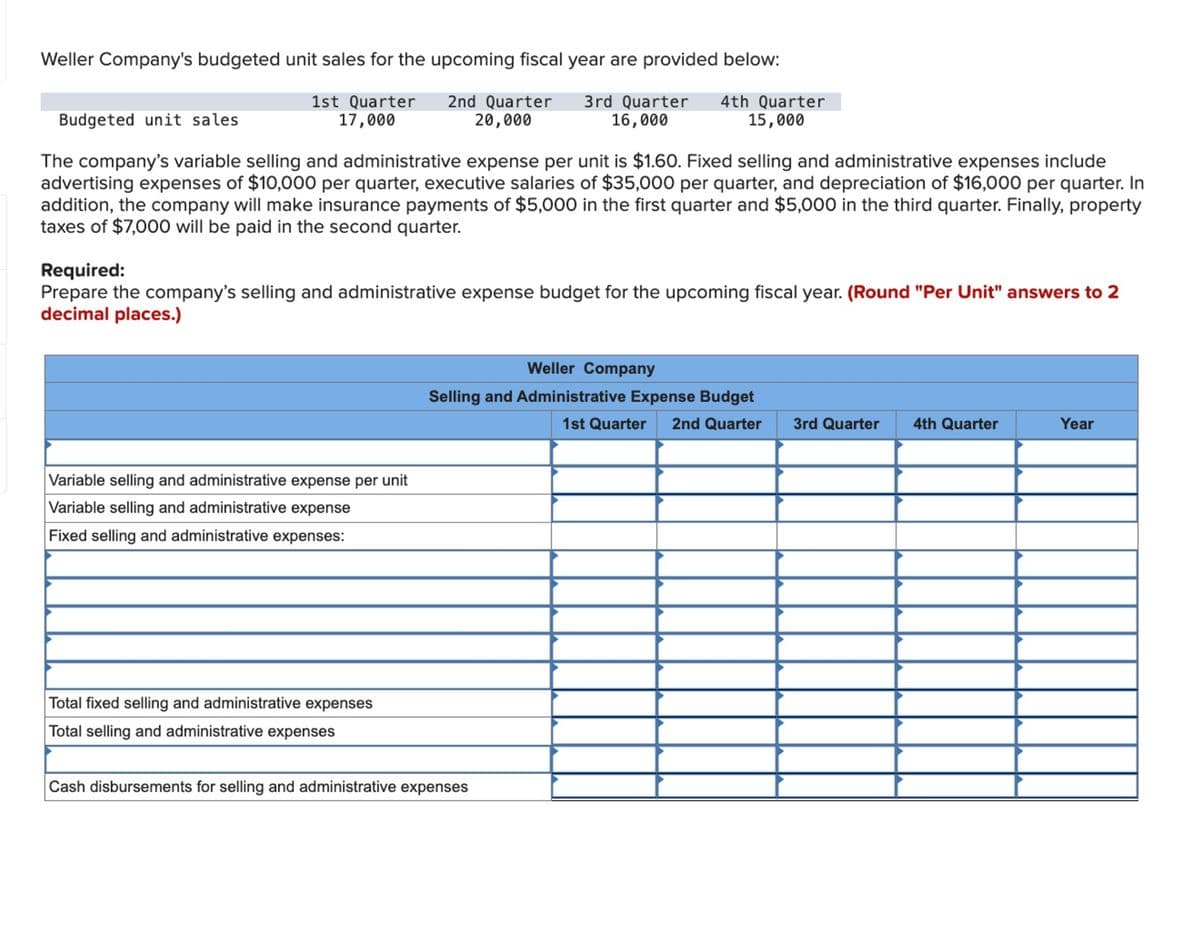

Weller Company's budgeted unit sales for the upcoming fiscal year are provided below: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 17,000 20,000 Budgeted unit sales 16,000 15,000 The company's variable selling and administrative expense per unit is $1.60. Fixed selling and administrative expenses include advertising expenses of $10,000 per quarter, executive salaries of $35,000 per quarter, and depreciation of $16,000 per quarter. In addition, the company will make insurance payments of $5,000 in the first quarter and $5,000 in the third quarter. Finally, property taxes of $7,000 will be paid in the second quarter. Required: Prepare the company's selling and administrative expense budget for the upcoming fiscal year. (Round "Per Unit" answers to 2 decimal places.) Variable selling and administrative expense per unit Variable selling and administrative expense Fixed selling and administrative expenses: Weller Company Selling and Administrative Expense Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total fixed selling and administrative expenses Total selling and administrative expenses Cash disbursements for selling and administrative expenses

Weller Company's budgeted unit sales for the upcoming fiscal year are provided below: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 17,000 20,000 Budgeted unit sales 16,000 15,000 The company's variable selling and administrative expense per unit is $1.60. Fixed selling and administrative expenses include advertising expenses of $10,000 per quarter, executive salaries of $35,000 per quarter, and depreciation of $16,000 per quarter. In addition, the company will make insurance payments of $5,000 in the first quarter and $5,000 in the third quarter. Finally, property taxes of $7,000 will be paid in the second quarter. Required: Prepare the company's selling and administrative expense budget for the upcoming fiscal year. (Round "Per Unit" answers to 2 decimal places.) Variable selling and administrative expense per unit Variable selling and administrative expense Fixed selling and administrative expenses: Weller Company Selling and Administrative Expense Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total fixed selling and administrative expenses Total selling and administrative expenses Cash disbursements for selling and administrative expenses

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 11CE: Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted...

Related questions

Question

Haresh

Transcribed Image Text:Weller Company's budgeted unit sales for the upcoming fiscal year are provided below:

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

17,000

20,000

Budgeted unit sales

16,000

15,000

The company's variable selling and administrative expense per unit is $1.60. Fixed selling and administrative expenses include

advertising expenses of $10,000 per quarter, executive salaries of $35,000 per quarter, and depreciation of $16,000 per quarter. In

addition, the company will make insurance payments of $5,000 in the first quarter and $5,000 in the third quarter. Finally, property

taxes of $7,000 will be paid in the second quarter.

Required:

Prepare the company's selling and administrative expense budget for the upcoming fiscal year. (Round "Per Unit" answers to 2

decimal places.)

Variable selling and administrative expense per unit

Variable selling and administrative expense

Fixed selling and administrative expenses:

Weller Company

Selling and Administrative Expense Budget

1st Quarter

2nd Quarter 3rd Quarter 4th Quarter

Year

Total fixed selling and administrative expenses

Total selling and administrative expenses

Cash disbursements for selling and administrative expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,