The Paws Index is a price weighted stock index based on the 3 largest pet food manufacturers in the nation. The stock prices for the three stocks are $30, $15, and $50. The price of the last stock was just split 3 for 1 and the stock price was reduced from $60 to $20. What is the new divisor for a price weighted index? 1.86

The Paws Index is a price weighted stock index based on the 3 largest pet food manufacturers in the nation. The stock prices for the three stocks are $30, $15, and $50. The price of the last stock was just split 3 for 1 and the stock price was reduced from $60 to $20. What is the new divisor for a price weighted index? 1.86

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter7: Linear Regression

Section: Chapter Questions

Problem 7P: The Dow Jones Industrial Average (DJIA) and the Standard Poors 500 (SP 500) indexes are used as...

Related questions

Question

Question 14?

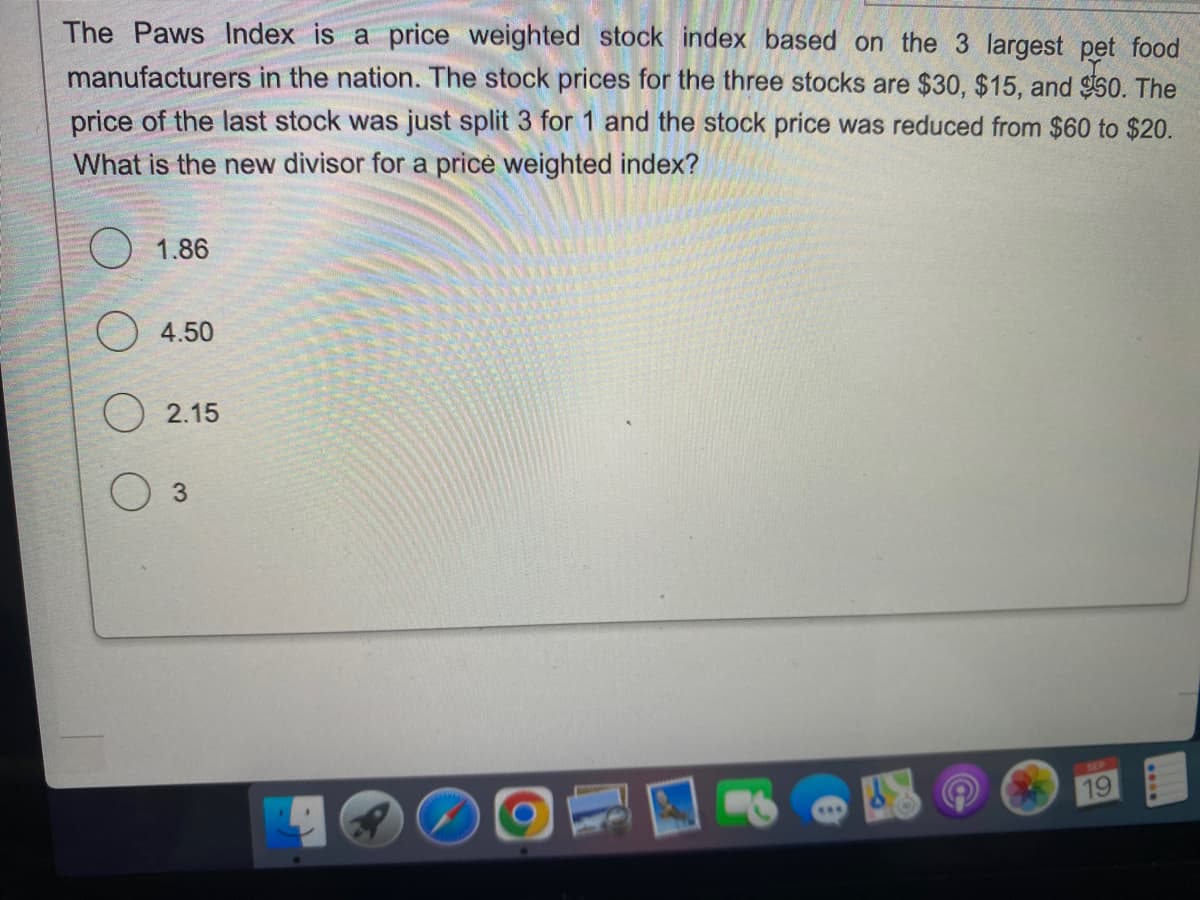

Transcribed Image Text:The Paws Index is a price weighted stock index based on the 3 largest pet food

manufacturers in the nation. The stock prices for the three stocks are $30, $15, and $50. The

price of the last stock was just split 3 for 1 and the stock price was reduced from $60 to $20.

What is the new divisor for a price weighted index?

1.86

4.50

2.15

3

19

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning