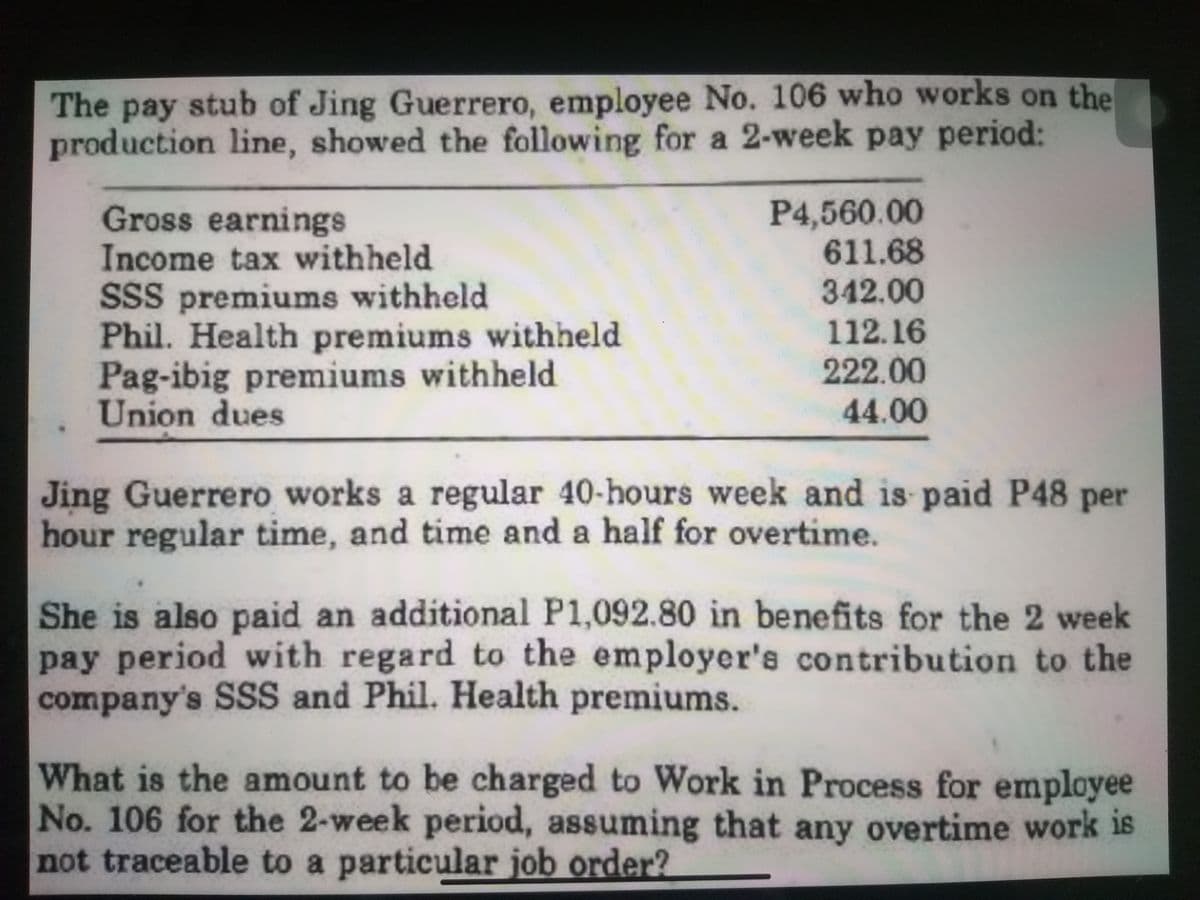

The pay stub of Jing Guerrero, employee No. 106 who works on the production line, showed the following for a 2-week pay period: P4,560.00 611.68 342.00 Gross earnings Income tax withheld SsS premiums withheld Phil. Health premiums withheld Pag-ibig premiums withheld Union dues 112.16 222.00 44.00 Jing Guerrero works a regular 40-hours week and is paid P48 per hour regular time, and time and a half for overtime. She is also paid an additional P1,092.80 in benefits for the 2 week pay period with regard to the employer's contribution to the company's SSS and Phil. Health premiums. What is the amount to be charged to Work in Process for employee No. 106 for the 2-week period, assuming that any overtime work is not traceable to a particular job order?

The pay stub of Jing Guerrero, employee No. 106 who works on the production line, showed the following for a 2-week pay period: P4,560.00 611.68 342.00 Gross earnings Income tax withheld SsS premiums withheld Phil. Health premiums withheld Pag-ibig premiums withheld Union dues 112.16 222.00 44.00 Jing Guerrero works a regular 40-hours week and is paid P48 per hour regular time, and time and a half for overtime. She is also paid an additional P1,092.80 in benefits for the 2 week pay period with regard to the employer's contribution to the company's SSS and Phil. Health premiums. What is the amount to be charged to Work in Process for employee No. 106 for the 2-week period, assuming that any overtime work is not traceable to a particular job order?

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 10PA: Lemur Corp. is going to pay three employees a year-end bonus. The amount of the year-end bonus and...

Related questions

Question

Transcribed Image Text:The pay stub of Jing Guerrero, employee No. 106 who works on the

production line, showed the following for a 2-week pay period:

Gross earnings

Income tax withheld

SSS premiums withheld

Phil. Health premiums withheld

Pag-ibig premiums withheld

Union dues

P4,560.00

611.68

342.00

112.16

222.00

44.00

Jing Guerrero works a regular 40-hours week and is paid P48 per

hour regular time, and time and a half for overtime.

She is also paid an additional P1,092.80 in benefits for the 2 week

pay period with regard to the employer's contribution to the

company's SSS and Phil. Health premiums.

What is the amount to be charged to Work in Process for employee

No. 106 for the 2-week period, assuming that any overtime work is

not traceable to a particular job order?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning