT CREDIT AmouAt Calculate the net book value of the office building on 31st December, 20X1? How much would be the net book value of the office building on 31st December, 20X1 if no revaluation is taken place?

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 10SPB

Related questions

Question

Transcribed Image Text:The Office building at cost account on 31th December, 20X1. before closing the account is as follows:

Office building at cost

$4

01.01) Transfer of accumulated

24

24 000

depr. Building

01.01) opening balance

6 000

01.01) Revaluation of

office building

4 000

The company's policy is to charge depreciation at 10% per year on a straight-line basis.

Calculate net book value of office building before revaluation:

Enter the relevant bookkeeping entries to charge the anrnual depreciation:

DEBIT

* CREDIT

AmouRt

Calculate the net book value of the office building on 31st December, 20X1?

How much would be the net book value of the office building on 31st December, 20X1 if no revaluation is taken place?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage