What will the multiplier be when the MPS is 0, 0.4, 0.6, and 1? What will it be when MPC is 1, 0.90, 0.67, 0.50, and 0? How much of a change in GDP will result if firms increase their level of investment by 8 billion and the MPC is 0.80? If the MPC instead of 0.67?

What will the multiplier be when the MPS is 0, 0.4, 0.6, and 1? What will it be when MPC is 1, 0.90, 0.67, 0.50, and 0? How much of a change in GDP will result if firms increase their level of investment by 8 billion and the MPC is 0.80? If the MPC instead of 0.67?

Chapter21: Financial Markets, Saving, And Investment

Section: Chapter Questions

Problem 9P

Related questions

Question

What will the multiplier be when the MPS is 0, 0.4, 0.6, and 1? What will it be when MPC is 1, 0.90, 0.67, 0.50, and 0? How much of a change in GDP will result if firms increase their level of investment by 8 billion and the MPC is 0.80? If the MPC instead of 0.67?

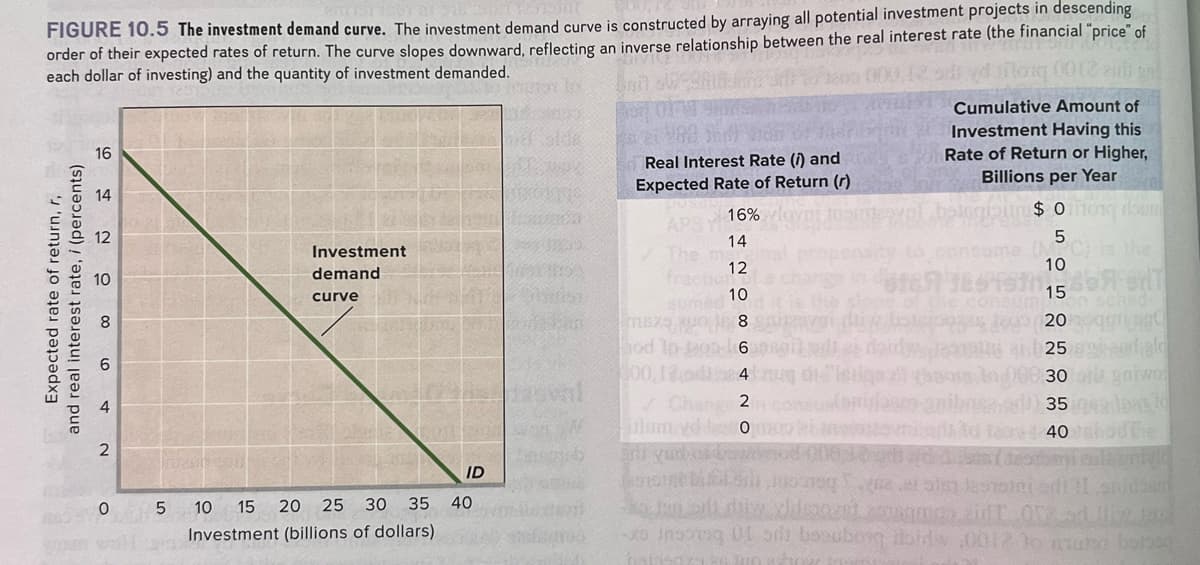

Transcribed Image Text:FIGURE 10.5 The investment demand curve. The investment demand curve is constructed by arraying all potential investment projects in descending

order of their expected rates of return. The curve slopes downward, reflecting an inverse relationship between the real interest rate (the financial "price" of

each dollar of investing) and the quantity of investment demanded.

long 0012-zit gal

Expected rate of return, r,

and real interest rate, / (percents)

16

14

0

vam vol

5

Investment

demand

curve

PALA

ID

10 15 20 25 30 35 40

Investment (billions of dollars)

Cumulative Amount of

Investment Having this

Rate of Return or Higher,

Billions per Year

$0tong roun

5

10

FONT

15

TO

20

a 25 pd ald

30 of garwo

ad 35 dans to

itd tas 40 bodThe

(depth calientely

lesti di 11 spidban

zidT 012

-o insorg 01 ons booubong toid 0012 to muran bolase

baser186 Jun whow im

Puteri diw hist

map

Real Interest Rate (i) and

Expected Rate of Return (r)

16%

APS THE

14

12

10

msza, wo in 8

hod 10-J800 6

100,12de4brug on "lesiges

✓ Chang 2

Konatet SD,

opiviasco quil

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning