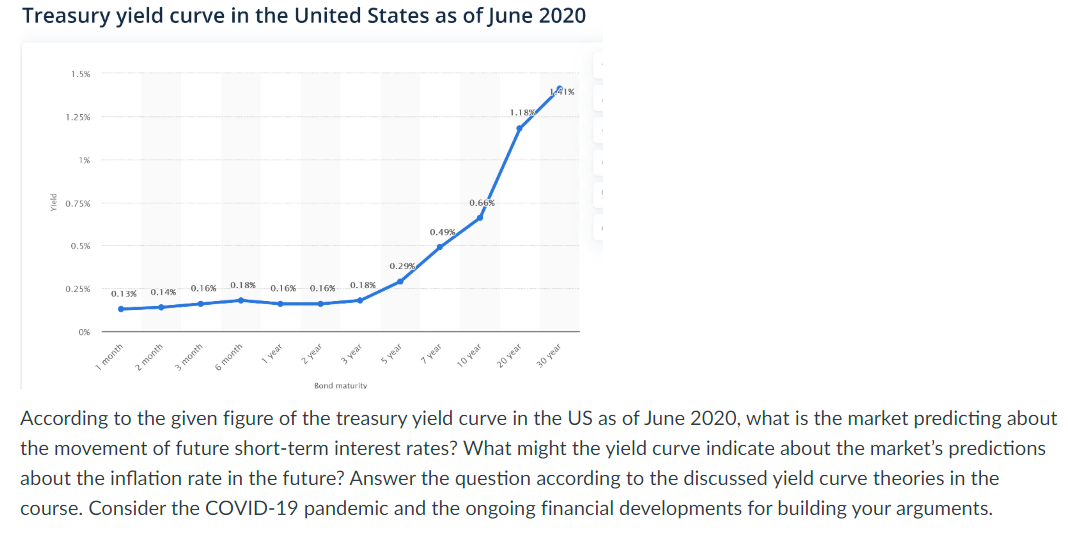

Treasury yield curve in the United States as of June 2020 1.5% 1.25% 1% 1.189 0.75% 0.5% 0.669 0.25% 0.1 3% 0.1 4% 0.49% 0.16% 0.18% 0.16% 0.29 0% 0.16% 0.18% 1 month 6 month 1 year According to the given figure of the treasury yield curve in the US as of June 2020, what is the market predicting about 2 year 5 year 7 year 3 year Bond maturity the movement of future short-term interest rates? What might the yield curve indicate about the market's predictions 30 year about the inflation rate in the future? Answer the question according to the discussed yield curve theories in the course. Consider the COVID-19 pandemic and the ongoing financial developments for building your arguments. 2 month 3 month 10 year 20 year

Treasury yield curve in the United States as of June 2020 1.5% 1.25% 1% 1.189 0.75% 0.5% 0.669 0.25% 0.1 3% 0.1 4% 0.49% 0.16% 0.18% 0.16% 0.29 0% 0.16% 0.18% 1 month 6 month 1 year According to the given figure of the treasury yield curve in the US as of June 2020, what is the market predicting about 2 year 5 year 7 year 3 year Bond maturity the movement of future short-term interest rates? What might the yield curve indicate about the market's predictions 30 year about the inflation rate in the future? Answer the question according to the discussed yield curve theories in the course. Consider the COVID-19 pandemic and the ongoing financial developments for building your arguments. 2 month 3 month 10 year 20 year

Chapter13: Monetary Policy: Conventional And Unconventional

Section: Chapter Questions

Problem 4TY

Related questions

Question

100%

hello. can you solve this question with explanations? Thank you.

Transcribed Image Text:Treasury yield curve in the United States as of June 2020

1.5%

1.25%

1%

1.189

0.75%

0.5%

0.669

0.25%

0.1 3%

0.1 4%

0.49%

0.16%

0.18%

0.16%

0.29

0%

0.16%

0.18%

1 month

6 month

1 year

According to the given figure of the treasury yield curve in the US as of June 2020, what is the market predicting about

2 year

5 year

7 year

3 year

Bond maturity

the movement of future short-term interest rates? What might the yield curve indicate about the market's predictions

30 year

about the inflation rate in the future? Answer the question according to the discussed yield curve theories in the

course. Consider the COVID-19 pandemic and the ongoing financial developments for building your arguments.

2 month

3 month

10 year

20 year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning