The payoff table depicting revenues and is shown in the following table. payoffs (PV in millions) states of nature Low Option Moderate high Small 10 10 10 Medium 12 12 Large -4 2 16 (a) Which alternative should the manager choose under the maximax criterion? (b) Which option should the manager choose under the maximin criterion? (c) Which option should the manager choose under the LaPlace criterion?

The payoff table depicting revenues and is shown in the following table. payoffs (PV in millions) states of nature Low Option Moderate high Small 10 10 10 Medium 12 12 Large -4 2 16 (a) Which alternative should the manager choose under the maximax criterion? (b) Which option should the manager choose under the maximin criterion? (c) Which option should the manager choose under the LaPlace criterion?

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

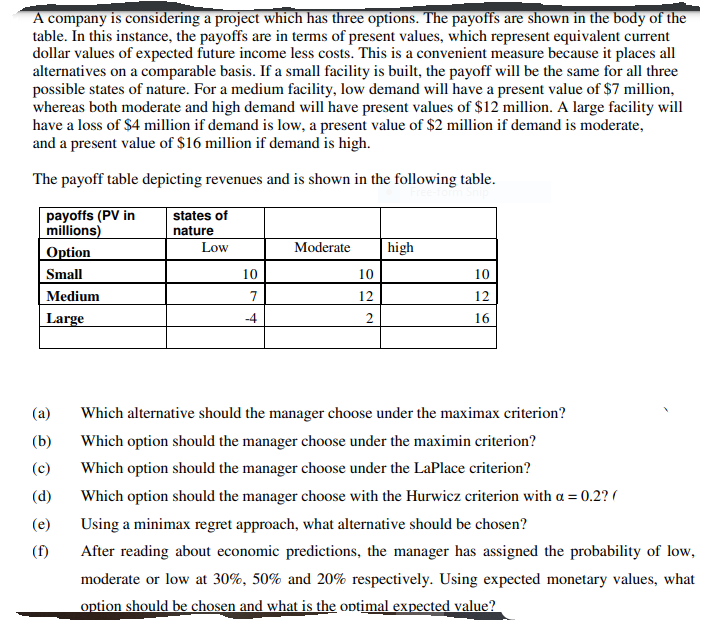

Transcribed Image Text:A company is considering a project which has three options. The payoffs are shown in the body of the

table. In this instance, the payoffs are in terms of present values, which represent equivalent current

dollar values of expected future income less costs. This is a convenient measure because it places all

alternatives on a comparable basis. If a small facility is built, the payoff will be the same for all three

possible states of nature. For a medium facility, low demand will have a present value of $7 million,

whereas both moderate and high demand will have present values of $12 million. A large facility will

have a loss of $4 million if demand is low, a present value of $2 million if demand is moderate,

and a present value of $16 million if demand is high.

The payoff table depicting revenues and is shown in the following table.

payoffs (PV in

millions)

states of

nature

Low

Option

Moderate

high

Small

10

10

10

Medium

7

12

12

Large

-4

2

16

(a)

Which alternative should the manager choose under the maximax criterion?

(b)

Which option should the manager choose under the maximin criterion?

(c)

Which option should the manager choose under the LaPlace criterion?

(d)

Which option should the manager choose with the Hurwicz criterion with a = 0.2? (

(e)

Using a minimax regret approach, what alternative should be chosen?

(f)

After reading about economic predictions, the manager has assigned the probability of low,

moderate or low at 30%, 50% and 20% respectively. Using expected monetary values, what

option should be chosen and what is the optimal expected value?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman