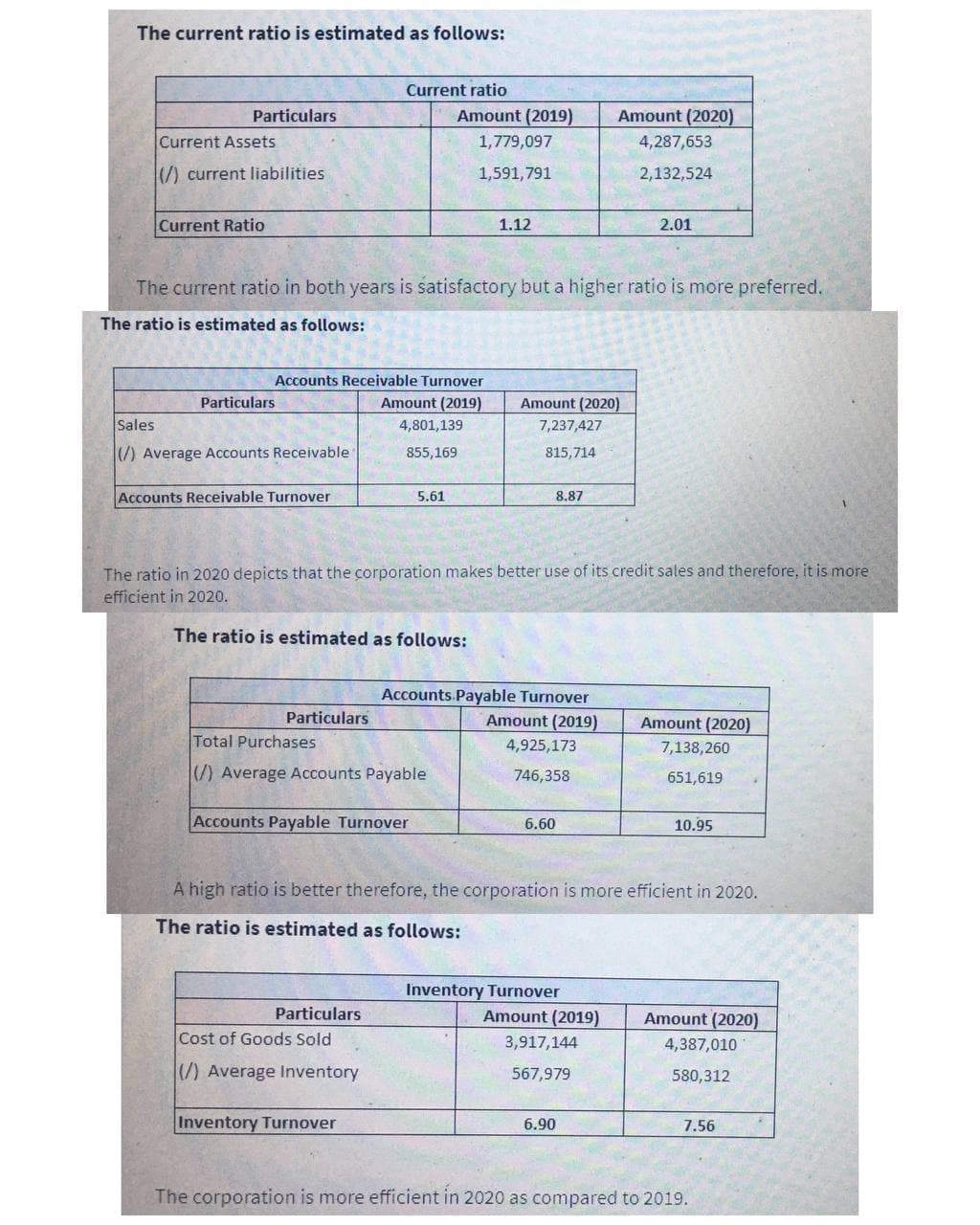

The current ratio is estimated as follows: Current ratio Particulars Amount (2019) Amount (2020) Current Assets 1,779,097 4,287,653 (/) current liabilities 1,591,791 2,132,524 Current Ratio 1.12 2.01 The current ratio in both years is satisfactory but a higher ratio is more preferred. The ratio is estimated as follows: Accounts Receivable Turnover Particulars Amount (2019) Amount (2020) Sales 4,801,139 7,237,427 (/) Average Accounts Receivable 855,169 815,714 Accounts Receivable Turnover 5.61 8.87 The ratio in 2020 depicts that the corporation makes better use of its credit sales and therefore, it is more efficient in 2020. The ratio is estimated as follows: Accounts Payable Turnover Particulars Amount (2019) Amount (2020) Total Purchases 4,925,173 7,138,260 (/) Average Accounts Payable 746,358 651,619 Accounts Payable Turnover 6.60 10.95 A high ratio is better therefore, the corporation is more efficient in 2020. The ratio is estimated as follows: Inventory Turnover Amount (2019) Particulars Amount (2020) Cost of Goods Sold 3,917,144 4,387,010 (/) Average Inventory 567,979 580,312 Inventory Turnover 6.90 7.56 The corporation is more efficient in 2020 as compared to 2019.

The current ratio is estimated as follows: Current ratio Particulars Amount (2019) Amount (2020) Current Assets 1,779,097 4,287,653 (/) current liabilities 1,591,791 2,132,524 Current Ratio 1.12 2.01 The current ratio in both years is satisfactory but a higher ratio is more preferred. The ratio is estimated as follows: Accounts Receivable Turnover Particulars Amount (2019) Amount (2020) Sales 4,801,139 7,237,427 (/) Average Accounts Receivable 855,169 815,714 Accounts Receivable Turnover 5.61 8.87 The ratio in 2020 depicts that the corporation makes better use of its credit sales and therefore, it is more efficient in 2020. The ratio is estimated as follows: Accounts Payable Turnover Particulars Amount (2019) Amount (2020) Total Purchases 4,925,173 7,138,260 (/) Average Accounts Payable 746,358 651,619 Accounts Payable Turnover 6.60 10.95 A high ratio is better therefore, the corporation is more efficient in 2020. The ratio is estimated as follows: Inventory Turnover Amount (2019) Particulars Amount (2020) Cost of Goods Sold 3,917,144 4,387,010 (/) Average Inventory 567,979 580,312 Inventory Turnover 6.90 7.56 The corporation is more efficient in 2020 as compared to 2019.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 10PA: Elegant Universal uses the balance sheet aging method to account for uncollectible debt on...

Related questions

Question

Critically evaluate the ratios calculated below, and comment on your analysis.

Transcribed Image Text:The current ratio is estimated as follows:

Current ratio

Particulars

Amount (2019)

Amount (2020)

Current Assets

1,779,097

4,287,653

(/) current liabilities

1,591, 791

2,132,524

Current Ratio

1.12

2.01

The current ratio in both years is satisfactory but a higher ratio is more preferred.

The ratio is estimated as follows:

Accounts Receivable Turnover

Particulars

Amount (2019)

Amount (2020)

Sales

4,801,139

7,237,427

(/) Average Accounts Receivable

855,169

815,714

Accounts Receivable Turnover

5.61

8.87

The ratio in 2020 depicts that the corporation makes better use of its credit sales and therefore, it is more

efficient in 2020.

The ratio is estimated as follows:

Accounts Payable Turnover

Particulars

Amount (2019)

Amount (2020)

Total Purchases

4,925,173

7,138,260

(/) Average Accounts Payable

746,358

651,619

Accounts Payable Turnover

6.60

10.95

A high ratio is better therefore, the corporation is more efficient in 2020.

The ratio is estimated as follows:

Inventory Turnover

Particulars

Amount (2019)

Amount (2020)

Cost of Goods Sold

3,917,144

4,387,010

(/) Average Inventory

567,979

580,312

Inventory Turnover

6.90

7.56

The corporation is more efficient in 2020 as compared to 2019.

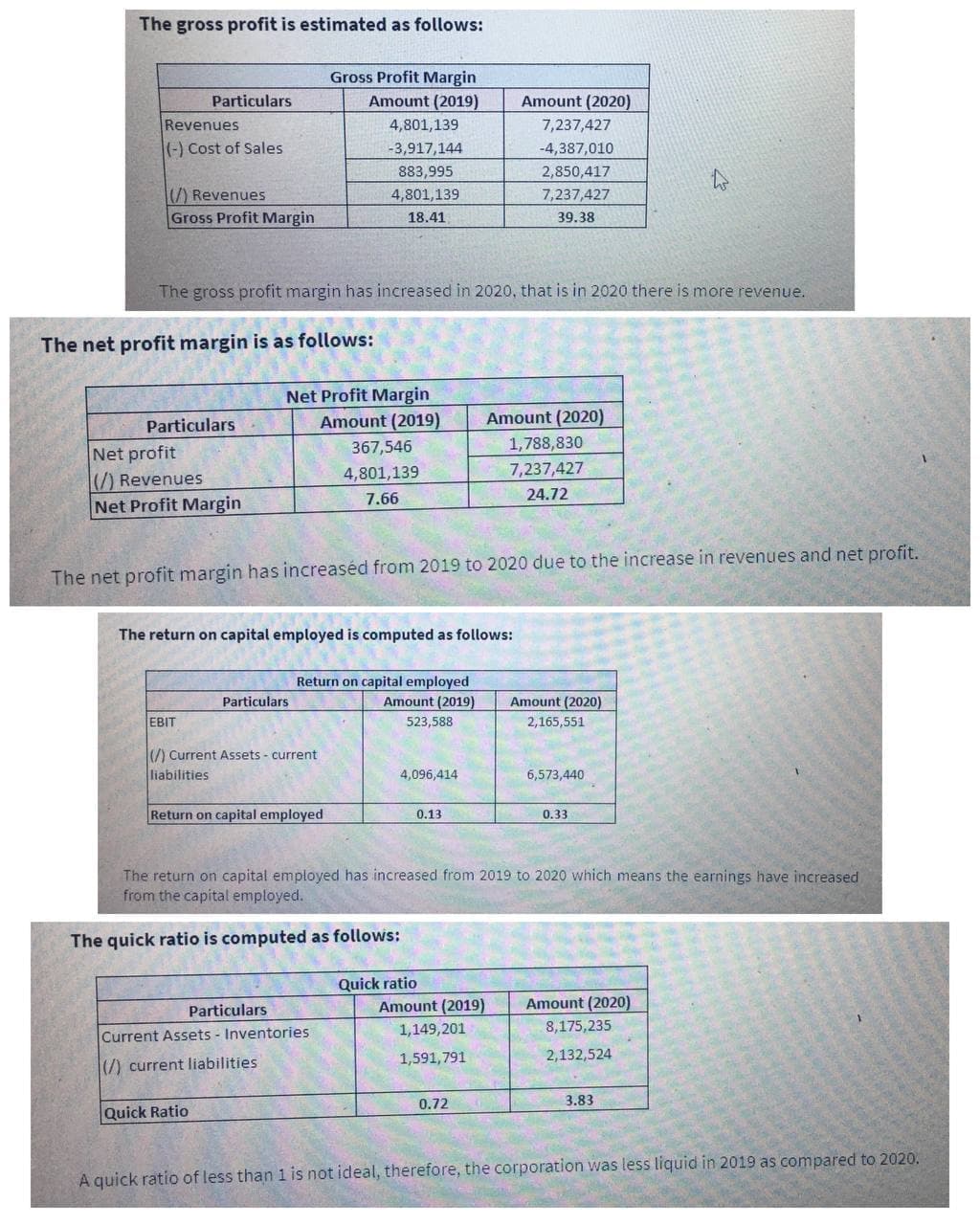

Transcribed Image Text:The gross profit is estimated as follows:

Gross Profit Margin

Particulars

Amount (2019)

Amount (2020)

Revenues

4,801,139

7,237,427

(-) Cost of Sales

-3,917,144

-4,387,010

883,995

2,850,417

(/) Revenues

Gross Profit Margin

4,801,139

7,237,427

18.41

39.38

The gross profit margin has increased in 2020, that is in 2020 there is more revenue.

The net profit margin is as follows:

Net Profit Margin

Particulars

Amount (2019)

Amount (2020)

367,546

1,788,830

Net profit

(/) Revenues

Net Profit Margin

4,801,139

7,237,427

7.66

24.72

The net profit margin has increaséd from 2019 to 2020 due to the increase in revenues and net profit.

The return on capital employed is computed as follows:

Return on capital employed

Amount (2019)

Particulars

Amount (2020)

EBIT

523,588

2,165,551

(/) Current Assets - current

liabilities

4,096,414

6,573,440

Return on capital employed

0.13

0.33

The return on capital employed has increased from 2019 to 2020 which means the earnings have increased

from the capital employed.

The quick ratio is computed as follows:

Quick ratio

Particulars

Amount (2019)

Amount (2020)

1,149,201

8,175,235

Current Assets - Inventories

1,591,791

2,132,524

(7) current liabilities

0.72

3.83

Quick Ratio

A quick ratio of less than 1 is not ideal, therefore, the corporation was less liquid in 2019 as compared to 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning