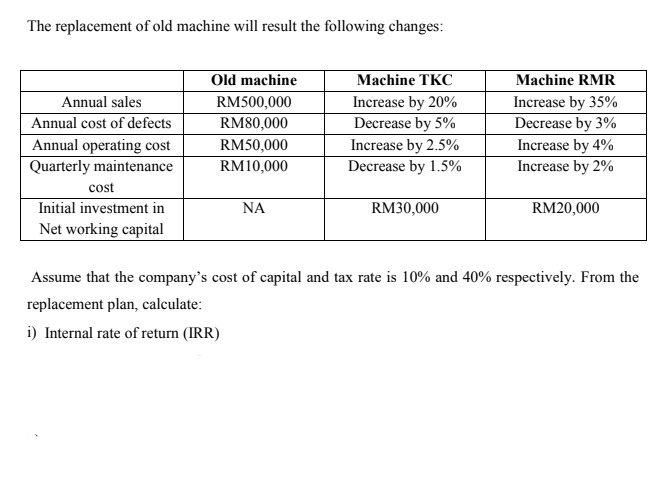

The replacement of old machine will result the following changes: Old machine Machine TKC Machine RMR Annual sales Increase by 20% Decrease by 5% Increase by 2.5% Decrease by 1.5% Increase by 35% Decrease by 3% RM500,000 Annual cost of defects RM80,000 Annual operating cost Quarterly maintenance RM50,000 RM10,000 Increase by 4% Increase by 2% cost Initial investment in Net working capital NA RM30,000 RM20,000 Assume that the company's cost of capital and tax rate is 10% and 40% respectively. From the replacement plan, calculate: i) Internal rate of return (IRR)

The replacement of old machine will result the following changes: Old machine Machine TKC Machine RMR Annual sales Increase by 20% Decrease by 5% Increase by 2.5% Decrease by 1.5% Increase by 35% Decrease by 3% RM500,000 Annual cost of defects RM80,000 Annual operating cost Quarterly maintenance RM50,000 RM10,000 Increase by 4% Increase by 2% cost Initial investment in Net working capital NA RM30,000 RM20,000 Assume that the company's cost of capital and tax rate is 10% and 40% respectively. From the replacement plan, calculate: i) Internal rate of return (IRR)

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 1SEQ: Mario Company is considering discontinuing a product. The costs of the product consist of $20,000...

Related questions

Question

Transcribed Image Text:The replacement of old machine will result the following changes:

Old machine

Machine TKC

Machine RMR

Annual sales

RM500,000

Increase by 20%

Decrease by 5%

Increase by 2.5%

Decrease by 1.5%

Increase by 35%

Decrease by 3%

Annual cost of defects

RM80,000

Annual operating cost

Quarterly maintenance

RM50,000

Increase by 4%

RM10,000

Increase by 2%

cost

Initial investment in

Net working capital

NA

RM30,000

RM20,000

Assume that the company's cost of capital and tax rate is 10% and 40% respectively. From the

replacement plan, calculate:

i) Internal rate of return (IRR)

Transcribed Image Text:Currently, this company is considering replacing an existing machine used in production that was

purchased 5 years ago for RM125, 000 with a new computer system that could improve the

company's operations. The old machine is being depreciated under straight line method over its

useful life of 10 years with no salvage value. Its current market value is RM5, 000.

Chief Financial Officer for this company, Mr Abraham Teo has reviewing two (2) options:

Machine TKC imported from China and Machine RMR imported from Japan. Below is the

information provided for the new machine.

Machine TKC

Machine RMR

Cost of Asset

RM200,000

RM150,000

RM12,000

Freight and transportation

RM10,000

cost

Installation cost

RM5,000

RM3,000

RM8,000

Renovation cost (before

installation of the machine)

RM5,000

Training cost (to operate the

NA

RM5,000

machine)

Depreciation method

Salvage value

Straight line

RM10,000

Straight line

RM8,000

5 years

Useful life

5 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning