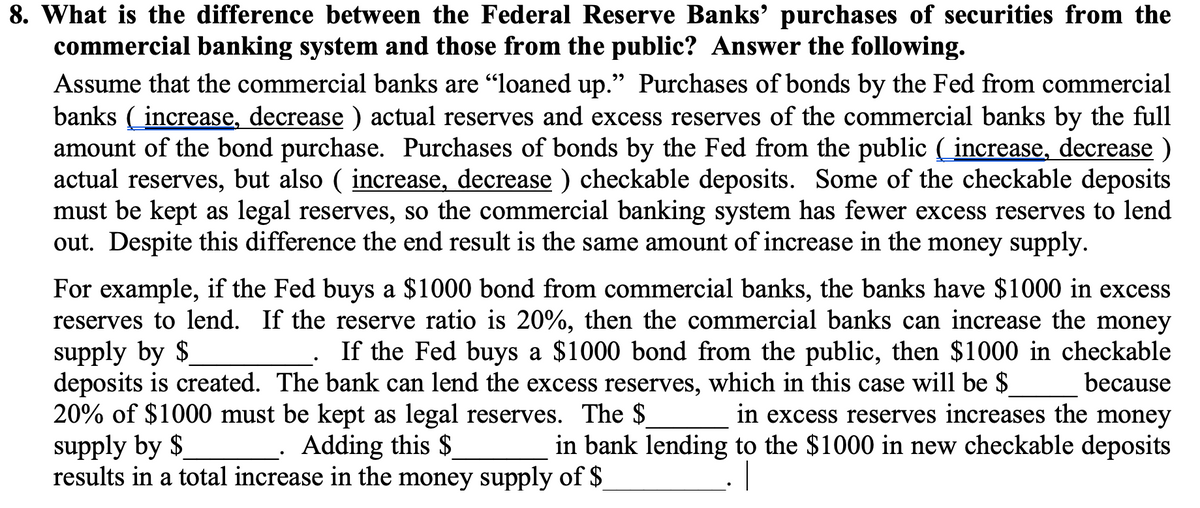

What is the difference between the Federal Reserve Banks’ purchases of securities from the commercial banking system and those from the public? Answer the following. Assume that the commercial banks are "loaned up." Purchases of bonds by the Fed from commercial banks ( increase, decrease ) actual reserves and excess reserves of the commercial banks by the full amount of the bond purchase. Purchases of bonds by the Fed from the public ( increase, decrease ) actual reserves, but also ( increase, decrease ) checkable deposits. Some of the checkable deposits must be kept as legal reserves, so the commercial banking system has fewer excess reserves to lend out. Despite this difference the end result is the same amount of increase in the money supply. For example, if the Fed buys a $1000 bond from commercial banks, the banks have $1000 in excess reserves to lend. If the reserve ratio is 20%, then the commercial banks can increase the money supply by $ deposits is created. The bank can lend the excess reserves, which in this case will be $ 20% of $1000 must be kept as legal reserves. The $ supply by $ results in a total increase in the money supply of $ If the Fed buys a $1000 bond from the public, then $1000 in checkable because in excess reserves increases the money in bank lending to the $1000 in new checkable deposits Adding this $

What is the difference between the Federal Reserve Banks’ purchases of securities from the commercial banking system and those from the public? Answer the following. Assume that the commercial banks are "loaned up." Purchases of bonds by the Fed from commercial banks ( increase, decrease ) actual reserves and excess reserves of the commercial banks by the full amount of the bond purchase. Purchases of bonds by the Fed from the public ( increase, decrease ) actual reserves, but also ( increase, decrease ) checkable deposits. Some of the checkable deposits must be kept as legal reserves, so the commercial banking system has fewer excess reserves to lend out. Despite this difference the end result is the same amount of increase in the money supply. For example, if the Fed buys a $1000 bond from commercial banks, the banks have $1000 in excess reserves to lend. If the reserve ratio is 20%, then the commercial banks can increase the money supply by $ deposits is created. The bank can lend the excess reserves, which in this case will be $ 20% of $1000 must be kept as legal reserves. The $ supply by $ results in a total increase in the money supply of $ If the Fed buys a $1000 bond from the public, then $1000 in checkable because in excess reserves increases the money in bank lending to the $1000 in new checkable deposits Adding this $

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter11: The Monetary System

Section: Chapter Questions

Problem 2PA

Related questions

Question

Transcribed Image Text:8. What is the difference between the Federal Reserve Banks' purchases of securities from the

commercial banking system and those from the public? Answer the following.

Assume that the commercial banks are "loaned up." Purchases of bonds by the Fed from commercial

banks ( increase, decrease ) actual reserves and excess reserves of the commercial banks by the full

amount of the bond purchase. Purchases of bonds by the Fed from the public ( increase, decrease )

actual reserves, but also ( increase, decrease ) checkable deposits. Some of the checkable deposits

must be kept as legal reserves, so the commercial banking system has fewer excess reserves to lend

out. Despite this difference the end result is the same amount of increase in the money supply.

For example, if the Fed buys a $1000 bond from commercial banks, the banks have $1000 in excess

reserves to lend. If the reserve ratio is 20%, then the commercial banks can increase the money

supply by $

deposits is created. The bank can lend the excess reserves, which in this case will be $

20% of $1000 must be kept as legal reserves. The $

supply by $

results in a total increase in the money supply of $_

If the Fed buys a $1000 bond from the public, then $1000 in checkable

because

in excess reserves increases the money

in bank lending to the $1000 in new checkable deposits

Adding this $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax