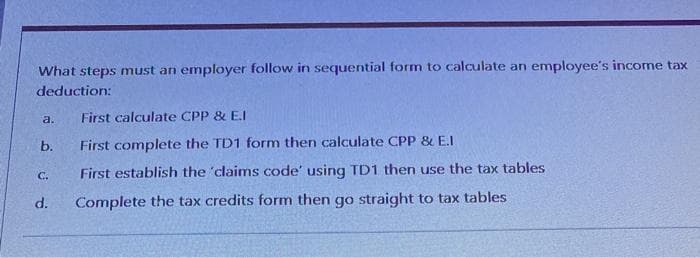

What steps must an employer follow in sequential form to calculate an employee's income tax deduction: a. First calculate CPP & E.I b. First complete the TD1 form then calculate CPP & E.I C. First establish the 'claims code' using TD1 then use the tax tables d. Complete the tax credits form then go straight to tax tables

What steps must an employer follow in sequential form to calculate an employee's income tax deduction: a. First calculate CPP & E.I b. First complete the TD1 form then calculate CPP & E.I C. First establish the 'claims code' using TD1 then use the tax tables d. Complete the tax credits form then go straight to tax tables

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 4QY

Related questions

Question

Transcribed Image Text:What steps must an employer follow in sequential form to calculate an employee's income tax

deduction:

a.

First calculate CPP & E.I

b.

First complete the TD1 form then calculate CPP & E.I

C.

First establish the 'claims code' using TD1 then use the tax tables

d.

Complete the tax credits form then go straight to tax tables

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,