Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 9E

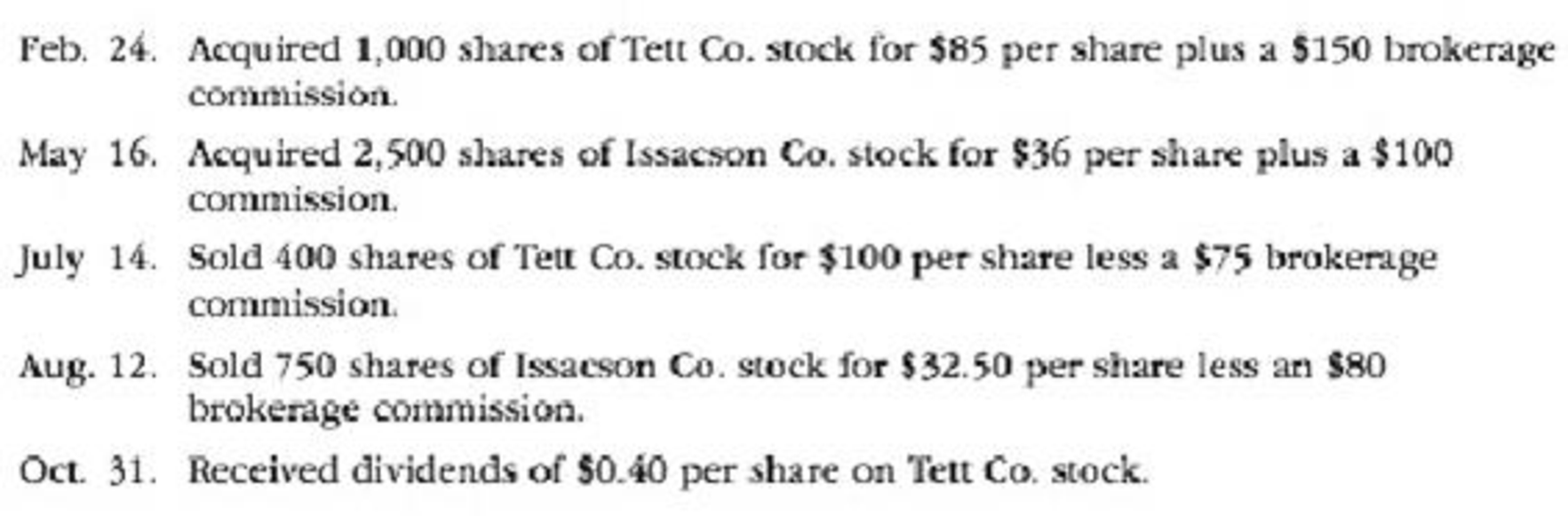

Seamus Industries Inc. buys and sells investments as part of its ongoing cash management. The following investment transactions were completed during the year:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Shown below are totals of the three sections from the SCF for the Sivad Motel for the year just ended. Analyze this information and prepare a report indicating your opinion regarding its sources and uses of cash and their impact on the future of the company. Your conclusions and recommendations should be supported with proper explanations and assumptions.

Statement of Cash Flows

Net cash provided by operating activities $10,000

Net cash used by investing activities (15,000)

Net cash used by financing activities (5,000)

Decrease in cash for the year (10,000)

Cash at beginning of year 15,000

Cash at end of…

Shown below are totals of the three sections from the SCF for the Nanood Motel for the year just ended. Analyze this information and prepare a report indicating your opinion regarding its sources and uses of cash and their impact on the future of the company. Your conclusions and recommendations should be supported with proper explanations and assumptions.

Statement of Cash Flows

Net cash provided by operating activities $5,000

Net cash used by investing activities (50,000)

Net cash provided by financing activities. $100,000

Increase in cash for the year 55,000

Cash at beginning of year…

Presented below are accounts of Cutie Company

Additional:

During the year, the owner made an additional investment of 20,000 and withdrawals of 50,000. Cutie company beginning capital is 617,600 and its net income for the year is 75,000.

Instructions: Prepare the Statement of Financial Position in account form and report form and determine the amount of cash.

Prepare the supporting notes.

Chapter 15 Solutions

Financial Accounting

Ch. 15 - Why might a business invest cash in temporary...Ch. 15 - What causes a gain or loss on the sale of a bond...Ch. 15 - When is the equity method the appropriate...Ch. 15 - Prob. 4DQCh. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - Prob. 9DQCh. 15 - Prob. 10DQ

Ch. 15 - Prob. 1PEACh. 15 - Prob. 1PEBCh. 15 - Prob. 2PEACh. 15 - Prob. 2PEBCh. 15 - Prob. 3PEACh. 15 - Prob. 3PEBCh. 15 - On January 1, Valuation Allowance for Trading...Ch. 15 - On January 1, Valuation Allowance for Trading...Ch. 15 - On January 1, Valuation Allowance for...Ch. 15 - On January 1, Valuation Allowance for...Ch. 15 - On June 30, Setzer Corporation had a market price...Ch. 15 - Prob. 6PEBCh. 15 - Prob. 1ECh. 15 - Prob. 2ECh. 15 - Bocelli Co. purchased 120,000 of 6%, 20-year Sanz...Ch. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - On February 22, Stewart Corporation acquired...Ch. 15 - The following equity investment transactions were...Ch. 15 - Yerbury Corp. manufactures construction equipment....Ch. 15 - Seamus Industries Inc. buys and sells investments...Ch. 15 - Prob. 10ECh. 15 - Prob. 11ECh. 15 - On January 6, Year 1, Bulldog Co. purchased 34% of...Ch. 15 - Hawkeye Companys balance sheet reported, under the...Ch. 15 - JED Capital Inc. makes investments in trading...Ch. 15 - The investments of Charger Inc. include a single...Ch. 15 - Gruden Bancorp Inc. purchased a portfolio of...Ch. 15 - Last Unguaranteed Financial Inc. purchased the...Ch. 15 - The income statement for Delta-tec Inc. for the...Ch. 15 - Highland Industries Inc. makes investments in...Ch. 15 - The investments of Steelers Inc. include a single...Ch. 15 - Prob. 21ECh. 15 - Storm, Inc. purchased the following...Ch. 15 - During Year 1, its first year of operations,...Ch. 15 - During Year 2, Copernicus Corporation held a...Ch. 15 - Prob. 25ECh. 15 - The market price for Microsoft Corporation closed...Ch. 15 - Prob. 27ECh. 15 - Prob. 28ECh. 15 - Prob. 29ECh. 15 - Soto Industries Inc. is an athletic footware...Ch. 15 - Rios Financial Co. is a regional insurance company...Ch. 15 - Forte Inc. produces and sells theater set designs...Ch. 15 - Prob. 4PACh. 15 - Rekya Mart Inc. is a general merchandise retail...Ch. 15 - Prob. 2PBCh. 15 - Glacier Products Inc. is a wholesaler of rock...Ch. 15 - Teasdale Inc. manufactures and sells commercial...Ch. 15 - Selected transactions completed by Equinox...Ch. 15 - Prob. 1CPCh. 15 - Prob. 2CPCh. 15 - Berkshire Hathaway, the investment holding company...Ch. 15 - On July 16, 20Y1, Wyatt Corp. purchased 40 acres...Ch. 15 - International Financial Reporting Standard No. 16...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tifton Co. had the following cash transactions during the current year: Prepare the investing activities section of Tiftons statement of cash flows.arrow_forwardTifton Co. had the following cash transactions during the current year: Refer to the information in RE21-6. Prepare the financing activities section of Tifton Co.s statement of cash flows.arrow_forwardThe following information is from a new business. Comment on the year-to-year changes in the accounts and possible sources and uses of funds (how were the funds obtained and used).arrow_forward

- The following information was taken from Oregon Corporations accounting records for 2019: Oregons statement of cash flows for the year ended December 31, 2019, should show the following amounts for investing and financing activities, based on the preceding information:arrow_forwardIn the current year, Harrisburg Corporation collected 100,000 from its customers and paid out 30,000 to suppliers, 20,000 to employees, and 8,000 for income taxes. Using the direct method, prepare the operating activities section of its statement of cash flows based on this information.arrow_forwardQuinze Seize Corp. reported the following amounts in its statement of financial position at each year-end:a. What is the net cash provided by operating activities?b. What is the net cash used in investing activities?c. What is the net cash provided by financing activities?arrow_forward

- Bramble Corporation engaged in the following cash transactions during 2020. Sale of land and building $198,200 Purchase of treasury stock 43,100 Purchase of land 44,800 Payment of cash dividend 86,200 Purchase of equipment 53,800 Issuance of common stock 155,600 Retirement of bonds 108,100 Compute the net cash provided (used) by investing activities.arrow_forwardThe accounting staff of Corny, Inc., has assembled the following information for the year ended December 31, 2011: Using this information, prepare a statement of cash flows. Include a proper heading for the financial statement, and classify the given information into the categories of operating activities, investing activities, and financing activities. Determine net cash flows from operating activities by the direct method. Place brackets around the dollar amounts of all cash disbursements.arrow_forwardBloom Corporation engaged in the following cash transactions during 2020. Sale of land and building $183,720 Purchase of treasury stock 49,600 Purchase of land 47,000 Payment of cash dividend 88,900 Purchase of equipment 62,500 Issuance of common stock 147,300 Retirement of bonds 105,700 Compute the net cash used (provided) by financing activities.arrow_forward

- Identify the following as cash inflows or outflows to Anderson and Dyess Design-Build Engineers: office supplies, GPS surveying equipment, auctioning of used earth-moving equipment, staff salaries, fees for services rendered, interest from bank deposits.arrow_forwardFor the past two years, Monroe Corporation’s statement of cash flows has shown net cash provided by financing activities. Which of the following choices could explain this result? a. Collection of accounts receivable balances. b. Sales of factory equipment. c. Issuance of long-term debt. d. Receipt of cash dividends from investments in other company’s stock.arrow_forwardEmma’s balance sheet showed an accounts receivable balance of $75 000 at the beginning of the year and $97 000 at the end of the year. Emma reported sales of $1 150 000 on her income statement. REQUIRED: Using the direct method, determine the amount that Emma will report as cash collections in the operating activities section of the statement of cash flows.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY