This case is arailable in MyFinancelab. Samuel and Grace Paganelli want to replace their 1996 pickup, which Samuel drives fom They already own two vehicles, but they need to replace Samuel's truck because it has 225,000 miles on the odometer. The replacement must be a vehicle that fits his job as employed electrician. Samuel knows that he drives a lot on the job and is worried about the high-mileage pen many leases, as well as the fees for excessive wear and tear. However, Grace is more con about the depreciation loss on a new truck purchase than the mileage penalty and rather lease the new vehicle. She also likes the idea of having a new, safer truck every few without the hassle of resale. Samuel also does not like the fact that, if they lease, they wo own the vehicle he will use for work. Warranty nrotection to insure the truck romainr in

This case is arailable in MyFinancelab. Samuel and Grace Paganelli want to replace their 1996 pickup, which Samuel drives fom They already own two vehicles, but they need to replace Samuel's truck because it has 225,000 miles on the odometer. The replacement must be a vehicle that fits his job as employed electrician. Samuel knows that he drives a lot on the job and is worried about the high-mileage pen many leases, as well as the fees for excessive wear and tear. However, Grace is more con about the depreciation loss on a new truck purchase than the mileage penalty and rather lease the new vehicle. She also likes the idea of having a new, safer truck every few without the hassle of resale. Samuel also does not like the fact that, if they lease, they wo own the vehicle he will use for work. Warranty nrotection to insure the truck romainr in

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter1: Introduction To Managerial Accounting

Section: Chapter Questions

Problem 15E: Ethical Behavior Consider the following scenario between Dave, a printer, and Steve, an assistant in...

Related questions

Question

If they were to lease, what key factors are important in a good lease?

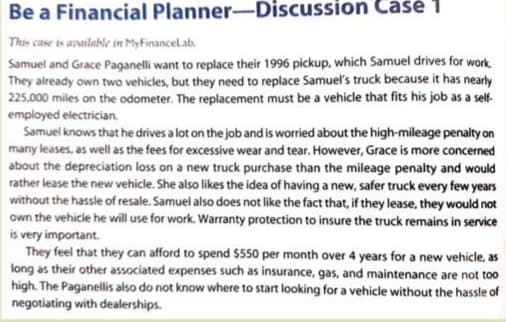

Transcribed Image Text:Be a Financial Planner-Discussion Casé 1

This case is arailable in MyFinancelab.

Samuel and Grace Paganelli want to replace their 1996 pickup, which Samuel drives for work.

They already own two vehicles, but they need to replace Samuel's truck because it has nearly

225,000 miles on the odometer. The replacement must be a vehicle that fits his job as a self-

employed electrician.

Samuel knows that he drives a lot on the job and is worried about the high-mileage penalty on

many leases, as well as the fees for excessive wear and tear. However, Grace is more concerned

about the depreciation loss on a new truck purchase than the mileage penalty and would

rather lease the new vehicle. She also likes the idea of having a new, safer truck every few years

without the hassle of resale. Samuel also does not like the fact that, if they lease, they would not

own the vehicle he will use for work. Warranty protection to insure the truck remains in service

is very important.

They feel that they can afford to spend $550 per month over 4 years for a new vehicle, as

long as their other associated expenses such as insurance, gas, and maintenance are not too

high. The Paganellis also do not know where to start looking for a vehicle without the hassle of

negotiating with dealerships.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning