The table below provides data for a hypothetical economy. Total value of corporate shares Currency outside chartered banks Chequable notice deposits at chartered banks Publicly held demand deposits at chartered banks Federal government bonds Other liquid assets included in M2+ Nonpersonal term and foreign-currency deposits at chartered banks Personal term deposits at chartered banks Non-chequable notice deposits at chartered banks Chequable notice deposits at near banks Personal term deposits at near banks Non-chequable notice deposits at near banks Based on a. M1+ is $ b. M2 is $ c. M3 is $ d. M2+ is $ data: 278 billion billion. billion, billion. $500 billion $42 billion $102 billion $45 billion $637 billion $32 billion $268 billion $134 billion. $94 billion $89 billion $114 billion $74 billion

The table below provides data for a hypothetical economy. Total value of corporate shares Currency outside chartered banks Chequable notice deposits at chartered banks Publicly held demand deposits at chartered banks Federal government bonds Other liquid assets included in M2+ Nonpersonal term and foreign-currency deposits at chartered banks Personal term deposits at chartered banks Non-chequable notice deposits at chartered banks Chequable notice deposits at near banks Personal term deposits at near banks Non-chequable notice deposits at near banks Based on a. M1+ is $ b. M2 is $ c. M3 is $ d. M2+ is $ data: 278 billion billion. billion, billion. $500 billion $42 billion $102 billion $45 billion $637 billion $32 billion $268 billion $134 billion. $94 billion $89 billion $114 billion $74 billion

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter28: Monetary Policy And Bank Regulation

Section: Chapter Questions

Problem 39P: Suppose the Fed conducts an open market sale by selling $10 million in Treasury bonds to Acme Bank....

Related questions

Question

Transcribed Image Text:)

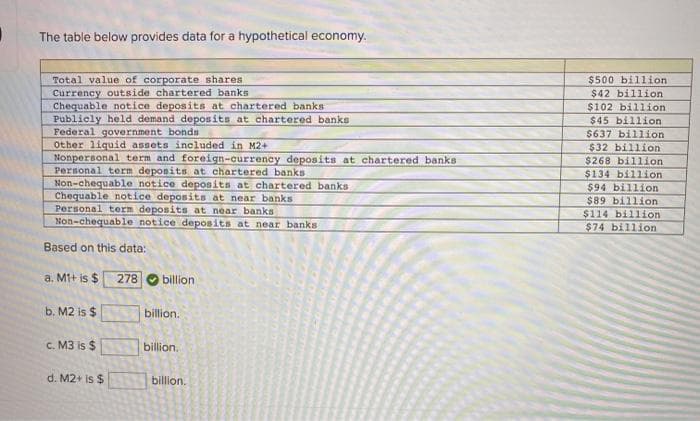

The table below provides data for a hypothetical economy.

Total value of corporate shares

Currency outside chartered banks.

Chequable notice deposits at chartered banks

Publicly held demand deposits at chartered banks.

Federal government bonds

Other liquid assets included in M2+

Nonpersonal term and foreign-currency deposits at chartered banks

Personal term deposits at chartered banks

Non-chequable notice deposits at chartered banks

Chequable notice deposits at near banks

Personal term deposits at near banks

Non-chequable notice deposits at near banks

Based on this data:

a. M1+ is $

b. M2 is $

c. M3 is $

d. M2+ is $

278

billion

billion.

billion,

billion.

$500 billion

$42 billion

$102 billion.

$45 billion.

$637 billion

$32 billion

$268 billion

$134 billion

$94 billion

$89 billion

$114 billion

$74 billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning