What is the balance of the ending capital? 2. How much is the increase in the capital of choy after taking into account all transactions?

Q: Prior to recording adjusting entries, the Office Supplies account had a $392 debit balance. A physic...

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period.

Q: SOUND CORE WIRELESS sells a variety of mobile telephone accessories including several brands of Wire...

A: First-in, first-out (FIFO) cost flow assumption - Under FIFO Method, Inventory purchased first is so...

Q: Give 5 examples that explain different types of Transactions

A: Transactions - Transaction is as agreement to make payment in return of goods, services. Transaction...

Q: A company has a fiscal year-end of December 31: (1) on October 1, $13,000 was paid for a one-year fi...

A: The financial transactions are initially recorded in the form of journal entry and posted to the gen...

Q: the acquisition, the two companies have the following account balances. Clay’s equipment (with a fiv...

A: Consolidated Statements: Consolidated statements are reports that can be utilized when the parent or...

Q: Job 123 was recently completed by BudolBudol Me Corporation. The following data have been recorded o...

A: The job cost is used to estimate the individual cost of the product. It includes both direct and ind...

Q: analysis of the cash book and other records of Byle Corporation shows the follow ta: Accounts payabl...

A: The total purchases is calculated as sum of credit purchases and cash purchases made during the peri...

Q: How does Accounts Payable impact Declan's Designs' 2022 Statement of Cash Flows?

A: Accounts payable form part of working capital of a company. Therefore, a change (increase or decreas...

Q: antiago, Inc. has the following receipts during 2018: From service billings to client P400,000 Ad...

A: Solution Accrual basis of accounting Under accrual basis , the income is recorded when s...

Q: How does the Loss on Sale of PPE impact Declan's Designs' 2022 Statement of Cash Flows? Questi...

A: Cash Flow Statement - The Cash Flow Statement is the statement that shows the cash inflow and outflo...

Q: ntity A is computing for its basic earnings er share and has gathered the following nformation: Loss...

A: Solution: Earnings per share represents the earnings available to the stockholders on the shares hel...

Q: car stuff.inc net sales-13,000 cost of goods sold-3,000 salary and wage expense-1,200 utility expens...

A: Gross profit = Net sales - Cost of goods sold Income from operations = Gross profit - operating expe...

Q: Freedom Co. purchased a new machine on July 2, 2019, at a total installed cost of $132,000. The mach...

A: 1. Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of th...

Q: At the beginning of September, Helen Rojas started Rojas Wealth Management Consulting, a firm that o...

A: Statement of owner's equity = Capital + Net income - Withdrawals Net Income = Revenue - expenses As...

Q: How do businesses recover the cost of capitalized, intangible assets? O Direct write-off O Depreciat...

A: Intangible assets are non-monetory assets and do not have physical existence. It includes goodwill p...

Q: Required information Skip to question [The following information applies to the questions display...

A: Calculation of the amount of service department cost allocated to P1 and P2 using step method: De...

Q: A company annually consumes 10,000 units of Part C. The carrying cost of this part is P2 per year an...

A: Economic order quantity in costing States the order quantity at which the ordering and carrying cost...

Q: Question: Considering the year-ending adjusting journal entries for the periodic inventory system. I...

A: Formula: Cost of goods sold= opening inventory+purchases - closing inventory. Gross profit = sales -...

Q: A taxpayer filed his income tax return in October 28, 2022. The deadline for the return was April 15...

A: solution concept as per the income tax provision stated by BIR in event when a person fails to file ...

Q: The balance sheets of HiROE Inc. showed the following at December 31, 2020 and 2019: December 31,...

A: Depreciation is a method of allocating the expense of a tangible or physical asset over its estimate...

Q: The Marchetti Soup Company entered into the following transactions during the month of June: (1) pur...

A: Under perpetual inventory system, the cost of goods sold is to be recognized with every sale transac...

Q: How does Accounts Receivable impact Declan's Designs 2022 Statement of Cash Flows? Question 19 op...

A: >Statement of Cash flows is one of the financial statements, and is prepared for a particular per...

Q: You are currently working as a planner in a construction company. The company is currently running 4...

A: The actual value of work done is given for each project and direct cost. The overhead is indirect co...

Q: Exercise 5-10 (Static) Multiproduct Break-Even Analysis [LO5-9] Lucido Products markets two computer...

A: Solution:- 1)Calculation of overall contribution margin ratio as follows under:- Overall contributio...

Q: equired: Compute the activity rate for each activity using activity-based costing. . Compute overhea...

A: Solution Concept Under traditional method overhead are allocated using a single recovery rate Under ...

Q: Comprehensive Problem Mulberry Services sells electronic data processing services to firms too smal...

A: Account Debit Credit 1 Accounts Receivable $ 6,90,000 Service Revenue $ 6,90,000 ...

Q: Identify the type of activity by choosing the best answer for each question. Select each item listed...

A: Introduction:- first we need to understand the following basic terms as follows under:- Identifyin...

Q: Determine the inventory cost by the first-in, first-out method. Round your answer to the nearest dol...

A: 1) If the entity uses First in first out, then units at the opening will be used & units purchas...

Q: Question 11 James Electronics is interested in purchasing Dyner Corp. Prior to the purchase James hi...

A: Ans. An auditor while discharging his professional duties is expected to exercise highest standards ...

Q: Answer if true or false. If false write the word that makes the statement incorrect/wrong. 1. In oth...

A: FOB destination and FOB shipping point are two type of shipping terms that are used. Credit card is ...

Q: 2. Add the values in cells D1, D2, and G3. 3. Multiply the values in cell D2 and E2 and add the valu...

A: Excel is a tool for calculate, manipulate, organize, data into meaningful and required manner. It is...

Q: On January 1, 2021 Asset of Matalino Company was P2,500,000 and its liabilities was P800,000. By Dec...

A: As per accounting equation in accounting, total assets must be equal to total liabilities and equity...

Q: The amount of assets consumed during the performance of business operations in a period while delive...

A: Assets can be defined as any resource which has its own intrinsic economic value, owned and controll...

Q: 1.) what is the break-even in dollar sales? 2.) what is the margin of safety percentage? 3.) what...

A: Solution Note : As per the Q&A guideline we are required to answer the first three subparts only...

Q: Sheffield Corporation agrees on January 1, 2020, to lease equipment from Packers, Inc. for 3 years. ...

A: The question is based on the concept of Operating Lease in Lease Accounting. Operating lease does n...

Q: Shamrock Corporation manufactures drones. On December 31, 2019, it leased to Althaus Company a drone...

A: The question is based on the concept of Lease accounting. Financial Lease: A financial lease is a ty...

Q: Seoli owned a 20% royalty interest in an oil well. Seoli received royalty payments on January 31 fo...

A: Royalty revenue is reported in the income statement of the company and the expenses would be deducte...

Q: I’m confused on how to enter these into the table. Specifically b & c. My table options are -beginni...

A: ACCOUNT RECEIVABLE; An account receivable is defined as it is money that has not been paid by custom...

Q: Consider the following data for two products of Vigano Manufacturing. Activity Budgeted Cost Activit...

A:

Q: Required information Problem 6-6B Record transactions using a perpetual system, prepare a partial in...

A: First-in, first-out (FIFO) cost flow assumption - Under FIFO Method, Inventory purchased first is so...

Q: The general ledger of Zips Storage at January 1, 2021, includes the following account balances: ...

A: GIVEN Accounts Debits Credits Cash $ 26,600 Accounts Receivable 17,400 ...

Q: 5. The following account balances were taken from the 2021 adjusted trial balance of the Bowler Corp...

A: Income Statement is the statement which shows the net income earned or net loss incurred by the comp...

Q: In 2014 Janice Martin fulfilled a life-long dream and moved her home-based cottage baking business t...

A: The contribution margin is excess of selling price over variable cost. While analyzing the decision ...

Q: Declan's Designs Balance Sheet Declan's Designs Income Statement ASSETS 12/31/2021 12/31/2022 For th...

A: Declan Design Cash Flow Statement (Partial) For the year ended December 31, 2022 Amount (In...

Q: An analysis of the cash book and other records of Bye Corporation shows the following data: Accounts...

A: The income statement is one of the financial statements of the business which represents the profita...

Q: Assume that IBM leased equipment that was carried at a cost of $62,000 to Carla Vista Company. The t...

A: Lease initially measured on Dec 31, 2019 = $92,001 During the year 2020: Interest Income = $92,001...

Q: Calculate the material price and usage variance, and the material cost variance for the concrete wor...

A: Variance analysis is one of the important technique of management accounting, under which actual cos...

Q: 4,500 per year for 5 years. Mutually Exclusive project LL costs 37,500, and its expected cash flows ...

A: Net present value = (Annual cash inflows x Present value of annuity factor at 14% for 5 years) - Ini...

Q: Statement 1: Under cash basis, if cash has been collected, revenue is recorded regardless of earning...

A: The accounting is based on different basis such as cash basis and accrual basis.

Q: The West Indies School Book Shop sells T Shirts emblazoned with the school's name and logo. The shir...

A: Introduction:- Job relationships are contractual in nature, consisting of an agreement between the p...

Step by step

Solved in 2 steps

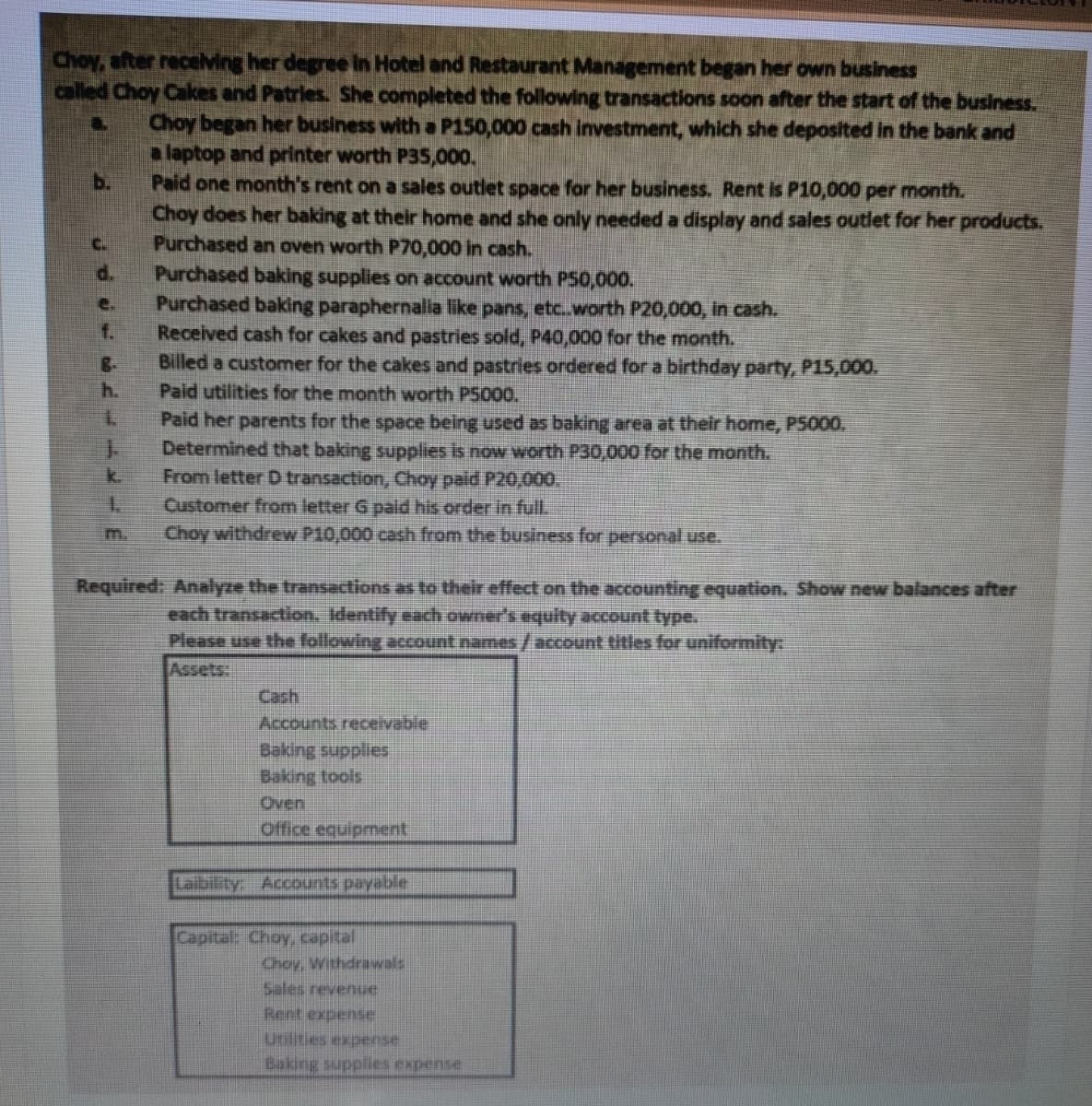

- In July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.Choy, after receiving her degree in Hotel and Restaurant Management began her own business called Choy Cakes and Pastries. She completed the following transactions: a. Choy began her business with a P150,000 cash investment, which she deposited in the bank and a laptop and printer worth P35,000. b. Paid one month's rent on a sales outlet space for her business. Rent is P10,000 per month. c. Purchased an oven worth P70,000 in cash. d. Purchased baking supplies on account worth P50,000. e. Purchased baking paraphernalia like pants, etc. worth P20,000 in cash. f. Received cash for cakes and pastries sold, P40,000 for the month. g. Billed a customer for the cakes and pastries ordered for a birthday party, P15,000. h. Paid utilities for the month worth P5,000. i. Paid her parents for the space being used as baking area at their home, P5,000. j. Determined that baking supplies is now worth P30,000 for the month. k. From letter D transaction, Choy paid P20,000. l. Customer from…Angela de Dios, a business graduate student who was working in Think Computer, a company selling all kinds of computers, decided to become an entrepreneur and put up an internet shop. The following are the transactions for the month of March: 1 - Angela started an internet shop called “Playnet. com” by investing her savings of ₱ 50,000 and the proceeds from the sale of her car of ₱ 300,000 5 - Angela hired two workers to assist her in the shop. 10 - Two month rent deposit was paid in cash, ₱10,000 15 - Paid ₱15,000 for building materials to fix the shop, ₱8,000 for furniture, ₱ 45,000 for one unit of aircon and two units of electric fan. 20 - Purchased supplies for cash, ₱1,500 25 - The shop was ready for the installation of the computer units. Angela purchased 12 units of computer hardware from Think PC. She paid 50% in cash for ₱ 125,000 and a note for the balance payable in 24 monthly installments starting April 20.

- Angela de Dios, a business graduate student who was working in Think Computer, a company selling all kinds of computers, decided to become an entrepreneur and put up an internet shop. The following are the transactions for the month of March: 1 - Angela started an internet shop called “ Playnet.com” by investing her savings of ₱ 50,000 and the proceeds from the sale of her car of ₱ 300,000 5 - Angela hired two workers to assist her in the shop. 10 - Two month rent deposit was paid in cash, ₱10,000 15 - Paid ₱15,000 for building materials to fix the shop, ₱8,000 for furniture, ₱ 45,000 for one unit of aircon and two units of electric fan. 20 - Purchased supplies for cash, ₱1,500 25 - The shop was ready for the installation of the computer units. Angela purchased 12 units of computer hardware from Think PC. She paid 50% in cash for ₱ 125,000 and a note for the balance payable in 24 monthly installments starting April 20. The transactions using the following accounts for asset and…On July 01, 2020, Maria initially invested P200,000 cash into Maria Merchandising. On the same date, she paid P45,000 for six months rent on the store space, P10,000 for business licenses and permits, and P50,000 for various store furniture. She also bought P60,000 worth of office supplies on account with the intention to sell them at a higher price. However, the next day, the business received a P1,500 credit memo for allowance granted on the purchased merchandise. The supplies were bought from 123 Supplies Store on terms n/60. On July 6, the business bought from 45 Supplies Shop P5,000 worth of supplies to be used in the store on terms 50% downpayment, balance n/30. Francisco, a part time employee, was able to sell on July 12 some of the store's merchandise to Mr. Sam for P16,000 on terms 50% downpayment, balance 2/10, n/30. On July 24, the business sold to Mrs. Aslani merchandise for P12,000 on terms 2/10, n/30. On July 30, Mr. Boom paid the business P42,000 for merchandise bought…On March 1, Ms. Ann Joy established AJ Beauty Salon. She invested P750,000 in the business and a laptop worth P60,000. She paid rent of P10,000 and bought equipment for P30,000 cash. Cash collection from walk-in customers amounted to P150,000. She bought beauty supplies for P7,000 cash and bought salon furniture worth P80,000 on account. Ms. Ann had major repairs in her residence amounting to P550,000 which was paid by the business. Collections of accounts receivable totaled P90,000 and accounts payable paid totaled P45,000. At the end of the month, salaries of beauticians paid amounted to P30,000. Payments made to MERALCO and MAYNILAD are P12,000 and P3,400, respectively. Salon net income for the month is P180,000. Required: Give the cash balance at the end of the month. (Hint: Prepare the T-Account for cash to get the cash balance at the end of the month.)

- On April 5, Timothy established an interior decorating business, Tim’s Design, with a cash investment ofP200,000. Timothy completed the following transactions for April:6 Paid rent for the month, P8,000.7 Purchased from Delta Co. office equipment, P55,0008 Purchased a used car for P180,000, paying P80,000 cash and taking a bank loan for theremainder.10 Purchased supplies and materials for cash, P11,315.12 Received cash from Miss Laura for job completed in her condo, P57,500. Supplies were used upamounting to P8,250.20 Purchased materials and supplies on credit, P15,000.23 Recorded job completed for Ms. Ferrer. Term: on account 10 days, P14,950. Supplies were usedup amounting to P3,500.24 Received an invoice for repairs on car and paid P4,500.25 Paid utilities expense, P1,750.26 Paid P20,000 on the bank loan.27 Received cash from Ms. Ferrer, P10,000.28 Paid salary of worker, P5,00029 Paid Delta a portion of the amount owed for equipment, P5,000.30 Withdrew cash for personal use, P3,500.…On April 5, Timothy established an interior decorating business, Tim’s Design, with a cash investment ofP200,000. Timothy completed the following transactions for April:6 Paid rent for the month, P8,000.7 Purchased from Delta Co. office equipment, P55,0008 Purchased a used car for P180,000, paying P80,000 cash and taking a bank loan for theremainder.10 Purchased supplies and materials for cash, P11,315.12 Received cash from Miss Laura for job completed in her condo, P57,500. Supplies were used upamounting to P8,250.20 Purchased materials and supplies on credit, P15,000.23 Recorded job completed for Ms. Ferrer. Term: on account 10 days, P14,950. Supplies were usedup amounting to P3,500.24 Received an invoice for repairs on car and paid P4,500.25 Paid utilities expense, P1,750.26 Paid P20,000 on the bank loan.27 Received cash from Ms. Ferrer, P10,000.28 Paid salary of worker, P5,00029 Paid Delta a portion of the amount owed for equipment, P5,000.30 Withdrew cash for personal use, P3,500.…Tom loves cooking and after attending culinary school, he decided to start his owneatery in downtown Vancouver in May. Since he did not receive formal business, hehas asked you to help him prepare monthly financial statements. He was able to collectall business receipt and financial records. The following are transactions for the monthof January 2022, the first month of operations.Jan 1 Tom invested his saving of $350,000 into business bank account at TD Bank andhe also borrowed &150,000 as 24 months bank loan.Jan 1 Signed lease contract and secured the locationJan 1 Purchased a one-year insurance policy for $24,000 in cash.Jan 2 Tom purchased kitchen equipment for $150,000 and $1000 kitchen suppliesincluding napkins and clean supplies in cashJan 1 he hired a soul chef and one receptionist. In contract, he will pay the soul chef$5,000 per month and receptionist $3,000 per monthJan 2 Tom purchased $100,000 furniture in cashJan 3 Tom hired a renovation company to do lease…

- Tom loves cooking and after attending culinary school, he decided to start his own eatery in downtown Vancouver in May. Since he did not receive formal business, he has asked you to help him prepare monthly financial statements. He was able to collect all business receipt and financial records. The following are transactions for the month of January 2022, the first month of operations. Jan 1 Tom invested his saving of $350,000 into business bank account at TD Bank and he also borrowed &150,000 as 24 months bank loan. Jan 1 Signed lease contract and secured the locationJan 1 Purchased a one-year insurance policy for $24,000 in cash. Jan 2 Tom purchased kitchen equipment for $150,000 and $1000 kitchen supplies including napkins and clean supplies in cash Jan 1 he hired a soul chef and one receptionist. In contract, he will pay the soul chef $5,000 per month and receptionist $3,000 per month Jan 2 Tom purchased $100,000 furniture in cash Jan 3 Tom hired a renovation company to do…Andi has decided that she is going to start a new business. Here are some transactions that have occurred prior to April 30 Received $96,000 cash when issuing 9,600 new common shares. Purchased land by paying $7,500 cash and signing a note payable for $11,500 due in three years. Hired a new aesthetician for a salary of $2,600 a month, starting next month. NGS purchased a company car (equipment) for $34,000 cash (list price of $37,000) to assist in running errands for the business. Bought and received $950 in supplies for the spa on account. Nicole sold 100 of her own personal shares to Raea Gooding for $300. Assuming that the beginning balances in each of the accounts are zero, complete T-accounts to summarize the transactions in (a)–(f).Wendy opened a hair care products shop in Georgetown in September 2020. During the first month of operations, the business completed the following transactions. Sep 1 Wendy invested RM80,000 cash into the business. Sep 2 She obtained a bank loan of RM80,000 for the business Sep 8 Bought goods on credit for RM75,000 from Century Saloon Supply Sep 10 Distributed free sample worth RM1,000 from her stocks Sep 12 Shampoo costing RM180 was taken from business stock as a personal gift to her friend Sep 16 Purchased a cash register worth RM2,500 on credit from Smart Solution Sep 17 Brought in his personal computer worth RM3,800 for business use Sep 19 Installed a security system for his office, total bill received from his supplier, Secure System was RM9,600 Sep 24 Withdrawn goods bought for resale for her personal use, value of the goods was RM680 Sep 28 Withdrew RM800 from business bank account for her personal use Required: Record the above transactions in the GENERAL JOURNAL. Narratives…