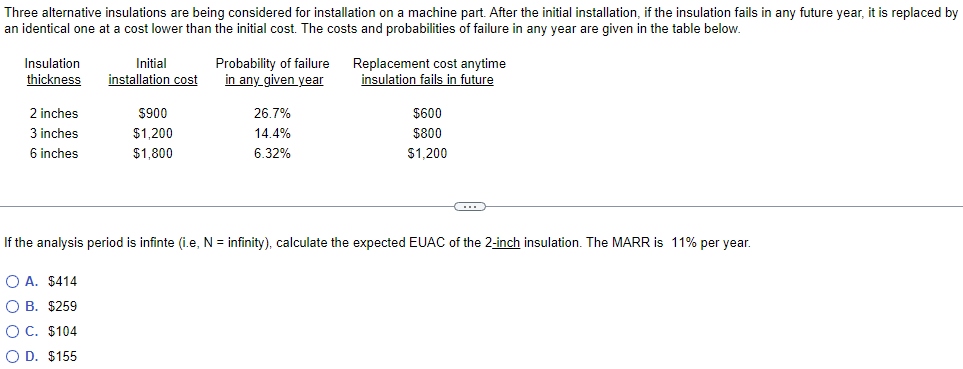

Three alternative insulations are being considered for installation on a machine part. After the initial installation, if the insulation fails in any future year, it is replaced by an identical one at a cost lower than the initial cost. The costs and probabilities of failure in any year are given in the table below.

Three alternative insulations are being considered for installation on a machine part. After the initial installation, if the insulation fails in any future year, it is replaced by an identical one at a cost lower than the initial cost. The costs and probabilities of failure in any year are given in the table below.

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter20: The Problem Of Adverse Selection Moral Hazard

Section: Chapter Questions

Problem 3MC

Related questions

Question

Transcribed Image Text:Three alternative insulations are being considered for installation on a machine part. After the initial installation, if the insulation fails in any future year, it is replaced by

an identical one at a cost lower than the initial cost. The costs and probabilities of failure in any year are given in the table below.

Insulation

thickness

2 inches

3 inches

6 inches

Initial

installation cost

$900

$1,200

$1,800

Probability of failure

in any given year

26.7%

14.4%

6.32%

Replacement cost anytime

insulation fails in future

$600

$800

$1,200

If the analysis period is infinte (i.e, N = infinity), calculate the expected EUAC of the 2-inch insulation. The MARR is 11% per year.

OA. $414

O B. $259

O C. $104

O D. $155

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning