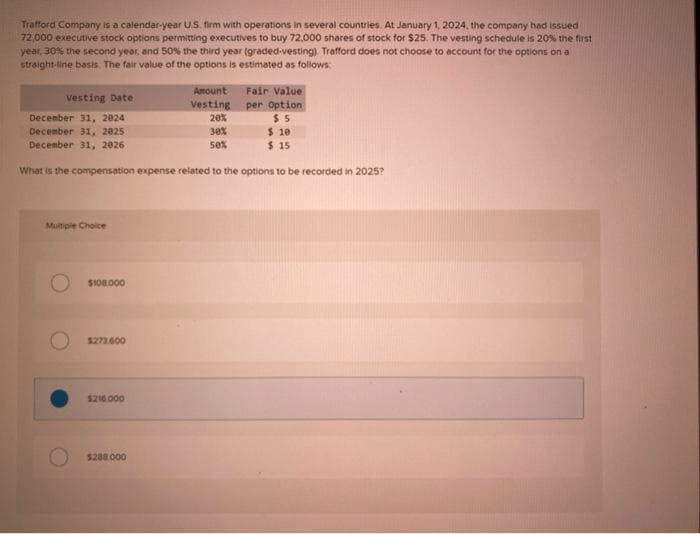

Trafford Company is a calendar-year U.S. firm with operations in several countries. At January 1, 2024, the company had issued 72,000 executive stock options permitting executives to buy 72.000 shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting). Trafford does not choose to account for the options on a straight-line basis. The fair value of the options is estimated as follows: Vesting Date December 31, 2024 December 31, 2025 December 31, 2026 Multiple Choice $100.000 What is the compensation expense related to the options to be recorded in 2025? $273.600 $216.000 Amount Vesting 20% 30% 50% $288.000 Fair Value per Option $5 $ 10 $ 15

Trafford Company is a calendar-year U.S. firm with operations in several countries. At January 1, 2024, the company had issued 72,000 executive stock options permitting executives to buy 72.000 shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting). Trafford does not choose to account for the options on a straight-line basis. The fair value of the options is estimated as follows: Vesting Date December 31, 2024 December 31, 2025 December 31, 2026 Multiple Choice $100.000 What is the compensation expense related to the options to be recorded in 2025? $273.600 $216.000 Amount Vesting 20% 30% 50% $288.000 Fair Value per Option $5 $ 10 $ 15

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 7RE: On January 1, 2019, Phoenix Corporation adopts a performance-based share option plan for 25...

Related questions

Question

M¹

Transcribed Image Text:Trafford Company is a calendar-year U.S. firm with operations in several countries. At January 1, 2024, the company had issued

72,000 executive stock options permitting executives to buy 72,000 shares of stock for $25. The vesting schedule is 20% the first

year, 30% the second year, and 50% the third year (graded-vesting). Trafford does not choose to account for the options on a

straight-line basis. The fair value of the options is estimated as follows:

Fair Value

Vesting Date

per Option

December 31, 2024

20%

$5

December 31, 2025

30%

$ 10

December 31, 2026

50%

$ 15

What is the compensation expense related to the options to be recorded in 2025?

Multiple Choice

$100,000

$273.600

$216.000

Amount

Vesting

$288.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT