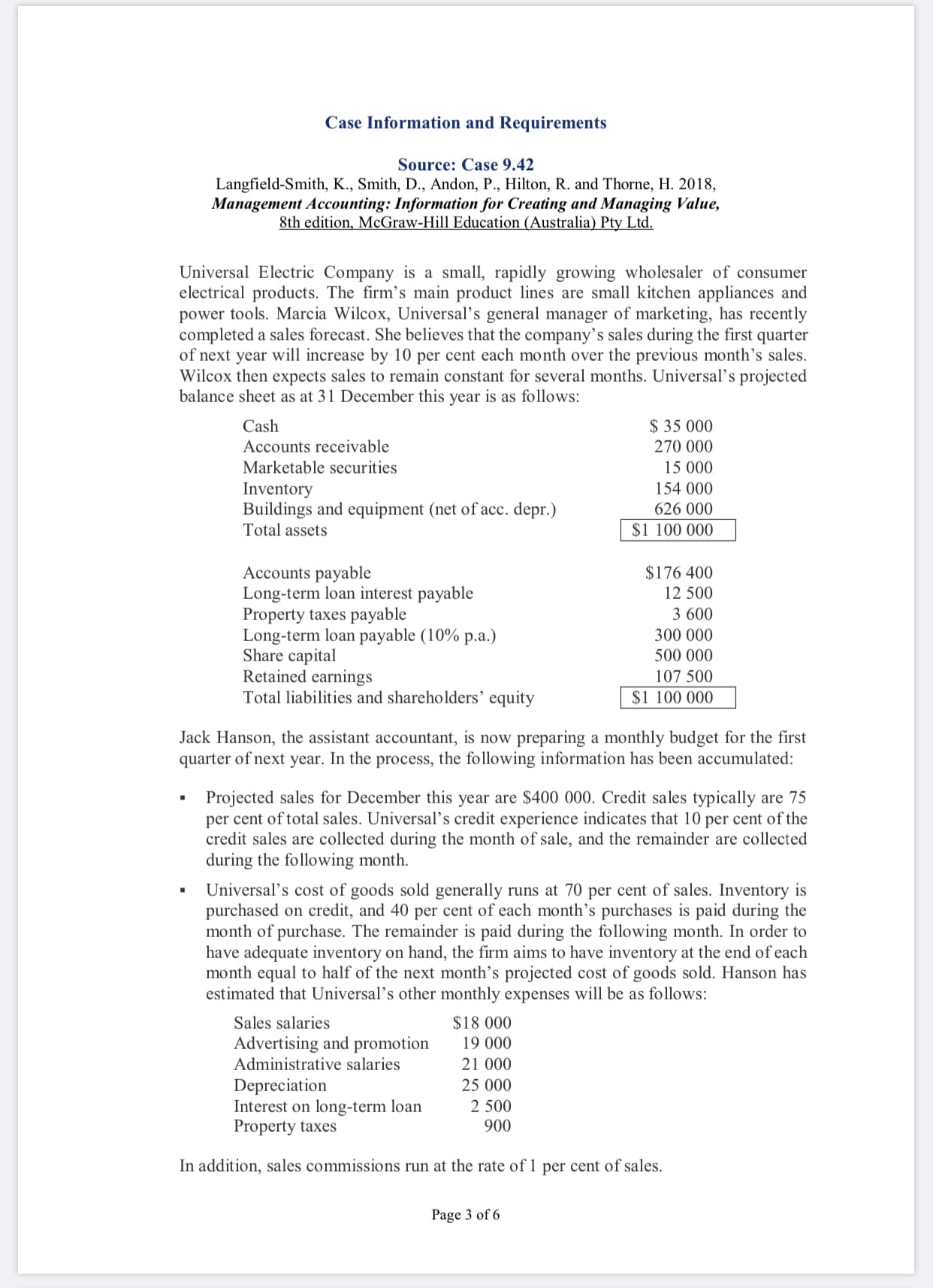

Universal Electric Company is a small, rapidly growing wholesaler of consumer electrical products. The firm's main product lines are small kitchen appliances and power tools. Marcia Wilcox, Universal's general manager of marketing, has recently completed a sales forecast. She believes that the company's sales during the first quarter of next year will increase by 10 per cent each month over the previous month's sales. Wilcox then expects sales to remain constant for several months. Universal's projected balance sheet as at 31 December this year is as follows: $ 35 000 Cash Accounts receivable 270 000 Marketable securities 15 000 154 000 Inventory Buildings and equipment (net of acc. depr.) Total assets 626 000 $1 100 000 Accounts payable Long-term loan interest payable Property taxes payable Long-term loan payable (10% p.a.) Share capital Retained earnings Total liabilities and shareholders' equity $176 400 12 500 3 600 300 000 500 000 107 500 $1 100 000 Jack Hanson, the assistant accountant, is now preparing a monthly budget for the first quarter of next year. In the process, the following information has been accumulated: Projected sales for December this year are $400 000. Credit sales typically are 75 per cent of total sales. Universal's credit experience indicates that 10 per cent of the credit sales are collected during the month of sale, and the remainder are collected during the following month. Universal's cost of goods sold generally runs at 70 per cent of sales. Inventory is purchased on credit, and 40 per cent of each month's purchases is paid during the month of purchase. The remainder is paid during the following month. In order to have adequate inventory on hand, the firm aims to have inventory at the end of each month equal to half of the next month's projected cost of goods sold. Hanson has estimated that Universal's other monthly expenses will be as follows: $18 000 Sales salaries Advertising and promotion Administrative salaries 19 000 21 000 Depreciation Interest on long-term loan Property taxes 25 000 2 500 900 In addition, sales commissions run at the rate of 1 per cent of sales.

Universal Electric Company is a small, rapidly growing wholesaler of consumer electrical products. The firm's main product lines are small kitchen appliances and power tools. Marcia Wilcox, Universal's general manager of marketing, has recently completed a sales forecast. She believes that the company's sales during the first quarter of next year will increase by 10 per cent each month over the previous month's sales. Wilcox then expects sales to remain constant for several months. Universal's projected balance sheet as at 31 December this year is as follows: $ 35 000 Cash Accounts receivable 270 000 Marketable securities 15 000 154 000 Inventory Buildings and equipment (net of acc. depr.) Total assets 626 000 $1 100 000 Accounts payable Long-term loan interest payable Property taxes payable Long-term loan payable (10% p.a.) Share capital Retained earnings Total liabilities and shareholders' equity $176 400 12 500 3 600 300 000 500 000 107 500 $1 100 000 Jack Hanson, the assistant accountant, is now preparing a monthly budget for the first quarter of next year. In the process, the following information has been accumulated: Projected sales for December this year are $400 000. Credit sales typically are 75 per cent of total sales. Universal's credit experience indicates that 10 per cent of the credit sales are collected during the month of sale, and the remainder are collected during the following month. Universal's cost of goods sold generally runs at 70 per cent of sales. Inventory is purchased on credit, and 40 per cent of each month's purchases is paid during the month of purchase. The remainder is paid during the following month. In order to have adequate inventory on hand, the firm aims to have inventory at the end of each month equal to half of the next month's projected cost of goods sold. Hanson has estimated that Universal's other monthly expenses will be as follows: $18 000 Sales salaries Advertising and promotion Administrative salaries 19 000 21 000 Depreciation Interest on long-term loan Property taxes 25 000 2 500 900 In addition, sales commissions run at the rate of 1 per cent of sales.

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 10EB: Keleher Industries manufactures pet doors and sells them directly to the consumer via their web...

Related questions

Question

100%

Transcribed Image Text:Universal Electric Company is a small, rapidly growing wholesaler of consumer

electrical products. The firm's main product lines are small kitchen appliances and

power tools. Marcia Wilcox, Universal's general manager of marketing, has recently

completed a sales forecast. She believes that the company's sales during the first quarter

of next year will increase by 10 per cent each month over the previous month's sales.

Wilcox then expects sales to remain constant for several months. Universal's projected

balance sheet as at 31 December this year is as follows:

$ 35 000

Cash

Accounts receivable

270 000

Marketable securities

15 000

154 000

Inventory

Buildings and equipment (net of acc. depr.)

Total assets

626 000

$1 100 000

Accounts payable

Long-term loan interest payable

Property taxes payable

Long-term loan payable (10% p.a.)

Share capital

Retained earnings

Total liabilities and shareholders' equity

$176 400

12 500

3 600

300 000

500 000

107 500

$1 100 000

Jack Hanson, the assistant accountant, is now preparing a monthly budget for the first

quarter of next year. In the process, the following information has been accumulated:

Projected sales for December this year are $400 000. Credit sales typically are 75

per cent of total sales. Universal's credit experience indicates that 10 per cent of the

credit sales are collected during the month of sale, and the remainder are collected

during the following month.

Universal's cost of goods sold generally runs at 70 per cent of sales. Inventory is

purchased on credit, and 40 per cent of each month's purchases is paid during the

month of purchase. The remainder is paid during the following month. In order to

have adequate inventory on hand, the firm aims to have inventory at the end of each

month equal to half of the next month's projected cost of goods sold. Hanson has

estimated that Universal's other monthly expenses will be as follows:

$18 000

Sales salaries

Advertising and promotion

Administrative salaries

19 000

21 000

Depreciation

Interest on long-term loan

Property taxes

25 000

2 500

900

In addition, sales commissions run at the rate of 1 per cent of sales.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning