United Residential is a real-estate developer considering a 40-unit apartment complex in a growing college town. As the area is also booming with foreign auto-makers locating their U.S. assembly plants, the firm expects that the apartment complex, once built, will enjoy a 90% occupancy for an extended period. The firm already complied some of the critical financial information related to the development project as follows: • Land price (1 acre) = $1,200,000. Building (40 units of single bedroom) = $4,800,000. Project life= 25 years. Building maintenance per unit per month= $100. Annual property taxes and insurance = $400,000. Assuming that the land will appreciate at an annual rate of 5%, but the building will have no value at the end of 25 years (it will be torn down and a new structure would be built). Determine the minimum monthly rate that should be charged if a 12% return for 0 9489% per month) before

United Residential is a real-estate developer considering a 40-unit apartment complex in a growing college town. As the area is also booming with foreign auto-makers locating their U.S. assembly plants, the firm expects that the apartment complex, once built, will enjoy a 90% occupancy for an extended period. The firm already complied some of the critical financial information related to the development project as follows: • Land price (1 acre) = $1,200,000. Building (40 units of single bedroom) = $4,800,000. Project life= 25 years. Building maintenance per unit per month= $100. Annual property taxes and insurance = $400,000. Assuming that the land will appreciate at an annual rate of 5%, but the building will have no value at the end of 25 years (it will be torn down and a new structure would be built). Determine the minimum monthly rate that should be charged if a 12% return for 0 9489% per month) before

Chapter14: Capital Structure Management In Practice

Section14.A: Breakeven Analysis

Problem 8P

Related questions

Question

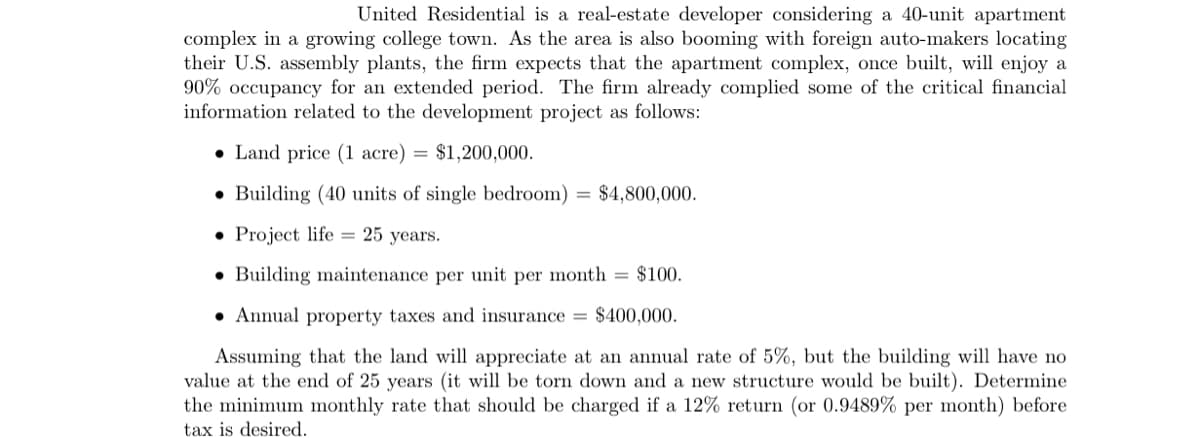

Transcribed Image Text:United Residential is a real-estate developer considering a 40-unit apartment

complex in a growing college town. As the area is also booming with foreign auto-makers locating

their U.S. assembly plants, the firm expects that the apartment complex, once built, will enjoy a

90% occupancy for an extended period. The firm already complied some of the critical financial

information related to the development project as follows:

Land price (1 acre) = $1,200,000.

● Building (40 units of single bedroom) = $4,800,000.

Project life 25 years.

Building maintenance per unit per month = $100.

Annual property taxes and insurance = $400,000.

Assuming that the land will appreciate at an annual rate of 5%, but the building will have no

value at the end of 25 years (it will be torn down and a new structure would be built). Determine

the minimum monthly rate that should be charged if a 12% return (or 0.9489% per month) before

tax is desired.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning