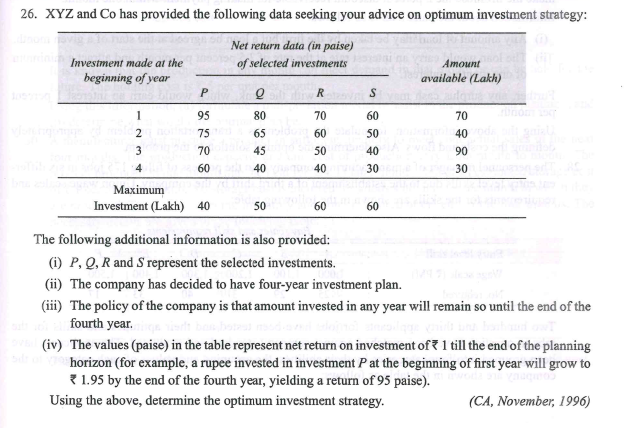

XYZ and Co has provided the following data seeking your advice on optimum investment strategy: Net return data (in paise) Investment made at the of selected investments Атount beginning of year available (Lakh) 1 95 80 70 60 70 2 75 65 60 50 40 3 70 45 50 40 90 60 40 30 30 Мaximum Investment (Lakh) 40 50 60 60 The following additional information is also provided: (i) P, Q, R and S represent the selected investments. (ii) The company has decided to have four-year investment plan. (iii) The policy of the company is that amount invested in any year will remain so until the end of the fourth year, (iv) The values (paise) in the table represent net return on investment of 7 1 till the end of the planning horizon (for example, a rupee invested in investment P at the beginning of first year will grow to { 1.95 by the end of the fourth year, yielding a return of 95 paise).

XYZ and Co has provided the following data seeking your advice on optimum investment strategy: Net return data (in paise) Investment made at the of selected investments Атount beginning of year available (Lakh) 1 95 80 70 60 70 2 75 65 60 50 40 3 70 45 50 40 90 60 40 30 30 Мaximum Investment (Lakh) 40 50 60 60 The following additional information is also provided: (i) P, Q, R and S represent the selected investments. (ii) The company has decided to have four-year investment plan. (iii) The policy of the company is that amount invested in any year will remain so until the end of the fourth year, (iv) The values (paise) in the table represent net return on investment of 7 1 till the end of the planning horizon (for example, a rupee invested in investment P at the beginning of first year will grow to { 1.95 by the end of the fourth year, yielding a return of 95 paise).

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter9: Decision Making Under Uncertainty

Section9.4: The Precision Tree Add-in

Problem 9P

Related questions

Question

Transcribed Image Text:26. XYZ and Co has provided the following data seeking your advice on optimum investment strategy:

Net return data (in paise)

Investment made at the

of selected investments

Amount

beginning of year

available (Lakh)

1

95

80

70

60

70

2

75

65

60

50

40

3

70

45

50

40

90

60

40

40

30

30

Маximum

Investment (Lakh) 40

50

60

60

The following additional information is also provided:

(i) P, Q, R and S represent the selected investments.

(ii) The company has decided to have four-year investment plan.

(iii) The policy of the company is that amount invested in any year will remain so until the end of the

fourth year.

(iv) The values (paise) in the table represent net return on investment of 7 1 till the end of the planning

horizon (for example, a rupee invested in investment P at the beginning of first year will grow to

{ 1.95 by the end of the fourth year, yielding a return of 95 paise).

Using the above, determine the optimum investment strategy.

(CA, November, 1996)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,