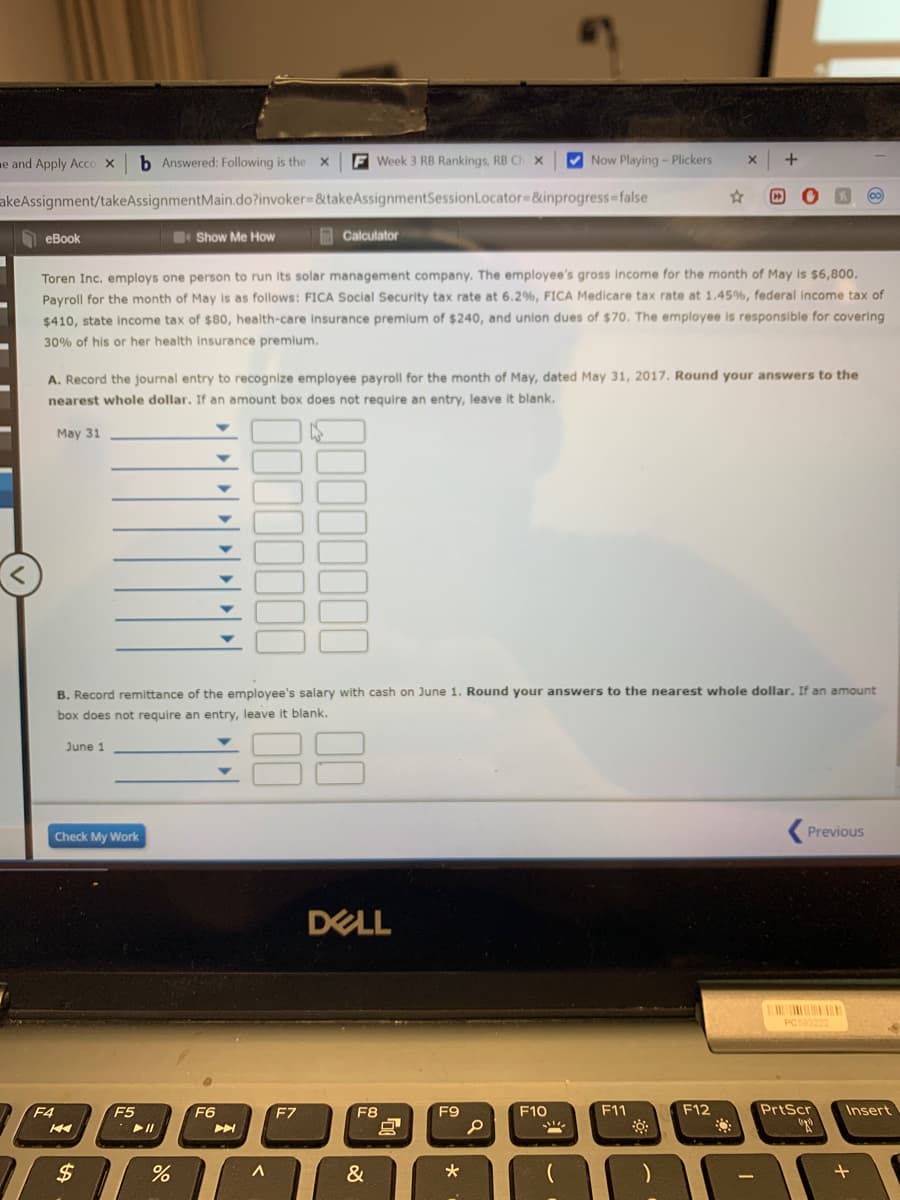

Toren Inc. employs one person to run its solar management company. The employee's gross income for the month of May is $6,800. Payroll for the month of May is as follows: FICA Social Security tax rate at 6.2%, FICA Medicare tax rate at 1.45%, federal income tax of $410, state income tax of $80, health-care insurance premium of $240, and union dues of $70. The employee is responsible for covering 30% of his or her health insurance premium. A. Record the journal entry to recognize employee payroll for the month of May, dated May 31, 2017. Round your answers to the nearest whole dollar. If an amount box does not require an entry, leave it blank. May 31 B. Record remittance of the employee's salary with cash on June 1. Round your answers to the nearest whole dollar. If an amount box does not require an entry, leave it blank. June 1

Toren Inc. employs one person to run its solar management company. The employee's gross income for the month of May is $6,800. Payroll for the month of May is as follows: FICA Social Security tax rate at 6.2%, FICA Medicare tax rate at 1.45%, federal income tax of $410, state income tax of $80, health-care insurance premium of $240, and union dues of $70. The employee is responsible for covering 30% of his or her health insurance premium. A. Record the journal entry to recognize employee payroll for the month of May, dated May 31, 2017. Round your answers to the nearest whole dollar. If an amount box does not require an entry, leave it blank. May 31 B. Record remittance of the employee's salary with cash on June 1. Round your answers to the nearest whole dollar. If an amount box does not require an entry, leave it blank. June 1

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 14EA: Toren Inc. employs one person to run its solar management company. The employees gross income for...

Related questions

Question

Transcribed Image Text:Toren Inc. employs one person to run its solar management company. The employee's gross income for the month of May is $6,800.

Payroll for the month of May is as follows: FICA Social Security tax rate at 6.2%, FICA Medicare tax rate at 1.45%, federal income tax of

$410, state income tax of $80, health-care insurance premium of $240, and union dues of $70. The employee is responsible for covering

30% of his or her health insurance premium.

A. Record the journal entry to recognize employee payroll for the month of May, dated May 31, 2017. Round your answers to the

nearest whole dollar. If an amount box does not require an entry, leave it blank.

May 31

B. Record remittance of the employee's salary with cash on June 1. Round your answers to the nearest whole dollar. If an amount

box does not require an entry, leave it blank.

June 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,