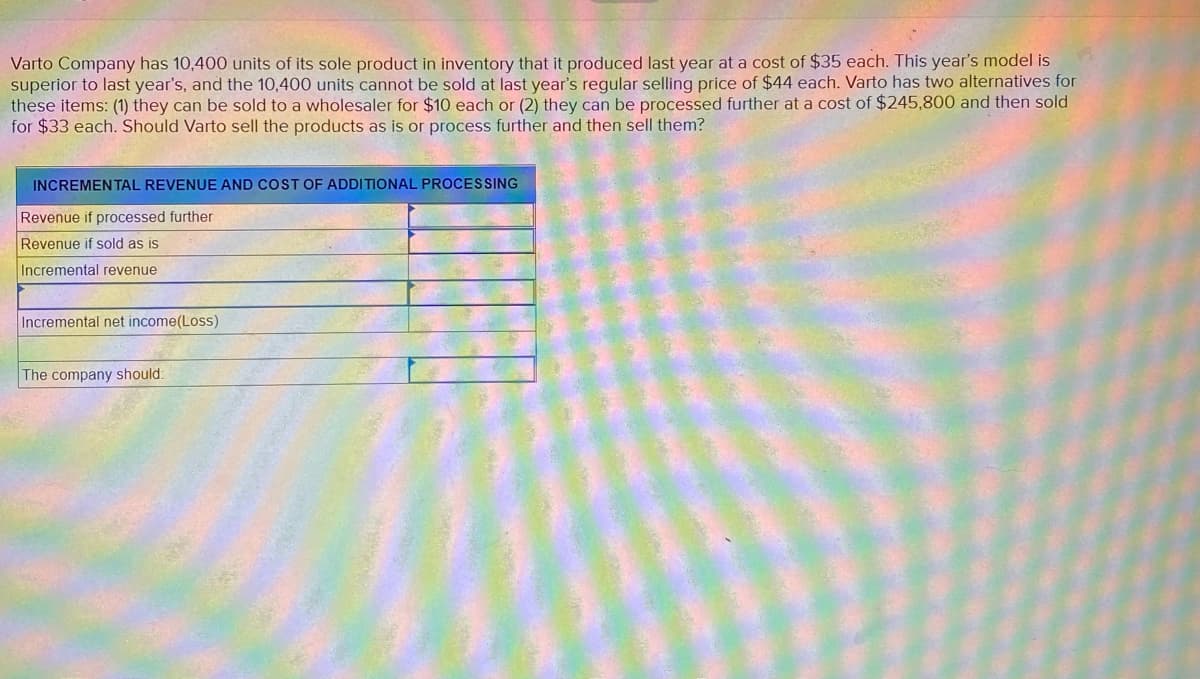

Varto Company has 10,400 units of its sole product in inventory that it produced last year at a cost of $35 each. This year's model is superior to last year's, and the 10,400 units cannot be sold at last year's regular selling price of $44 each. Varto has two alternatives for these items: (1) they can be sold to a wholesaler for $10 each or (2) they can be processed further at a cost of $245,800 and then sold for $33 each. Should Varto sell the products as is or process further and then sell them? INCREMENTAL REVENUE AND COST OF ADDITIONAL PROCESSING Revenue if processed further Revenue if sold as is Incremental revenue Incremental net income(Loss) The company should.

Varto Company has 10,400 units of its sole product in inventory that it produced last year at a cost of $35 each. This year's model is superior to last year's, and the 10,400 units cannot be sold at last year's regular selling price of $44 each. Varto has two alternatives for these items: (1) they can be sold to a wholesaler for $10 each or (2) they can be processed further at a cost of $245,800 and then sold for $33 each. Should Varto sell the products as is or process further and then sell them? INCREMENTAL REVENUE AND COST OF ADDITIONAL PROCESSING Revenue if processed further Revenue if sold as is Incremental revenue Incremental net income(Loss) The company should.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 2MC: Moore Company uses the LIFO cost flow assumption and carries Product A in inventory on December 31,...

Related questions

Topic Video

Question

Transcribed Image Text:Varto Company has 10,400 units of its sole product in inventory that it produced last year at a cost of $35 each. This year's model is

superior to last year's, and the 10,400 units cannot be sold at last year's regular selling price of $44 each. Varto has two alternatives for

these items: (1) they can be sold to a wholesaler for $10 each or (2) they can be processed further at a cost of $245,800 and then sold

for $33 each. Should Varto sell the products as is or process further and then sell them?

INCREMENTAL REVENUE AND COST OF ADDITIONAL PROCESSING

Revenue if processed further

Revenue if sold as is

Incremental revenue

Incremental net income(Loss)

The company should.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT