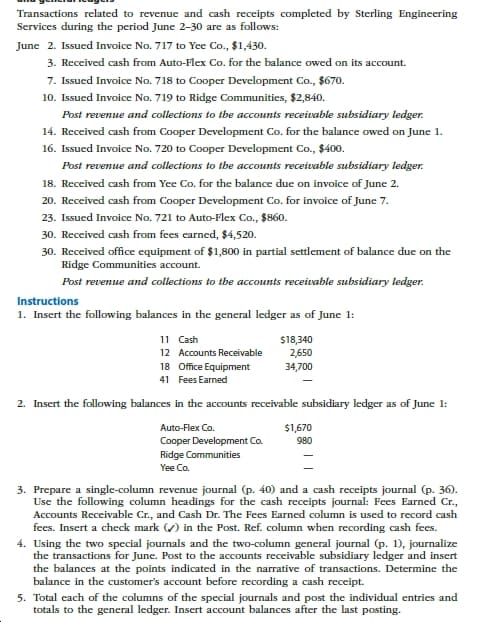

Transactions related to revenue and cash receipts completed by Sterling Engineering Services during the period June 2-30 are as follows: June 2. Issued Invoice No. 717 to Yee Co., $1,430. 3. Received cash from Auto-Flex Co. for the balance owed on its account. 7. Issued Invoice No. 718 to Cooper Development Co., $670. 10. Issued Invoice No. 719 to Ridge Communities, $2,840. Post revenue and collections to the accounts receivable subsidiary ledger. 14. Received cash from Cooper Development Co. for the balance owed on June 1. 16. Issued Invoice No. 720 to Cooper Development Co., $400. Post revenue and collections to the accounts receivable subsidiary ledger. 18. Received cash from Yee Co. for the balance due on invoice of June 2. 20. Received cash from Cooper Development Co. for invoice of June 7. 23. Issued Invoice No. 721 to Auto-Flex Co., $860. 30. Received cash from fees earned, $4,520. 30. Received office equipment of $1,800 in partial settlement of balance due on the Ridge Communities account. Post revenue and collections to the accounts receivable subsidiary ledger. Instructions 1. Insert the following balances in the general ledger as of June 1: $18,340 2,650 11 Cash 12 Accounts Receivable 18 Office Equipment 34,700 41 Fees Earned 2. Insert the following balances in the accounts receivable subsidiary ledger as of June 1: Auto-Flex Co. $1,670 980 Cooper Development Co. Ridge Communities Yee Co. 3. Prepare a single-column revenue journal (p. 40) and a cash receipts journal (p. 36). Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. The Fees Earned column is used to record cash fees. Insert a check mark () in the Post. Ref. column when recording cash fees. 4. Using the two special journals and the two-column general journal (p. 1), journalize the transactions for June. Post to the accounts receivable subsidiary ledger and insert the balances at the points indicated in the narrative of transactions. Determine the balance in the customer's account before recording a cash receipt. 5. Total each of the columns of the special journals and post the individual entries and totals to the general ledger. Insert account balances after the last posting. Crapter ACcounang Pystems 6. Determine that the sum of the customer accounts agrees with the accounts receivable controlling account in the general ledger. 7. Why would an automated system omit postings to a control account as performed in step 5 for Accounts Receivable?

Transactions related to revenue and cash receipts completed by Sterling Engineering Services during the period June 2-30 are as follows: June 2. Issued Invoice No. 717 to Yee Co., $1,430. 3. Received cash from Auto-Flex Co. for the balance owed on its account. 7. Issued Invoice No. 718 to Cooper Development Co., $670. 10. Issued Invoice No. 719 to Ridge Communities, $2,840. Post revenue and collections to the accounts receivable subsidiary ledger. 14. Received cash from Cooper Development Co. for the balance owed on June 1. 16. Issued Invoice No. 720 to Cooper Development Co., $400. Post revenue and collections to the accounts receivable subsidiary ledger. 18. Received cash from Yee Co. for the balance due on invoice of June 2. 20. Received cash from Cooper Development Co. for invoice of June 7. 23. Issued Invoice No. 721 to Auto-Flex Co., $860. 30. Received cash from fees earned, $4,520. 30. Received office equipment of $1,800 in partial settlement of balance due on the Ridge Communities account. Post revenue and collections to the accounts receivable subsidiary ledger. Instructions 1. Insert the following balances in the general ledger as of June 1: $18,340 2,650 11 Cash 12 Accounts Receivable 18 Office Equipment 34,700 41 Fees Earned 2. Insert the following balances in the accounts receivable subsidiary ledger as of June 1: Auto-Flex Co. $1,670 980 Cooper Development Co. Ridge Communities Yee Co. 3. Prepare a single-column revenue journal (p. 40) and a cash receipts journal (p. 36). Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. The Fees Earned column is used to record cash fees. Insert a check mark () in the Post. Ref. column when recording cash fees. 4. Using the two special journals and the two-column general journal (p. 1), journalize the transactions for June. Post to the accounts receivable subsidiary ledger and insert the balances at the points indicated in the narrative of transactions. Determine the balance in the customer's account before recording a cash receipt. 5. Total each of the columns of the special journals and post the individual entries and totals to the general ledger. Insert account balances after the last posting. Crapter ACcounang Pystems 6. Determine that the sum of the customer accounts agrees with the accounts receivable controlling account in the general ledger. 7. Why would an automated system omit postings to a control account as performed in step 5 for Accounts Receivable?

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter5: Accounting Systems

Section: Chapter Questions

Problem 2PB: Transactions related to revenue and cash receipts completed by Sterling Engineering Services during...

Related questions

Question

Transcribed Image Text:Transactions related to revenue and cash receipts completed by Sterling Engineering

Services during the period June 2-30 are as follows:

June 2. Issued Invoice No. 717 to Yee Co., $1,430.

3. Received cash from Auto-Flex Co. for the balance owed on its account.

7. Issued Invoice No. 718 to Cooper Development Co., $670.

10. Issued Invoice No. 719 to Ridge Communities, $2,840.

Post revenue and collections to the accounts receivable subsidiary ledger.

14. Received cash from Cooper Development Co. for the balance owed on June 1.

16. Issued Invoice No. 720 to Cooper Development Co., $400.

Post revenue and collections to the accounts receivable subsidiary ledger.

18. Received cash from Yee Co. for the balance due on invoice of June 2.

20. Received cash from Cooper Development Co. for invoice of June 7.

23. Issued Invoice No. 721 to Auto-Flex Co., $860.

30. Received cash from fees earned, $4,520.

30. Received office equipment of $1,800 in partial settlement of balance due on the

Ridge Communities account.

Post revenue and collections to the accounts receivable subsidiary ledger.

Instructions

1. Insert the following balances in the general ledger as of June 1:

$18,340

2,650

11 Cash

12 Accounts Receivable

18 Office Equipment

34,700

41 Fees Earned

2. Insert the following balances in the accounts receivable subsidiary ledger as of June 1:

Auto-Flex Co.

$1,670

980

Cooper Development Co.

Ridge Communities

Yee Co.

3. Prepare a single-column revenue journal (p. 40) and a cash receipts journal (p. 36).

Use the following column headings for the cash receipts journal: Fees Earned Cr.,

Accounts Receivable Cr., and Cash Dr. The Fees Earned column is used to record cash

fees. Insert a check mark () in the Post. Ref. column when recording cash fees.

4. Using the two special journals and the two-column general journal (p. 1), journalize

the transactions for June. Post to the accounts receivable subsidiary ledger and insert

the balances at the points indicated in the narrative of transactions. Determine the

balance in the customer's account before recording a cash receipt.

5. Total each of the columns of the special journals and post the individual entries and

totals to the general ledger. Insert account balances after the last posting.

Transcribed Image Text:Crapter ACcounang Pystems

6. Determine that the sum of the customer accounts agrees with the accounts receivable

controlling account in the general ledger.

7. Why would an automated system omit postings to a control account as performed in

step 5 for Accounts Receivable?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 7 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage