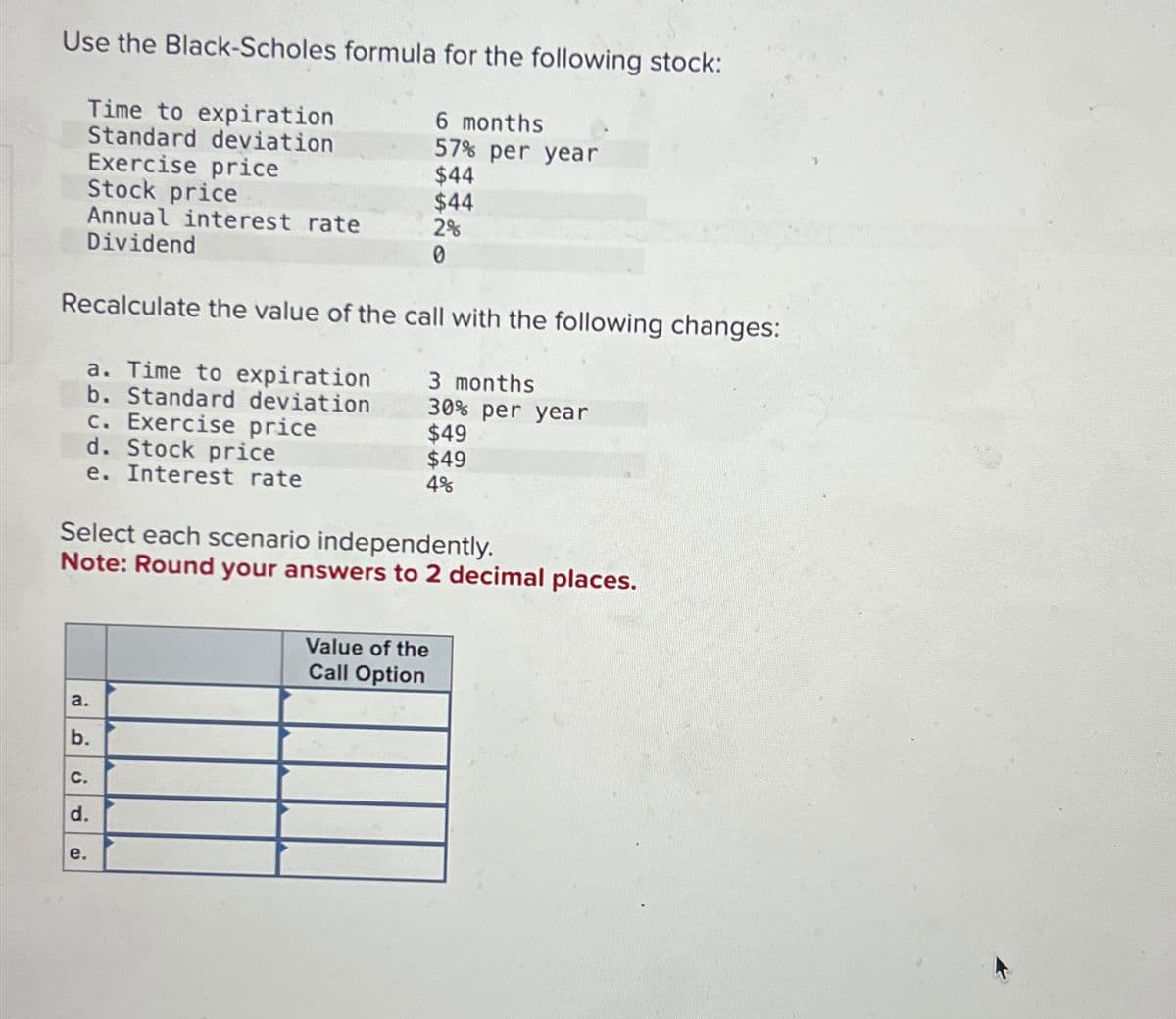

Use the Black-Scholes formula for the following stock: Time to expiration Standard deviation Exercise price Annual interest rate Stock price Dividend 6 months 57% per year $44 $44 2% 0 Recalculate the value of the call with the following changes: a. Time to expiration b. Standard deviation c. Exercise price d. Stock price e. Interest rate 3 months 30% per year $49 $49 4% Select each scenario independently. Note: Round your answers to 2 decimal places. a. b. C. d. e. Value of the Call Option

Use the Black-Scholes formula for the following stock: Time to expiration Standard deviation Exercise price Annual interest rate Stock price Dividend 6 months 57% per year $44 $44 2% 0 Recalculate the value of the call with the following changes: a. Time to expiration b. Standard deviation c. Exercise price d. Stock price e. Interest rate 3 months 30% per year $49 $49 4% Select each scenario independently. Note: Round your answers to 2 decimal places. a. b. C. d. e. Value of the Call Option

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 20P

Related questions

Question

Transcribed Image Text:Use the Black-Scholes formula for the following stock:

Time to expiration

Standard deviation

Exercise price

Annual interest rate

Stock price

Dividend

6 months

57% per year

$44

$44

2%

0

Recalculate the value of the call with the following changes:

a. Time to expiration

b. Standard deviation

c. Exercise price

d. Stock price

e. Interest rate

3 months

30% per year

$49

$49

4%

Select each scenario independently.

Note: Round your answers to 2 decimal places.

a.

b.

C.

d.

e.

Value of the

Call Option

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning