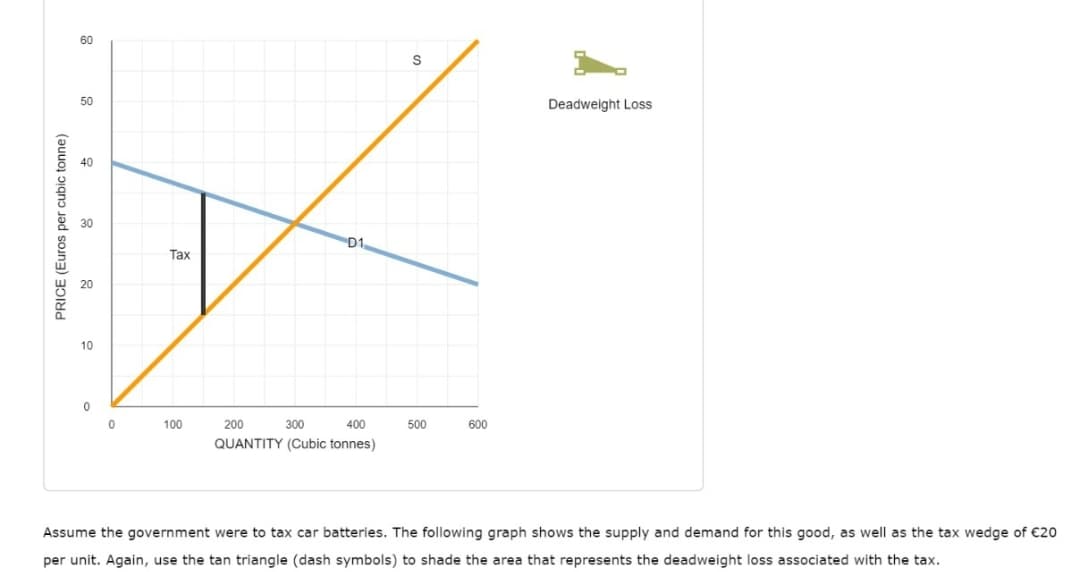

This problem uses the 'wedge' approach in a supply and demand diagram to show the effect of a tax. The government is considering levying a tax of €20 per unit on either carbon emissions or car batteries. The supply curve for each of these goods is identical and is shown by S. The demand for carbon emissions is shown by D1, and the demand for car batteries is shown by D2. Assume the government were to tax carbon emissions. The following graph shows the supply and demand for this good. The graph also shows a wedge representing the tax. Use the tan triangle (dash symbols) to shade the area that represents the deadweight loss associated with the tax.

This problem uses the 'wedge' approach in a supply and demand diagram to show the effect of a tax. The government is considering levying a tax of €20 per unit on either carbon emissions or car batteries. The supply curve for each of these goods is identical and is shown by S. The demand for carbon emissions is shown by D1, and the demand for car batteries is shown by D2. Assume the government were to tax carbon emissions. The following graph shows the supply and demand for this good. The graph also shows a wedge representing the tax. Use the tan triangle (dash symbols) to shade the area that represents the deadweight loss associated with the tax.

Macroeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter4: Demand And Demand: Applications And Extensions

Section: Chapter Questions

Problem 13CQ

Related questions

Question

This problem uses the 'wedge' approach in a supply and demand diagram to show the effect of a tax.

The government is considering levying a tax of €20 per unit on either carbon emissions or car batteries. The supply curve for each of these goods is identical and is shown by S. The demand for carbon emissions is shown by D1, and the demand for car batteries is shown by D2.

Assume the government were to tax carbon emissions. The following graph shows the supply and demand for this good. The graph also shows a wedge representing the tax.

Use the tan triangle (dash symbols) to shade the area that represents the deadweight loss associated with the tax.

Transcribed Image Text:60

50

Deadweight Loss

40

30

D1

Таx

20

10

100

200

300

400

500

600

QUANTITY (Cubic tonnes)

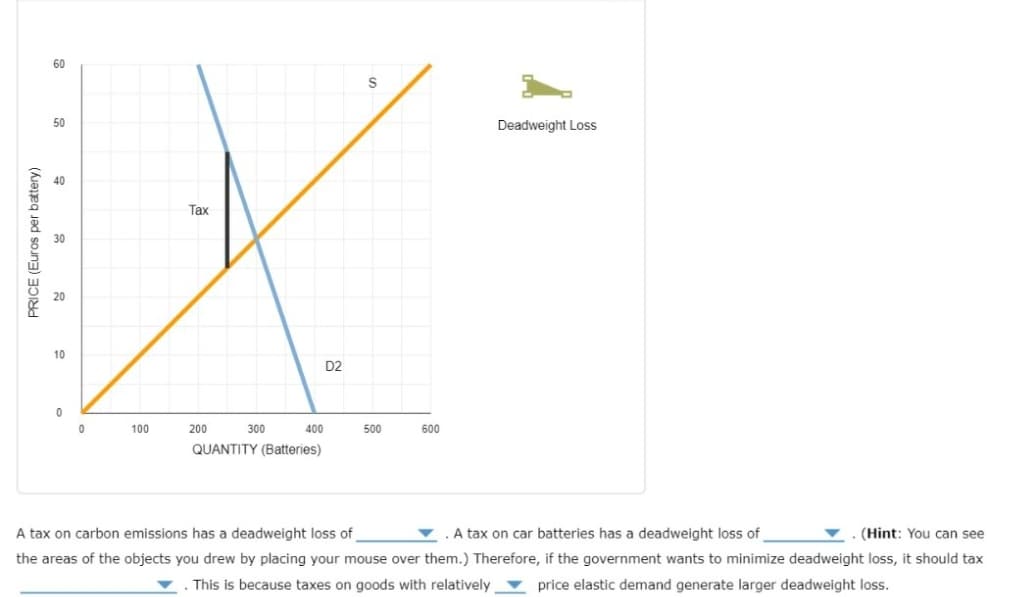

Assume the government were to tax car batteries. The following graph shows the supply and demand for this good, as well as the tax wedge of €20

per unit. Again, use the tan triangle (dash symbols) to shade the area that represents the deadweight loss associated with the tax.

PRICE (Euros per cubic tonne)

Transcribed Image Text:60

50

Deadweight Loss

Тах

10

D2

100

200

300

400

500

600

QUANTITY (Batteries)

A tax on carbon emissions has a deadweight loss of

. A tax on car batteries has a deadweight loss of

(Hint: You can see

the areas of the objects you drew by placing your mouse over them.) Therefore, if the government wants to minimize deadweight loss, it should tax

This is because taxes on goods with relatively ▼ price elastic demand generate larger deadweight loss.

PRICE (Euros per batery)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning