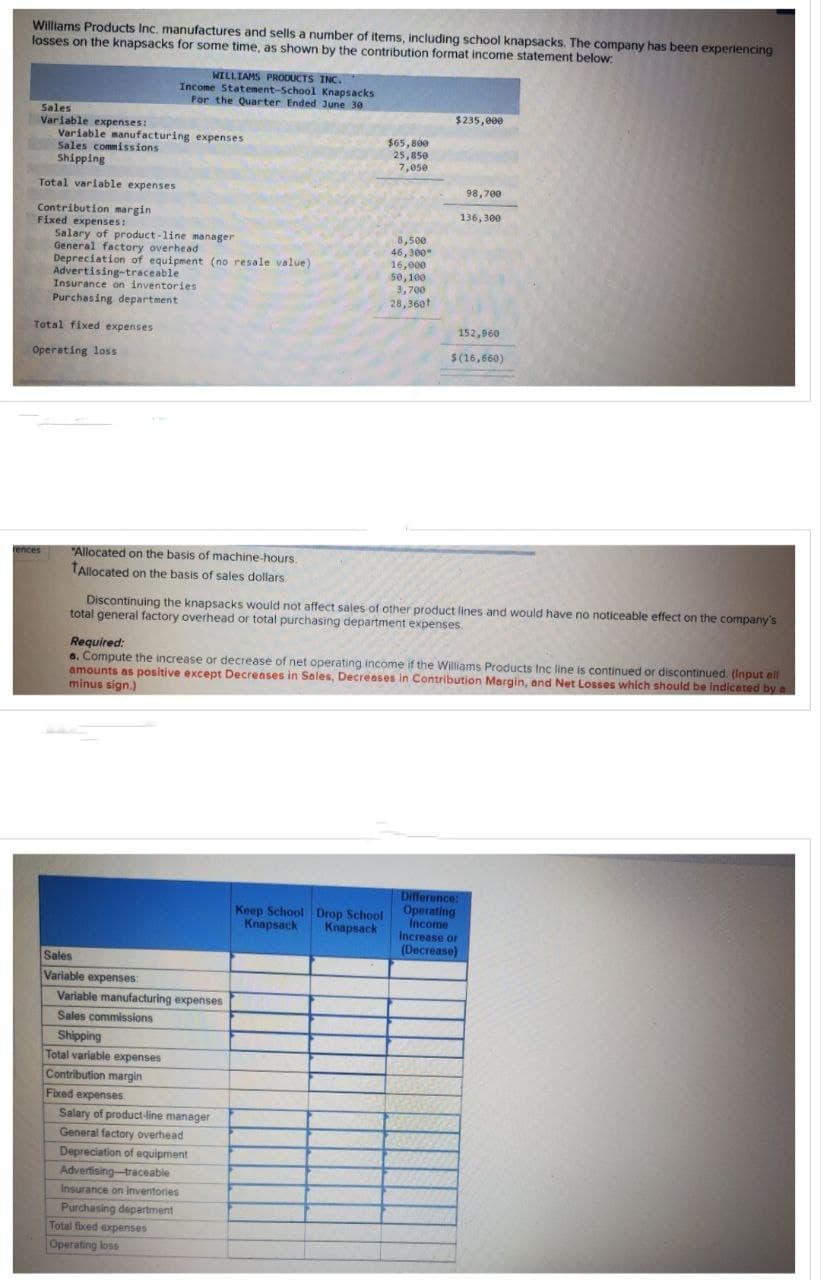

Williams Products Inc. manufactures and sells a number of items, including school knapsacks. The company has been experiencing losses on the knapsacks for some time, as shown by the contribution format income statement below: Sales Variable expenses: Variable manufacturing expenses Sales commissions Shipping Total variable expenses WILLIAMS PRODUCTS INC. Income Statement-School Knapsacks For the Quarter Ended June 30 Contribution margin Fixed expenses: Salary of product-line manager General factory overhead Depreciation of equipment (no resale value) Advertising-traceable Insurance on inventories Purchasing department Total fixed expenses Operating loss ences "Allocated on the basis of machine-hours. TAllocated on the basis of sales dollars. $65,800 25,850 7,050 8,500 46,300 16,000 50, 100 3,700 28,3601 $235,000 98,700 136,300 152,960 $(16,660) Discontinuing the knapsacks would not affect sales of other product lines and would have no noticeable effect on the company's total general factory overhead or total purchasing department expenses. Required: a. Compute the increase or decrease of net operating income if the Williams Products Inc line is continued or discontinued. (Input all amounts as positive except Decreases in Sales, Decreases in Contribution Margin, and Net Losses which should be indi minus sign)

Williams Products Inc. manufactures and sells a number of items, including school knapsacks. The company has been experiencing losses on the knapsacks for some time, as shown by the contribution format income statement below: Sales Variable expenses: Variable manufacturing expenses Sales commissions Shipping Total variable expenses WILLIAMS PRODUCTS INC. Income Statement-School Knapsacks For the Quarter Ended June 30 Contribution margin Fixed expenses: Salary of product-line manager General factory overhead Depreciation of equipment (no resale value) Advertising-traceable Insurance on inventories Purchasing department Total fixed expenses Operating loss ences "Allocated on the basis of machine-hours. TAllocated on the basis of sales dollars. $65,800 25,850 7,050 8,500 46,300 16,000 50, 100 3,700 28,3601 $235,000 98,700 136,300 152,960 $(16,660) Discontinuing the knapsacks would not affect sales of other product lines and would have no noticeable effect on the company's total general factory overhead or total purchasing department expenses. Required: a. Compute the increase or decrease of net operating income if the Williams Products Inc line is continued or discontinued. (Input all amounts as positive except Decreases in Sales, Decreases in Contribution Margin, and Net Losses which should be indi minus sign)

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 4EB: Roper Furniture manufactures office furniture and tracks cost data across their process. The...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Williams Products Inc. manufactures and sells a number of items, including school knapsacks. The company has been experiencing

losses on the knapsacks for some time, as shown by the contribution format income statement below:

Sales

Variable expenses:

Variable manufacturing expenses

Sales commissions

Shipping

Total variable expenses

Contribution margin

Fixed expenses:

Salary of product-line manager

General factory overhead

Depreciation of equipment (no resale value)

Advertising-traceable

Insurance on inventories

Purchasing department

Total fixed expenses

Operating loss

rences

WILLIAMS PRODUCTS INC.

Income Statement-School Knapsacks

For the Quarter Ended June 30

"Allocated on the basis of machine-hours.

TAllocated on the basis of sales dollars.

Sales

Variable expenses

Variable manufacturing expenses

Sales commissions

Shipping

Total variable expenses

Contribution margin

Fixed expenses

Salary of product-line manager

General factory overhead

Depreciation of equipment

Advertising-traceable

Insurance on inventories

Purchasing department

Total fixed expenses

Operating loss

$65,800

25,850

7,050

8,500

46,300*

16,000

Discontinuing the knapsacks would not affect sales of other product lines and would have no noticeable effect on the company's

total general factory overhead or total purchasing department expenses.

Keep School Drop School

Knapsack Knapsack

50, 100

3,700

28,3601

Required:

a. Compute the increase or decrease of net operating income if the Williams Products Inc line is continued or discontinued. (Input all

amounts as positive except Decreases in Sales, Decreases in Contribution Margin, and Net Losses which should be indicated by a

minus sign.)

$235,000

98,700

136,300

152,960

$(16,660)

Difference:

Operating

Income

Increase or

(Decrease)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub