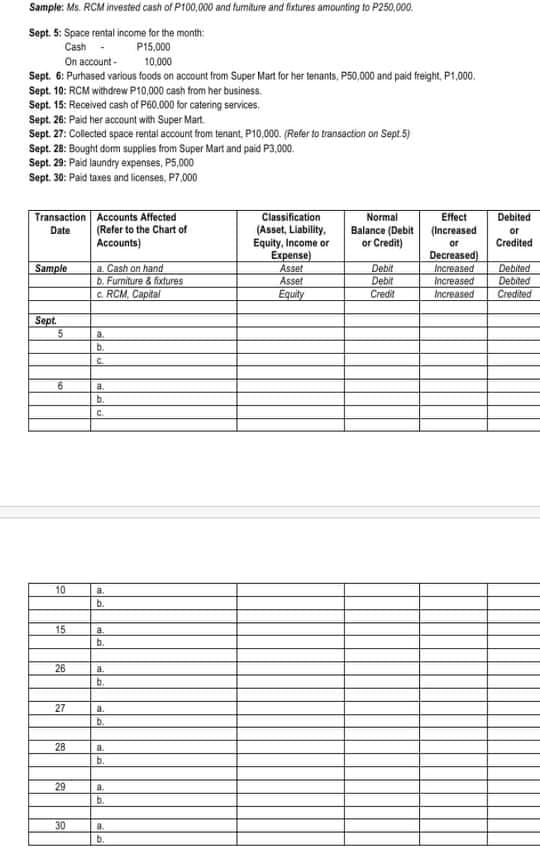

Sample: Ms. RCM invested cash of P100,000 and fumiture and fixtures amounting to P250,000, Sept. 5: Space rental income for the month: Cash P15,000 On account - 10,000 Sept. 6: Purhased various foods on account from Super Mart for her tenants, P50,000 and paid freight, P1.00. Sept. 10: RCM withdrew P10,000 cash from her business. Sept. 15: Received cash of P60.000 for catering services, Sept. 26: Paid her account with Super Mart. Sept. 27: Collected space rerstal account from tenant, P10,000. (Refer to transaction on Sept.5) Sept. 28: Bought dom supplies from Super Mart and paid P3,000. Sept. 29: Paid laundry expenses, P5,000 Sept. 30: Paid taxes and licenses, P7.000 Transaction Accounts Affected (Refer to the Chart of Accounts) Normal Balance (Debit or Credit) Effect Classification (Asset, Liability, Equity, Income or Expense) Asset Asset Equily Debited Date (Increased or or Credited Decreased) Increased Increased Increased Sample Debit Debit Credit Debited a. Cash on hand b. Furniture & fxtures c. RCM, Capital Debited Credited Sept. a. b. 6. a. b. C.

Q: Mark Jacobs established Jacobs Services in August by contributing $30,000 cash from his personal…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: October 1 - Invested P250,000 to start the business October 2 - Paid P30,000 cash for various…

A: Accounting is the detailed process of recording, summarizing, and classifying accounting…

Q: The company completed the following transactions in July 2013: July 2 Paid rent for the month,…

A: In accounting we pass journal entries to record a business transaction and a financial transaction…

Q: In June 20X1. Fred Placement Agency had the following transactions: June 1 Fred invested P60,000 in…

A: First step of double entry accounting is to record journal entries as an when transaction occur.…

Q: On June 1, Cindy Godfrey started Divine Designs Co., a company that provides craft opportunities,…

A: Formula: Net profit = Revenues - Expenses

Q: 01 January Kirill introduced $17,000 cash and a vehicle (costing $2,000) as capital 01 January…

A: Answer: General Journal

Q: Edgar Detoya, tax consultant, began his pračtice un he firm are as follows: Detoya invested P150,000…

A: "Since you have posted a question with multiple sub-parts , we will solve first three sub-parts for…

Q: October 1 - Invested P250,000 to start the business October 2 - Paid P30,000 cash for various…

A: Journal is the primary book where transactions are originally recorded. Further, a journal entry is…

Q: J. Keith commenced business on 1 September, and had several special transactions during the month:…

A: Solution A journal is a book in which a business records its business transactions. The process of…

Q: 9. During the current month, the company completed the transactions listed below. The owner invested…

A: Owner equity means the amount that belong to the owner of the business. Any profit will increase…

Q: aylor’s transactions for November are as follows: Nov. 1 Paid rent, $300. 2 Purchased tailoring…

A:

Q: On February 15, 20X1, Evelyn Ferrer opened Cookie Fantasy Bakeshop. She invested 75,000 to purchase…

A: Statement of Changes in Equity is component of financial statements that reconciles between the…

Q: 5. The following transactions occurred in the first month of operation of the "At-Your-Service…

A: General ledgers are the T accounts in which the balances are identified for the journal…

Q: On April 01, 2016 Anees started business with P100,000 and other transactions for the month are: 2.…

A: Journal entry is an accounting activity under which all relevant business transactions are recorded.…

Q: October 1 - Invested P250,000 to start the business October 2 - Paid P30,000 cash for various…

A: The trial balance is prepared to record the balances of each account as debit and credit.

Q: Oct. 1- Mr. Leo Cruz invested P80, 000 cash and five automobiles worth P200, 000 each. Notes payable…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: 01 January Kirill introduced $17,000 cash and a vehicle (costing $2,000) as capital 01 January…

A: Profit & Loss (Income statement) is a financial statement that summarizes the revenues, expenses…

Q: Galle Inc. entered into the following transactions during January.a. January 1: Borrowed $50,000…

A: You enter transaction data in your company's records to create a journal entry.. Your journal…

Q: The following transactions were taken from Mating Dormitory, a pegspace and catering services…

A: The different accounts in the business have debit or credit balance. The assets and expenses have…

Q: Presented below is the Trial Balance of Ozamiz Laundry Services owned by Efren Barillo for the first…

A: Income Statement refers to a statement which helps in calculating the net profit generated or loss…

Q: Prepare: (iv) a statement of profit or loss (income statement) for the year to date; (v) a…

A: The income statement and the balance sheet are two of the major financial statements of any company.…

Q: 01 January Kirill introduced $17,000 cash and a vehicle (costing $2,000) as capital 01 January…

A: The following computations are done in the records of Kirill Business.

Q: 5. The following transactions occurred in the first month of operation of the "At-Your-Service…

A: As posted multiple sub parts we are answering only first question kindly repost the unanswered…

Q: Mark Jacobs established Jacobs Services in August by contributing $30,000 cash from his personal…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Prepare ledger in T format. month. During the month of June entered into the following transactions

A: Cash Book Particulars Amount($) Particulars Amount($) cash cash To advance received on…

Q: 2021 April 5 Dr. Ramirez invested P725,000 in the business April 7 Purchased equipment from Triple X…

A: The journal entries are prepared to keep the record of day to day transactions of the business. The…

Q: Mr. Steve Persian hired Elizabeth to prepare the Statement of Financial Position of his business. To…

A: Statem ent showing financial position is nothong but Balance Sheet. On the basis…

Q: 8 January Sue started the business with $10,000 in cash 9 January Borrowed a sum of $8,000 in cash…

A: Journal is the book of original entry in which transactions are recorded in a chronological order…

Q: 01 January Kirill introduced $17,000 cash and a vehicle (costing $2,000) as capital 01 January…

A: Journal entries represent the record of day to day operating transactions of the company related to…

Q: Bought washing machines and dryers from Bataan Equipment Corp., P115,000. following transactions…

A: T accounts are the general ledger accounts that are prepared in the business for classification of…

Q: na Sharples opened a retail shop on January 1. She invested $10,000 of her own money. She rented a…

A: Sales revenue includes the amount that has been earned due to the sales of the product or providing…

Q: Ena Sharples opened a retail shop on January 1. She invested $10,000 of her own money. She rented a…

A: Operating expenses are expenses which are incurred for running and maintenance of the business.…

Q: how to fill in the boxes

A: 1. Accounting Equation - Accounting Equation is calculated using following equation - Assets =…

Q: March 2021 1 The owner, Gina, invested the following: filing cabinets and fixtures- 15,000; cash,…

A: Journal entries are the basic method for recording financial transactions in the books of accounts.…

Q: а. Kimchi invested P600,000 cash in the cafe'. Cash Owners' Equity b. Kimchi purchased P3,500 in…

A: Journal entry: A journal entry is used to record day-to-day transactions of the business by debiting…

Q: Christopher started anew business, and completed the following transactions during December: Dec. 1…

A: Transaction: It is an event between a buyer and seller which involves money. It is an exchange of…

Q: ng Year 5, Pacilio Security Services experienced the following transactions: did the salaries…

A: Pacillio Security Services, Inc. General Journal, year 5 Date Account title Debit Credit…

Q: On 1-1-2020, Mr. A started business of dealing in electric fans by investing cash Rs. 200000 and…

A: Accounting Equation shows a relationship between assets , liability and equity . it is based on…

Q: Alex Vera organized Succulent Express at the beginning of February 20Y4. During February, Succulent…

A: Cash flow statement is one of the major financial statements which a company is required to publish…

Q: On August 1, Worthy invested P3, 000 cash and P15, 000 of equipment in Expressions. On August 2,…

A: A journal entry is an act of recording or keeping track of some financial or non-financial activity.

Q: Prepare journal entry Transactions: a) April 1- Mr. Song invested P100,000 cash and P 250,000 worth…

A: In accounting, each financial transaction enters the books of accounts through journal entry of the…

Q: p. On April 5, Timothy established an interior decorating business, Tim's Design, with a cash…

A: Journal entries recording is the very first step in accounting cycle process. Under this process,…

Q: Mr Alex opened furniture shop called Alex Furniture Shop and completed the following transactions in…

A: The journal entries represent the country entry sustain which means a transaction effected a minimum…

Q: ** Gypsy Co. had the following cash related transaction for the fist month of operation, March 2018.…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: Alex Vera organized Succulent Express at the beginning of February 20Y4. During February, Succulent…

A: Statement of cash flows consist of three main activities under which the changes in cash or cash…

Q: 7. Joshua Owen commenced business on 1 September, and had several special transactions during the…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: Transactions Date Description July -01 - 20XI The owner of Company K deposited $50,000 into the…

A: As per the accounting equation Assets = Liabilities + Capital (equity) Assets are resources of the…

Q: On 1-1-2020, Mr. A started business of dealing in electric fans by investing cash Rs. 200000 and…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Step by step

Solved in 2 steps with 1 images

- The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 91; a purchases journal, page 74; a cash receipts journal, page 56; a cash payments journal, page 63; and a general journal, page 119. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

- Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.Calculation of Revenue from Cash Collection Anderson Lawn Service provides mowing, weed control, and pest management services for a flat fee of $300 per lawn per month. During November, Anderson collected $9,900 in cash from customers, which included $1,200 for lawn care provided in October. At the end of November, Anderson had not collected from 6 customers who had promised to pay in December when they returned from vacation. Required: Calculate the amount of Andersons revenue for November.Krespy Corp. has a cash balance of $7,500 before the following transactions occur: A. received customer payments of $965 B. supplies purchased on account $435 C. services worth $850 performed, 25% is paid in cash the rest will be billed D. corporation pays $275 for an ad in the newspaper E. bill is received for electricity used $235. F. dividends of $2,500 are distributed What is the balance in cash after these transactions are journalized and posted?

- A business has the following transactions: A. The business is started by receiving cash from an investor in exchange for common stock $10,000. B. Rent of $1,250 is paid for the first month. C. Office supplies are purchased for $375. D. Services worth $3,450 are performed. Cash is received for half. E. Customers pay $1,250 for services to be performed next month. F. $6,000 is paid for a one year insurance policy. G. We receive 25% of the money owed by customers in D. H. A customer has placed an order for $475 of services to be done this coming week. How much total revenue does the company have?On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.