X FILE Paste Clipboard H5 1. Compute a predetermined overhead rate. 2. Prepare schedules of cost of goods manufactured and cost of goods sold. HOME Calibri 23 24 INSERT BIU I Font X 11 Cost of Goods Manufactured and Cost of Goods Sold - Excel FORMULAS DATA REVIEW VIEW PAGE LAYOUT fx B с 1 Stanford Enterprises uses job-order costing. 2 The allocation base for overhead is direct labor hours. 3 Raw materials (all direct) Work in process Finished goods 4 Data for the year just ended: 5 Estimated total manufacturing overhead cost 6 Estimated total direct labor hours 7 Actual total direct labor hours 8 9 Actual costs for the year: 10 11 12 13 14 Inventories: 15 16 17 18 19 Use the data to answer the following. 20 % Alignment Number Purchase of raw materials (all direct) Direct labor cost Manufacturing overhead costs D Cell Conditional Format as Formatting Table Styles Styles E $ 275,000 25,000 27,760 $375,000 $536,300 $302,750 Ending Beginning $ 15,000 $ $ 27,875 $ $ 34,600 $ 26,450 11,375 22,350 F Cells 21 1. Compute applied overhead and determine the amount of underapplied or overapplied overhead: 22 Actual manufacturing overhead cost Predetermined overhead rate Actual direct labor hours ? 26 Editing G I 0 Sign In H X < <

X FILE Paste Clipboard H5 1. Compute a predetermined overhead rate. 2. Prepare schedules of cost of goods manufactured and cost of goods sold. HOME Calibri 23 24 INSERT BIU I Font X 11 Cost of Goods Manufactured and Cost of Goods Sold - Excel FORMULAS DATA REVIEW VIEW PAGE LAYOUT fx B с 1 Stanford Enterprises uses job-order costing. 2 The allocation base for overhead is direct labor hours. 3 Raw materials (all direct) Work in process Finished goods 4 Data for the year just ended: 5 Estimated total manufacturing overhead cost 6 Estimated total direct labor hours 7 Actual total direct labor hours 8 9 Actual costs for the year: 10 11 12 13 14 Inventories: 15 16 17 18 19 Use the data to answer the following. 20 % Alignment Number Purchase of raw materials (all direct) Direct labor cost Manufacturing overhead costs D Cell Conditional Format as Formatting Table Styles Styles E $ 275,000 25,000 27,760 $375,000 $536,300 $302,750 Ending Beginning $ 15,000 $ $ 27,875 $ $ 34,600 $ 26,450 11,375 22,350 F Cells 21 1. Compute applied overhead and determine the amount of underapplied or overapplied overhead: 22 Actual manufacturing overhead cost Predetermined overhead rate Actual direct labor hours ? 26 Editing G I 0 Sign In H X < <

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter7: The Master Budget And Flexible Budgeting

Section: Chapter Questions

Problem 11P: Overhead application rate Creole Manufacturing Inc. uses a job order cost system and standard costs....

Related questions

Question

Transcribed Image Text:X

Paste

Clipboard

FILE

H5

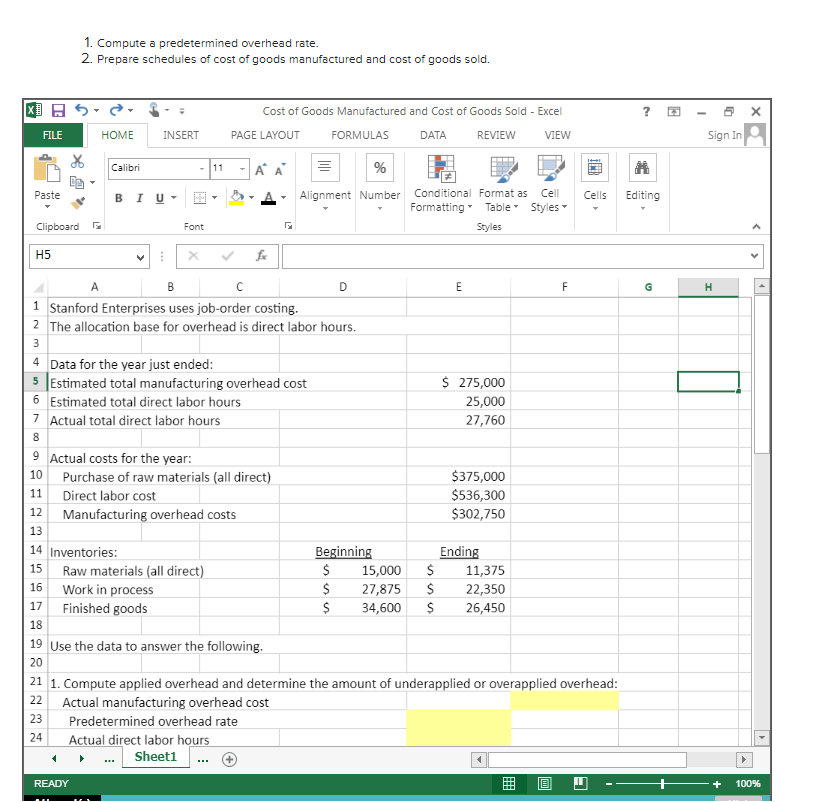

1. Compute a predetermined overhead rate.

2. Prepare schedules of cost of goods manufactured and cost of goods sold.

15

56

HOME

A

Calibri

의

INSERT

BI U ▾

11

12

13

14 Inventories:

1

9 Actual costs for the year:

10

READY

▾

Font

6 Estimated total direct labor hours

7 Actual total direct labor hours

8

Raw materials (all direct)

16

Work in process

17 Finished goods

18

11

B

с

1 Stanford Enterprises uses job-order costing.

2 The allocation base for overhead is direct labor hours.

3

4

Data for the year just ended:

5 Estimated total manufacturing overhead cost

PAGE LAYOUT

Cost of Goods Manufactured and Cost of Goods Sold - Excel

DATA REVIEW VIEW

A A

Purchase of raw materials (all direct)

Direct labor cost

Manufacturing overhead costs

fx

19 Use the data to answer the following.

20

Predetermined overhead rate

Actual direct labor hours

Sheet1

G

FORMULAS

%

Alignment Number

D

Beginning

$

$

$

Conditional Format as Cell

Formatting Table Styles

Styles

E

T

$ 275,000

25,000

27,760

$375,000

$536,300

$302,750

Ending

$ 11,375

15,000

27,875 $ 22,350

34,600 $ 26,450

F

21 1. Compute applied overhead and determine the amount of underapplied or overapplied overhead:

22

Actual manufacturing overhead cost

23

24

Cells

Editing

G

I

Sign In

H

u

+

►

<

100%

Transcribed Image Text:X

FILE

Paste

Clipboard

G14

HOME

Calibri

INSERT

BIU

Font

A

B

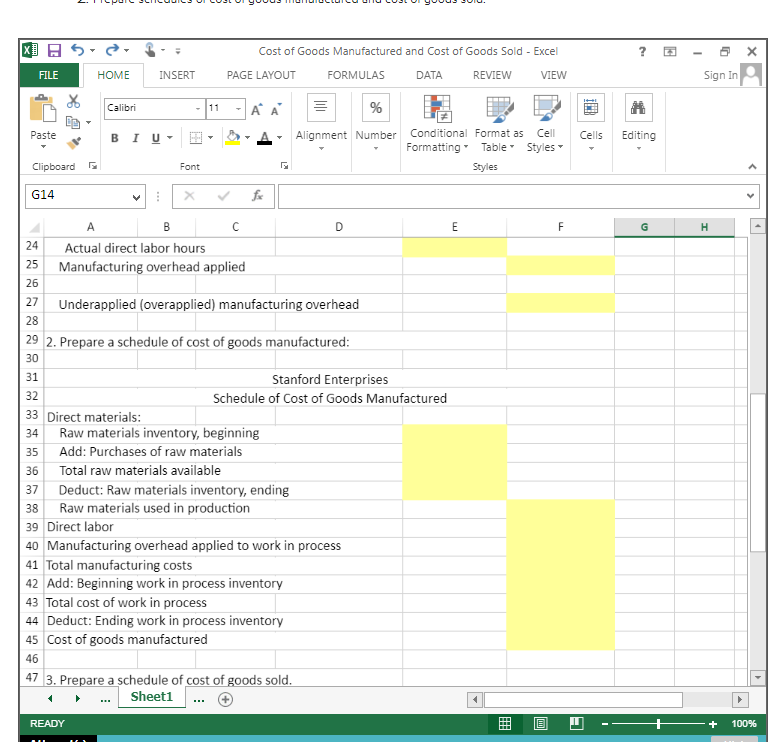

Actual direct labor hours

READY

PAGE LAYOUT

Cost of Goods Manufactured and Cost of Goods Sold - Excel

FORMULAS

DATA

REVIEW

VIEW

11 A

с

Schedule

Raw materials inventory, beginning

35 Add: Purchases of raw materials

Total raw materials available

24

25 Manufacturing overhead applied

26

27 Underapplied (overapplied) manufacturing overhead

28

29 2. Prepare a schedule of cost of goods manufactured:

30

31

32

33 Direct materials:

34

38 Raw materials used in production

39 Direct labor

36

37 Deduct: Raw materials inventory, ending

%

Alignment Number

D

47 3. Prepare a schedule of cost of goods sold.

Sheet1

Stanford Enterprises

of Cost of Goods Manufactured

40 Manufacturing overhead applied to work in process

41 Total manufacturing costs

42 Add: Beginning work in process inventory

43 Total cost of work in process

44 Deduct: Ending work in process inventory

45 Cost of goods manufactured

46

Conditional Format as Cell

Formatting Table Styles

Styles

E

T

E

F

HI

Cells

H

?

23

Editing

4

U

Sign In

H

▶

X

<

<

+ 100%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning