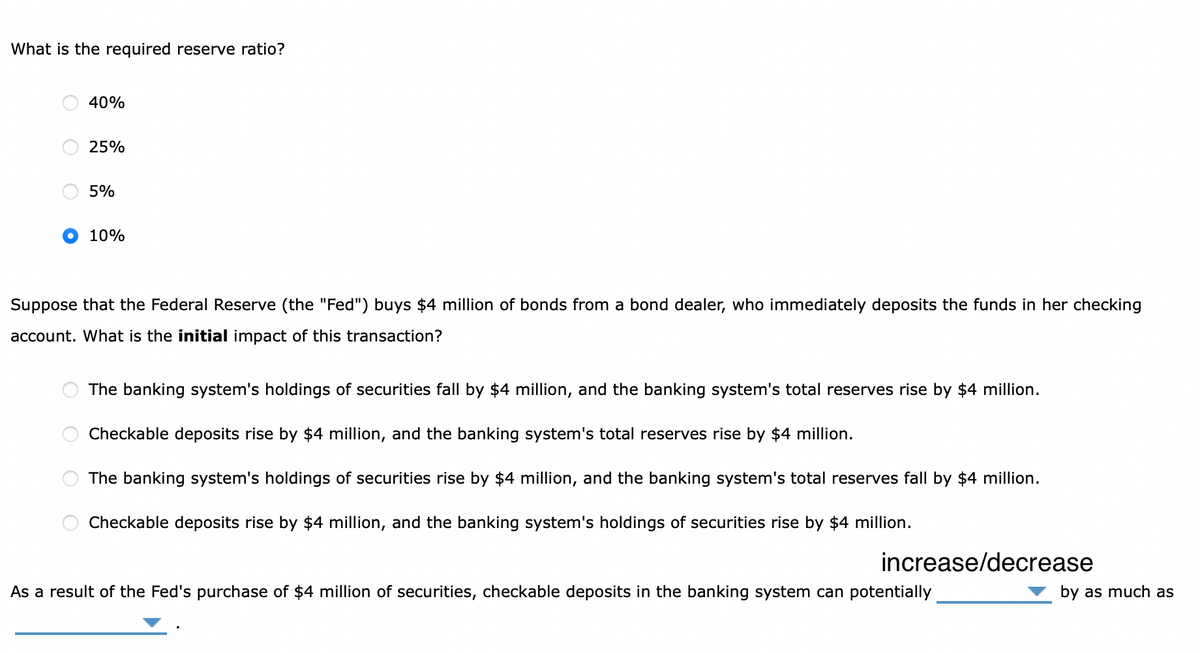

What is the required reserve ratio? 40% 25% 5% 10% Suppose that the Federal Reserve (the "Fed") buys $4 million of bonds from a bond dealer, who immediately deposits the funds in her checking account. What is the initial impact of this transaction? O The banking system's holdings of securities fall by $4 million, and the banking system's total reserves rise by $4 million. O Checkable deposits rise by $4 million, and the banking system's total reserves rise by $4 million. The banking system's holdings of securities rise by $4 million, and the banking system's total reserves fall by $4 million. Checkable deposits rise by $4 million, and the banking system's holdings of securities rise by $4 million. increase/decrease As a result of the Fed's purchase of $4 million of securities, checkable deposits in the banking system can potentially by as muc

What is the required reserve ratio? 40% 25% 5% 10% Suppose that the Federal Reserve (the "Fed") buys $4 million of bonds from a bond dealer, who immediately deposits the funds in her checking account. What is the initial impact of this transaction? O The banking system's holdings of securities fall by $4 million, and the banking system's total reserves rise by $4 million. O Checkable deposits rise by $4 million, and the banking system's total reserves rise by $4 million. The banking system's holdings of securities rise by $4 million, and the banking system's total reserves fall by $4 million. Checkable deposits rise by $4 million, and the banking system's holdings of securities rise by $4 million. increase/decrease As a result of the Fed's purchase of $4 million of securities, checkable deposits in the banking system can potentially by as muc

Chapter14: Banking And The Money Supply

Section: Chapter Questions

Problem 2.3P

Related questions

Question

100%

Transcribed Image Text:What is the required reserve ratio?

O

O

O

O

40%

Suppose that the Federal Reserve (the "Fed") buys $4 million of bonds from a bond dealer, who immediately deposits the funds in her checking

account. What is the initial impact of this transaction?

O

25%

5%

10%

The banking system's holdings of securities fall by $4 million, and the banking system's total reserves rise by $4 million.

deposits rise by $4 million, and the banking system's total reserves rise by $4 million.

The banking system's holdings of securities rise by $4 million, and the banking system's total reserves fall by $4 million.

Checkable deposits rise by $4 million, and the banking system's holdings of securities rise by $4 million.

Checkable

increase/decrease

As a result of the Fed's purchase of $4 million of securities, checkable deposits in the banking system can potentially

by as much as

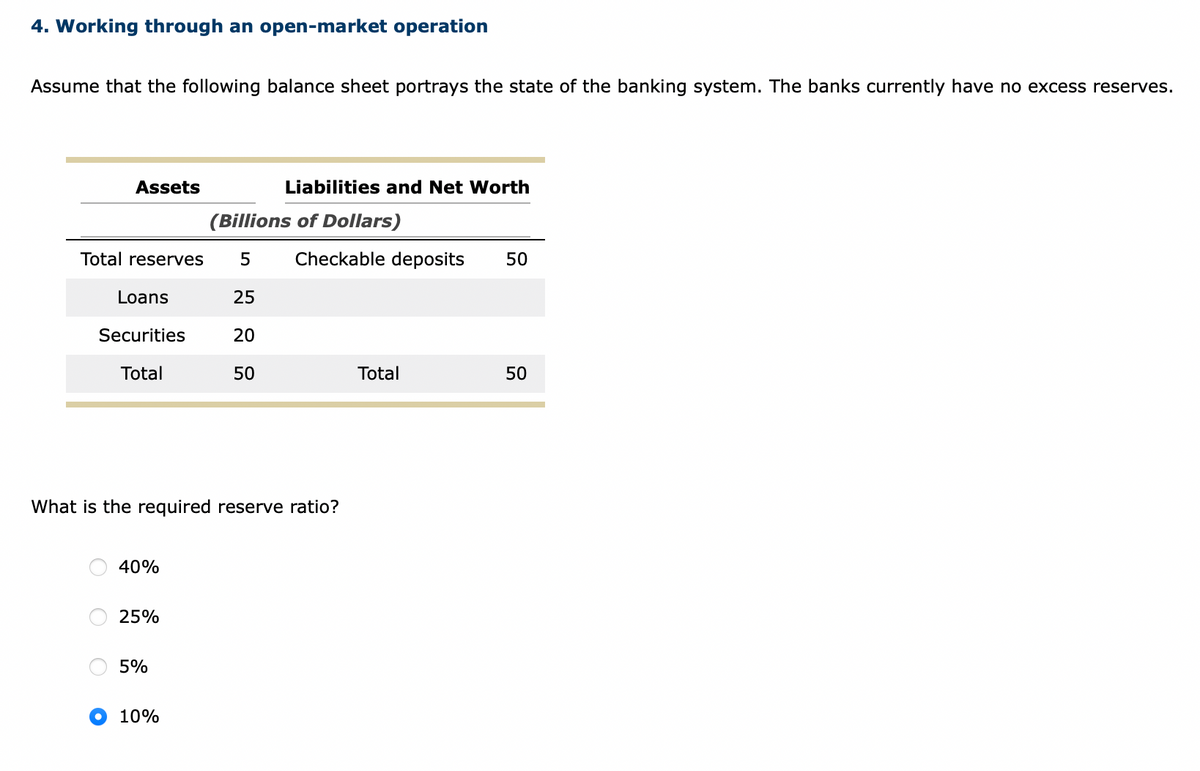

Transcribed Image Text:4. Working through an open-market operation

Assume that the following balance sheet portrays the state of the banking system. The banks currently have no excess reserves.

Assets

(Billions of Dollars)

Total reserves 5 Checkable deposits

25

20

50

Loans

Securities

Total

O

What is the required reserve ratio?

40%

25%

Liabilities and Net Worth

5%

10%

Total

50

50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning