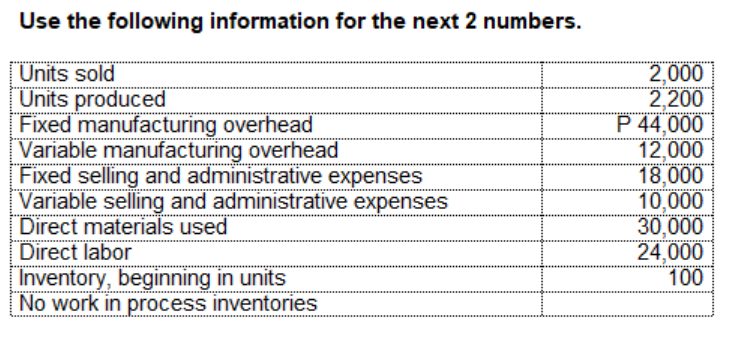

Units sold 2,000 Units produced 2,200 Fixed manufacturing overhead 44,000 Variable manufacturing overhead 12,000 Fixed selling and administrative expenses 18,000 Variable selling and administrative expenses 10,000 Direct materials used 30,000 Direct labor 24,000 Inventory, beginning in units 100 No work in process inventories Compute for the ending Finished Goods Inventory under Absorption costing Compute for the Ending Finished Goods Inventory under Variable Costing method

Units sold 2,000 Units produced 2,200 Fixed manufacturing overhead 44,000 Variable manufacturing overhead 12,000 Fixed selling and administrative expenses 18,000 Variable selling and administrative expenses 10,000 Direct materials used 30,000 Direct labor 24,000 Inventory, beginning in units 100 No work in process inventories Compute for the ending Finished Goods Inventory under Absorption costing Compute for the Ending Finished Goods Inventory under Variable Costing method

Chapter4: Job Order Costing

Section: Chapter Questions

Problem 10MC: Assigning indirect costs to specific jobs is completed by which of the following? applying the costs...

Related questions

Question

| Units sold | 2,000 |

| Units produced | 2,200 |

| Fixed manufacturing overhead | 44,000 |

| Variable manufacturing overhead | 12,000 |

| Fixed selling and administrative expenses | 18,000 |

| Variable selling and administrative expenses | 10,000 |

| Direct materials used | 30,000 |

| Direct labor | 24,000 |

| Inventory, beginning in units | 100 |

| No work in process inventories |

- Compute for the ending Finished Goods Inventory under Absorption costing

- Compute for the Ending Finished Goods Inventory under Variable Costing method

BDM Co. presented the following data for 2021:

| Sales | 256,000 |

| Variable |

96,000 |

| Fixed manufacturing costs | 64,000 |

| Fixed selling and administrative expenses | 80,000 |

| Actual production in units | 10,000 |

| Finished goods, end in units | 2,000 |

| Finished goods, beginning in units | None |

- What is the net income under variable costing method?

- What is the net income under absorption costing method?

Transcribed Image Text:Use the following information for the next 2 numbers.

Units sold

Units produced

Fixed manufacturing overhead

Variable manufacturing overhead

Fixed selling and administrative expenses

Variable selling and administrative expenses

Direct materials used

Direct labor

Inventory, beginning in units

No work in process inventories

2,000

2,200

P 44,000

12,000

18,000

10,000

30,000

24,000

100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning