Solve each of the following parts independently: a. Sugar Company has hired a management consulting firm to review and make recommendations concerning Sugar's organizational structure. The consulting firm's fee will be P100,000. What will be the after-tax cost of the consulting firm's fee if Sugar's tax rate is 30%? b. The Royal Riding Club has redirected its advertising toward a different sector of the market. As a result of this change in advertising, the club's annual revenues have increased by P40,000. If the club's tax rate is 30%, what is the after-tax benefit from the increased revenues? The Sparkling Stars Basketball Team has just installed an electronic scoreboard in its playing arena at a cost of P210,000. For tax purposes, the entire original cost of the electronic scoreboard will be depreciated over seven years, using the straight-line method. Determine the yearly tax savings from the depreciation tax shield. Assume that the income tax rate is 30%. с.

Solve each of the following parts independently: a. Sugar Company has hired a management consulting firm to review and make recommendations concerning Sugar's organizational structure. The consulting firm's fee will be P100,000. What will be the after-tax cost of the consulting firm's fee if Sugar's tax rate is 30%? b. The Royal Riding Club has redirected its advertising toward a different sector of the market. As a result of this change in advertising, the club's annual revenues have increased by P40,000. If the club's tax rate is 30%, what is the after-tax benefit from the increased revenues? The Sparkling Stars Basketball Team has just installed an electronic scoreboard in its playing arena at a cost of P210,000. For tax purposes, the entire original cost of the electronic scoreboard will be depreciated over seven years, using the straight-line method. Determine the yearly tax savings from the depreciation tax shield. Assume that the income tax rate is 30%. с.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 12.1.2P

Related questions

Question

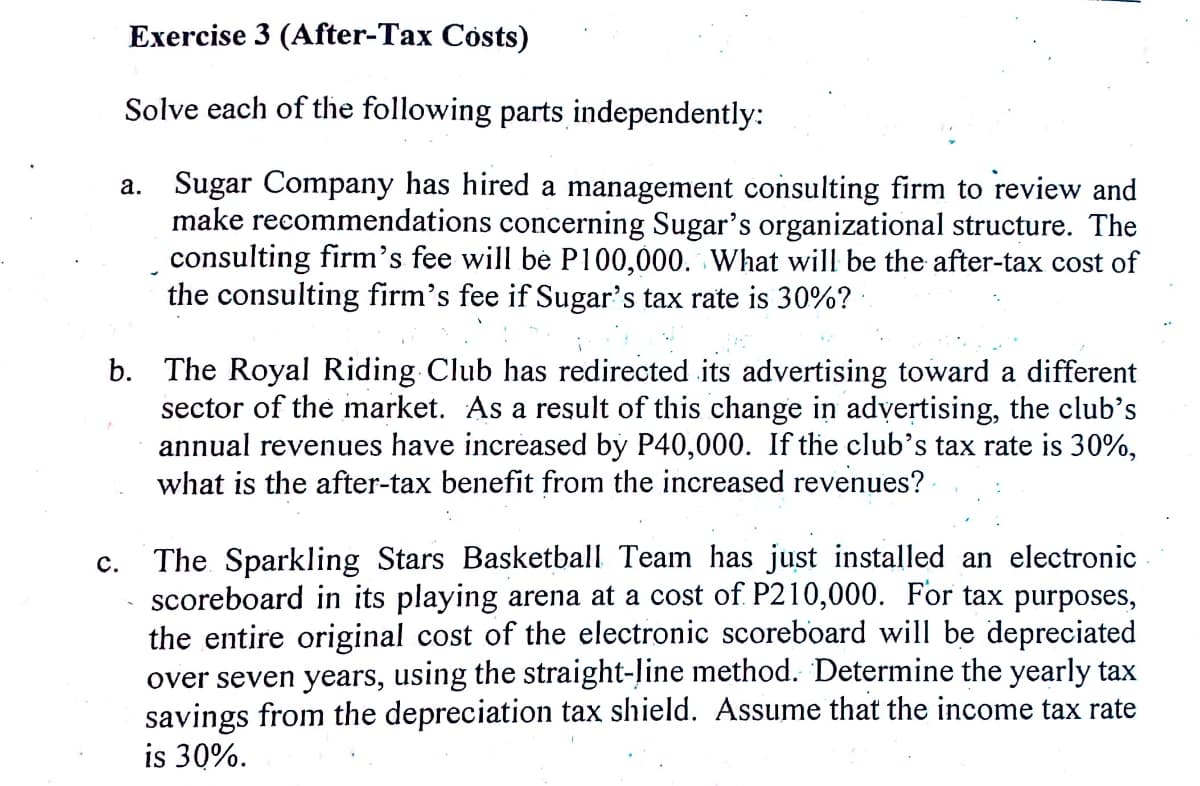

Transcribed Image Text:Exercise 3 (After-Tax Costs)

Solve each of the following parts independently:

a. Sugar Company has hired a management consulting firm to review and

make recommendations concerning Sugar's organizational structure. The

consulting firm's fee will be P100,000. What will be the after-tax cost of

the consulting firm's fee if Sugar's tax rate is 30%? ·

b. The Royal Riding Club has redirected its advertising toward a different

sector of the market. As a result of this change in advertising, the club's

annual revenues have increased by P40,000. If the club's tax rate is 30%,

what is the after-tax benefit from the increased revenues?

The. Sparkling Stars Basketball Team has just installed an electronic

scoreboard in its playing arena at a cost of P210,000. For tax purposes,

the entire original cost of the electronic scoreboard will be depreciated

over seven years, using the straight-Jine method. Determine the yearly tax

savings from the depreciation tax shield. Assume that the income tax rate

is 30%.

с.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning