Two multinational Dynamic Games of Industrial Organisation companies produce the same good. In the first period, firm 1 sells its prod- uct as a monopolist in Paris. In the second period, firm 1 competes with firm 2 in Berlin as a Cournot duopolist. There is no discounting between the two pe- riods. Firm 1 produces quantity xp < c/a in Paris at cost cxp. Interestingly, in Berlin, firm 1 produces quantity xg at cost (c-axp)xg, where 0

Two multinational Dynamic Games of Industrial Organisation companies produce the same good. In the first period, firm 1 sells its prod- uct as a monopolist in Paris. In the second period, firm 1 competes with firm 2 in Berlin as a Cournot duopolist. There is no discounting between the two pe- riods. Firm 1 produces quantity xp < c/a in Paris at cost cxp. Interestingly, in Berlin, firm 1 produces quantity xg at cost (c-axp)xg, where 0

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter16: Government Regulation

Section: Chapter Questions

Problem 2E

Related questions

Question

part B

Transcribed Image Text:Two multinational

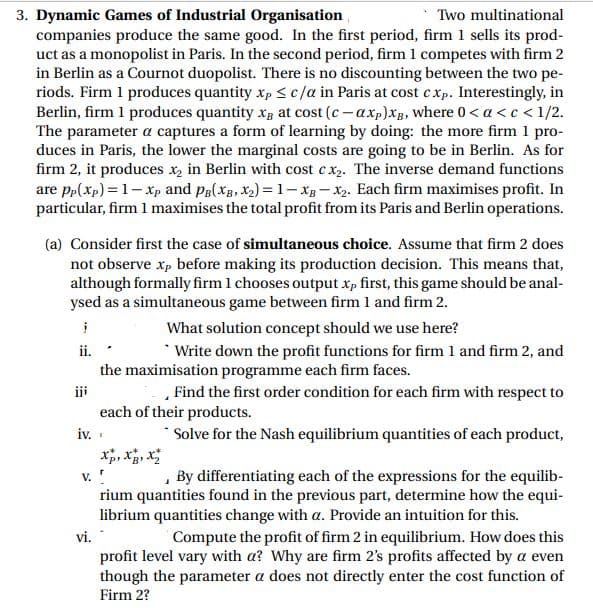

3. Dynamic Games of Industrial Organisation

companies produce the same good. In the first period, firm 1 sells its prod-

uct as a monopolist in Paris. In the second period, firm1 competes with firm 2

in Berlin as a Cournot duopolist. There is no discounting between the two pe-

riods. Firm 1 produces quantity xp <c/a in Paris at cost cXp. Interestingly, in

Berlin, firm 1 produces quantity xg at cost (c - axp)xB, where 0< a <c < 1/2.

The parameter a captures a form of learning by doing: the more firm 1 pro-

duces in Paris, the lower the marginal costs are going to be in Berlin. As for

firm 2, it produces x, in Berlin with cost cx. The inverse demand functions

are pp(xp) = 1- Xp and pa(xg, X2) = 1- xg-X2. Each firm maximises profit. In

particular, firm 1 maximises the total profit from its Paris and Berlin operations.

(a) Consider first the case of simultaneous choice. Assume that firm 2 does

not observe xp before making its production decision. This means that,

although formally firm 1 chooses output xp first, this game should be anal-

ysed as a simultaneous game between firm 1 and firm 2.

What solution concept should we use here?

ii.

* Write down the profit functions for firm 1 and firm 2, and

the maximisation programme each firm faces.

iji

, Find the first order condition for each firm with respect to

each of their products.

* Solve for the Nash equilibrium quantities of each product,

iv. .

xp, X, x

V.

rium quantities found in the previous part, determine how the equi-

librium quantities change with a. Provide an intuition for this.

By differentiating each of the expressions for the equilib-

vi.

Compute the profit of firm 2 in equilibrium. How does this

profit level vary with a? Why are firm 2's profits affected by a even

though the parameter a does not directly enter the cost function of

Firm 2?

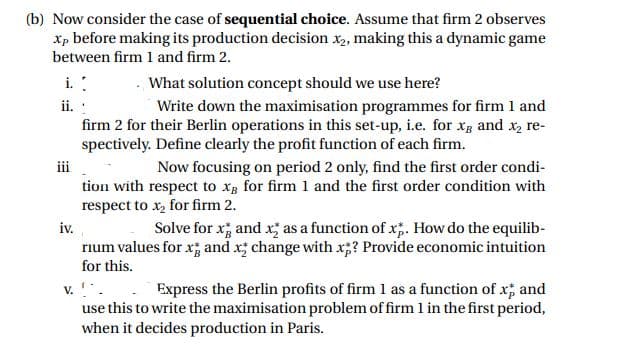

Transcribed Image Text:(b) Now consider the case of sequential choice. Assume that firm 2 observes

Xp before making its production decision x, making this a dynamic game

between firm 1 and firm 2.

i. :

What solution concept should we use here?

ii. :

Write down the maximisation programmes for firm 1 and

firm 2 for their Berlin operations in this set-up, i.e. for Xg and x, re-

spectively. Define clearly the profit function of each firm.

iii

Now focusing on period 2 only, find the first order condi-

tion with respect to xg for firm 1 and the first order condition with

respect to x, for firm 2.

iv.

rium values for x; and x; change with x;? Provide economic intuition

Solve for x; and x; as a function of x;. How do the equilib-

for this.

v. .. Express the Berlin profits of firm 1 as a function of x; and

use this to write the maximisation problem of firm 1 in the first period,

when it decides production in Paris.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning