THIS IS A MULTIPLE ANSWER QUESTION. IT MAY HAVE MORE THAN ONE CORRECT ANSWER. Consider a homogeneous product industry with inverse demand given by p(Q) = 100 - Q. There are two firms competing in quantities. Timing: In stage 1 Firm 1 chooses its quantity, denoted by q1. Then in stage 2 Firm 2 chooses its quantity, denoted by q2. The cost function of Firm 1 is TC(9) = 20q. The cost function of Firm 2 is TC(q) = 100 + 20q if q > 0, TC(q) = 0 if q = 0. Which of the below is a Nash equilibrium that also satisfies firm, such that each firm's equilibrium strategy is a best response to the other firm's equilibrium strategy. Here Firm 1's strategy is a value for q1, Firm 2's strategy is a function that determines the value of q2 for each possible value of q1 Firm 1 may choose.) O Firm 1:q1 = 60, Firm 2: q2 = 40 - 0.5q1 if q1 < 60, q2 = 0 if q1 ? 60. Firm 1: q1 = 40, Firm 2: q2 = 40 - 0.5q1 if q1 < 80, q2 = 0 if q1 ? 80. Firm 1: q1 = 80/3, Firm 2: q2 = 80/3 if q1 < 80, q2 = 0 if q1 ? 80. Firm 1: q1 = 100, Firm 2: q2 = 40 - 0.5q1 if q1 < 80, q2 = 0 if q1 ? 80. None of the above

THIS IS A MULTIPLE ANSWER QUESTION. IT MAY HAVE MORE THAN ONE CORRECT ANSWER. Consider a homogeneous product industry with inverse demand given by p(Q) = 100 - Q. There are two firms competing in quantities. Timing: In stage 1 Firm 1 chooses its quantity, denoted by q1. Then in stage 2 Firm 2 chooses its quantity, denoted by q2. The cost function of Firm 1 is TC(9) = 20q. The cost function of Firm 2 is TC(q) = 100 + 20q if q > 0, TC(q) = 0 if q = 0. Which of the below is a Nash equilibrium that also satisfies firm, such that each firm's equilibrium strategy is a best response to the other firm's equilibrium strategy. Here Firm 1's strategy is a value for q1, Firm 2's strategy is a function that determines the value of q2 for each possible value of q1 Firm 1 may choose.) O Firm 1:q1 = 60, Firm 2: q2 = 40 - 0.5q1 if q1 < 60, q2 = 0 if q1 ? 60. Firm 1: q1 = 40, Firm 2: q2 = 40 - 0.5q1 if q1 < 80, q2 = 0 if q1 ? 80. Firm 1: q1 = 80/3, Firm 2: q2 = 80/3 if q1 < 80, q2 = 0 if q1 ? 80. Firm 1: q1 = 100, Firm 2: q2 = 40 - 0.5q1 if q1 < 80, q2 = 0 if q1 ? 80. None of the above

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter18: Auctions

Section: Chapter Questions

Problem 18.6IP

Related questions

Question

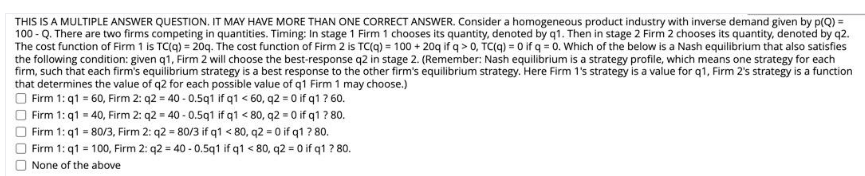

Transcribed Image Text:THIS IS A MULTIPLE ANSWER QUESTION. IT MAY HAVE MORE THAN ONE CORRECT ANSWER. Consider a homogeneous product industry with inverse demand given by p(Q) =

100 - Q. There are two firms competing in quantities. Timing: In stage 1 Firm 1 chooses its quantity, denoted by q1. Then in stage 2 Firm 2 chooses its quantity, denoted by q2.

The cost function of Firm 1 is TC(q) = 20g. The cost function of Firm 2 is TC(q) = 100 + 20g if q > 0, TC(q) = 0 if q = 0. Which of the below is a Nash equilibrium that also satisfies

the following condition: given q1, Firm 2 will choose the best-response q2 in stage 2. (Remember: Nash equilibrium is a strategy profile, which means one strategy for each

firm, such that each firm's equilibrium strategy is a best response to the other firm's equilibrium strategy. Here Firm 1's strategy is a value for q1, Firm 2's strategy is a function

that determines the value of q2 for each possible value of q1 Firm 1 may choose.)

Firm 1: q1 = 60, Firm 2: q2 = 40 - 0.5q1 if q1 < 60, q2 = 0 if q1 ? 60.

Firm 1: q1 = 40, Firm 2: q2 = 40 - 0.5q1 if q1 < 80, q2 = 0 if q1 ? 80.

Firm 1: q1 = 80/3, Firm 2: q2 = 80/3 if q1 < 80, q2 = 0 if q1 ? 80.

Firm 1: q1 = 100, Firm 2: q2 = 40 - 0.5q1 if q1 < 80, q2 = 0 if q1 ? 80.

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning