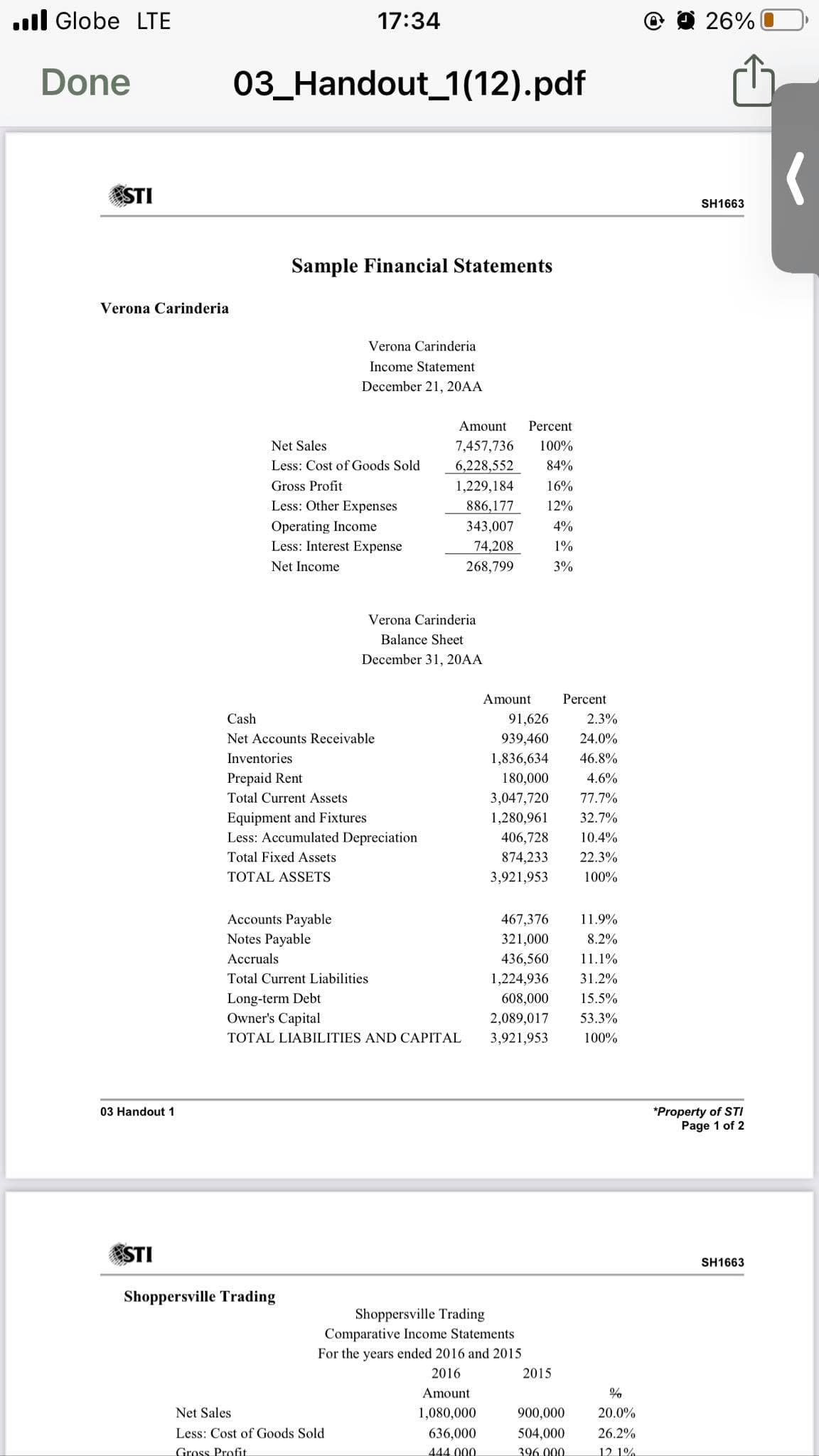

ull Globe LTE 17:34 O O 26% Done 03_Handout_1(12).pdf ESTI SH1663 Sample Financial Statements Verona Carinderia Verona Carinderia Income Statement December 21, 20AA Amount Percent Net Sales 7,457,736 100% Less: Cost of Goods Sold 6,228,552 84% Gross Profit 1,229,184 16% Less: Other Expenses 886,177 12% Operating Income Less: Interest Expense 343,007 4% 74,208 1% Net Income 268,799 3% Verona Carinderia Balance Sheet December 31, 20AA Amount Percent Cash 91,626 2.3% Net Accounts Receivable 939,460 24.0% Inventories 1,836,634 46.8% Prepaid Rent 180,000 4.6% Total Current Assets 3,047,720 77.7% Equipment and Fixtures Less: Accumulated Depreciation 1,280,961 32.7% 406,728 10.4% Total Fixed Assets 874,233 22.3% TOTAL ASSETS 3,921,953 100% Accounts Payable 467,376 11.9% Notes Payable 321,000 8.2% Accruals 436,560 11.1% Total Current Liabilities 1,224,936 31.2% Long-term Debt Owner's Capital 608,000 15.5% 2,089,017 53.3% TOTAL LIABILITIES AND CAPITAL 3,921,953 100% 03 Handout 1 *Property of STI

ull Globe LTE 17:34 O O 26% Done 03_Handout_1(12).pdf ESTI SH1663 Sample Financial Statements Verona Carinderia Verona Carinderia Income Statement December 21, 20AA Amount Percent Net Sales 7,457,736 100% Less: Cost of Goods Sold 6,228,552 84% Gross Profit 1,229,184 16% Less: Other Expenses 886,177 12% Operating Income Less: Interest Expense 343,007 4% 74,208 1% Net Income 268,799 3% Verona Carinderia Balance Sheet December 31, 20AA Amount Percent Cash 91,626 2.3% Net Accounts Receivable 939,460 24.0% Inventories 1,836,634 46.8% Prepaid Rent 180,000 4.6% Total Current Assets 3,047,720 77.7% Equipment and Fixtures Less: Accumulated Depreciation 1,280,961 32.7% 406,728 10.4% Total Fixed Assets 874,233 22.3% TOTAL ASSETS 3,921,953 100% Accounts Payable 467,376 11.9% Notes Payable 321,000 8.2% Accruals 436,560 11.1% Total Current Liabilities 1,224,936 31.2% Long-term Debt Owner's Capital 608,000 15.5% 2,089,017 53.3% TOTAL LIABILITIES AND CAPITAL 3,921,953 100% 03 Handout 1 *Property of STI

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.13P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Compute for the following

1. TIE Ratio

2. Gross Profit Ratio

3. Operating Profit Ratio

4. Net Profit Ratio

Transcribed Image Text:ull Globe LTE

17:34

O O 26%

Done

03_Handout_1(12).pdf

ESTI

SH1663

Sample Financial Statements

Verona Carinderia

Verona Carinderia

Income Statement

December 21, 20AA

Amount

Percent

Net Sales

7,457,736

100%

Less: Cost of Goods Sold

6,228,552

84%

Gross Profit

1,229,184

16%

Less: Other Expenses

886,177

12%

Operating Income

Less: Interest Expense

343,007

4%

74,208

1%

Net Income

268,799

3%

Verona Carinderia

Balance Sheet

December 31, 20AA

Amount

Percent

Cash

91,626

2.3%

Net Accounts Receivable

939,460

24.0%

Inventories

1,836,634

46.8%

Prepaid Rent

180,000

4.6%

Total Current Assets

3,047,720

77.7%

Equipment and Fixtures

Less: Accumulated Depreciation

1,280,961

32.7%

406,728

10.4%

Total Fixed Assets

874,233

22.3%

TOTAL ASSETS

3,921,953

100%

Accounts Payable

467,376

11.9%

Notes Payable

321,000

8.2%

Accruals

436,560

11.1%

Total Current Liabilities

1,224,936

31.2%

Long-term Debt

Owner's Capital

608,000

15.5%

2,089,017

53.3%

TOTAL LIABILITIES AND CAPITAL

3,921,953

100%

*Property of STI

Page 1 of 2

03 Handout 1

STI

SH1663

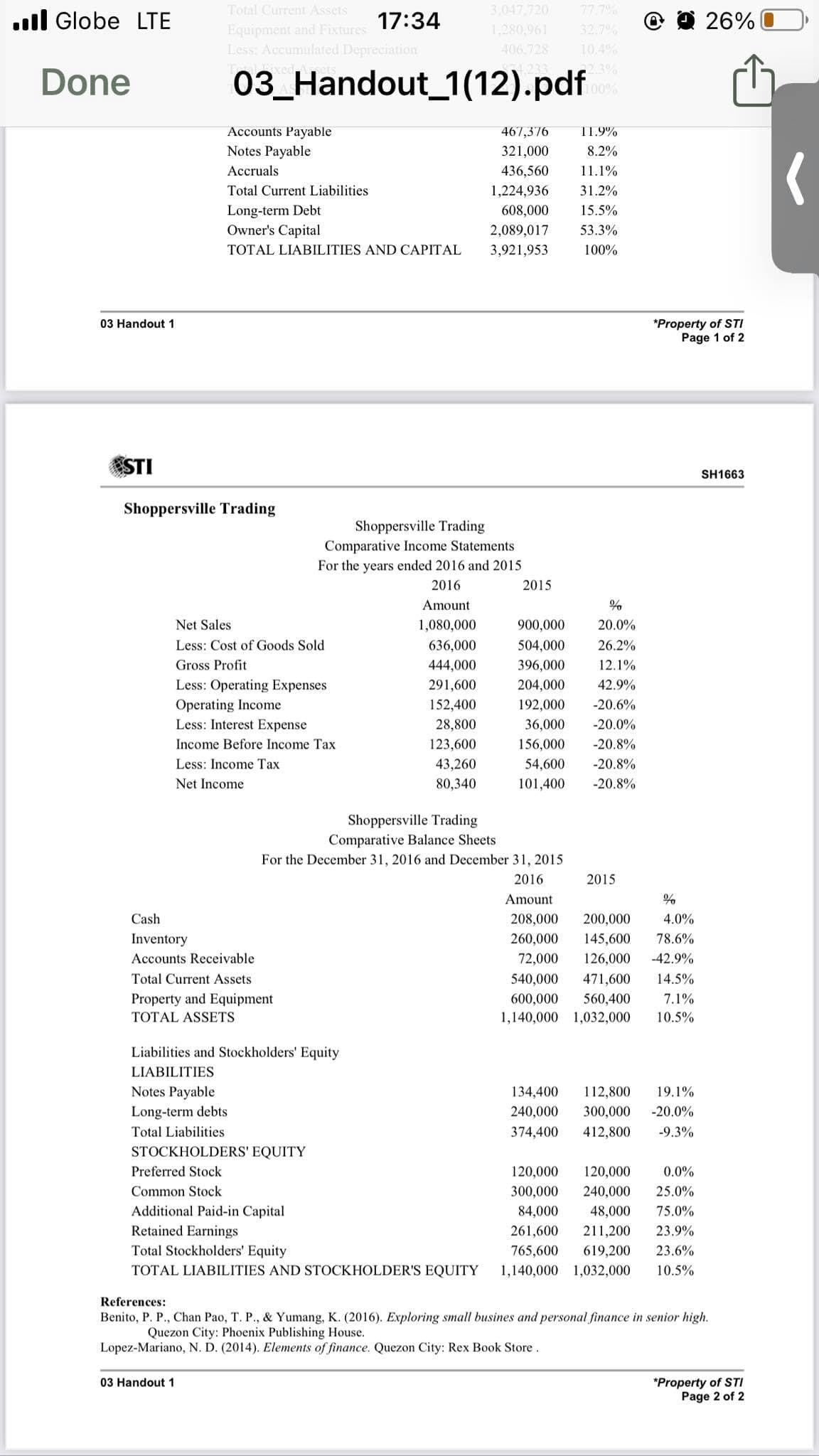

Shoppersville Trading

Shoppersville Trading

Comparative Income Statements

For the years ended 2016 and 2015

2016

2015

Amount

Net Sales

1,080,000

900,000

20.0%

Less: Cost of Goods Sold

636,000

504,000

26.2%

Gross Profit

444.000

396.000

12 1%

Transcribed Image Text:Total Current Assets

3,047,720

77.7%

ull Globe LTE

17:34

© O 26%

Equipment and Fixtures

Less: Accumulated Depreciation

1,280,961

32.7%

406.728

10.4%

Done

03_Handout_1(12).pdf

100%

Accounts Payable

467,376

11.9%

Notes Payable

321,000

8.2%

Accruals

436,560

11.1%

Total Current Liabilities

1,224,936

31.2%

Long-term Debt

Owner's Capital

608,000

15.5%

2,089,017

53.3%

TOTAL LIABILITIES AND CAPITAL

3,921,953

100%

03 Handout 1

*Property of STI

Page 1 of 2

STI

SH1663

Shoppersville Trading

Shoppersville Trading

Comparative Income Statements

For the years ended 2016 and 2015

2016

2015

Amount

Net Sales

1,080,000

900,000

20.0%

Less: Cost of Goods Sold

636,000

504,000

26.2%

Gross Profit

444,000

396,000

12.1%

Less: Operating Expenses

291,600

204,000

42.9%

Operating Income

Less: Interest Expense

152,400

192,000

-20.6%

28,800

36,000

-20.0%

Income Before Income Tax

123,600

156,000

-20.8%

Less: Income Tax

43,260

54,600

-20.8%

Net Income

80,340

101,400

-20.8%

Shoppersville Trading

Comparative Balance Sheets

For the December 31, 2016 and December 31, 2015

2016

2015

Amount

Cash

208,000

200,000

4.0%

Inventory

260,000

145,600

78.6%

Accounts Receivable

72,000

126,000

-42.9%

Total Current Assets

540,000

471,600

14.5%

Property and Equipment

600,000

560,400

7.1%

TOTAL ASSETS

1,140,000 1,032,000

10.5%

Liabilities and Stockholders' Equity

LIABILITIES

Notes Payable

134,400

112,800

19.1%

Long-term debts

240,000

300,000

-20.0%

Total Liabilities

374,400

412,800

-9.3%

STOCKHOLDERS' EQUITY

Preferred Stock

120,000

120,000

0.0%

Common Stock

300,000

240,000

25.0%

Additional Paid-in Capital

84,000

48,000

75.0%

Retained Earnings

Total Stockholders' Equity

261,600

211,200

23.9%

765,600

619,200

23.6%

TOTAL LIABILITIES AND STOCKHOLDER'S EQUITY

1,140,000 1,032,000

10.5%

References:

Benito, P. P., Chan Pao, T. P., & Yumang, K. (2016). Exploring small busines and personal finance in senior high.

Quezon City: Phoenix Publishing House.

Lopez-Mariano, N. D. (2014). Elements of finance. Quezon City: Rex Book Store.

03 Handout 1

*Property of STI

Page 2 of 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning