Under the terms of his salary agreement, president Morgan Walters has an option of receiving either an immediate bonus of $66,000, or a deferred bonus of $84,000 payable in 10 years. Click here to view factor tables gnoring tax considerations and assuming a relevant interest rate of 4%, which form of settlement should Walters accept? Present value of deferred bonus

Under the terms of his salary agreement, president Morgan Walters has an option of receiving either an immediate bonus of $66,000, or a deferred bonus of $84,000 payable in 10 years. Click here to view factor tables gnoring tax considerations and assuming a relevant interest rate of 4%, which form of settlement should Walters accept? Present value of deferred bonus

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 45P

Related questions

Question

Please help solve

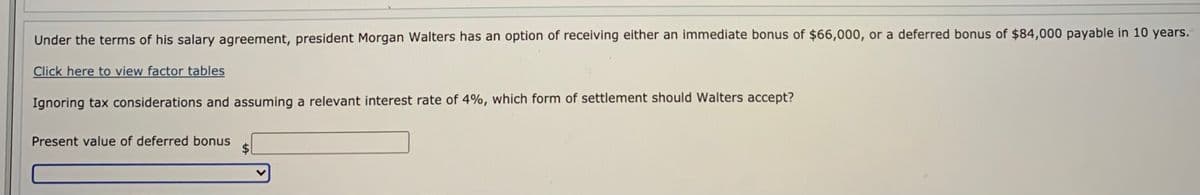

Transcribed Image Text:Under the terms of his salary agreement, president Morgan Walters has an option of receiving either an immediate bonus of $66,000, or a deferred bonus of $84,000 payable in 10 years.

Click here to view factor tables

Ignoring tax considerations and assuming a relevant interest rate of 4%, which form of settlement should Walters accept?

Present value of deferred bonus

$1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT