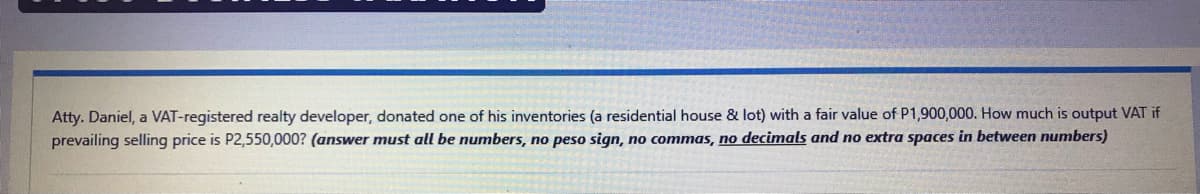

y. Daniel, a VAT-registered realty developer, donated one of his inventories (a residential house & lot) with a fair value of P1,900,000. How mu vailing selling price is P2,550,000? (answer must all be numbers, no peso sign, no commas, no decimals and no extra spaces in between

Q: Hauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse…

A: Answer to question a. Purchase cost of warehouse $65,000 Less: Depreciation claimed till year 0…

Q: A parcel of land is offered for sale at $600,000, is recognized by its purchasers as easily being…

A: Accounting principles are those rules and guidelines which needs to be followed by accountants all…

Q: On October 1st, you purchased a residentialhome in which to locate your professional office…

A: a) The first question askes to find the depreciation expense for the first year that the person…

Q: In March of Year 2, Mason contributed the following two properties, which he acquired in February of…

A: Adjusted base value describes the amount a person has invested in his property. Expenses incurred…

Q: At the beginning of the current year, Dianne company purchased a tract of land for P6,000,000. The…

A: Total Sales:- It is the value of those goods which are ready for sale in the market including profit…

Q: Anderson disposes a vacant lot for P3,000,000. The lot has an Assessor's fair value of P2,800,000,…

A: What is the basis in the valuation of real property? The value of the real property will be based…

Q: On December 1, 20xo, AKE Pte Ltd paid $5,000 to a Real Estate consulting company for a market report…

A: Here Building Y is treated as Investment Property and Building X is treated as PPE.

Q: Gareth, a sales tax registered trader purchased a computer for use in his business. The invoice for…

A: Assets whose value is not realized within a period of one accounting cycle is known as Non-current…

Q: In 20X6, Hat Corporation exchanged an apartment complex in Dallas (purchased in 20X2; cost $540,000;…

A: GIVEN In 20X6, Hat Corporation exchanged an apartment complex in Dallas (purchased in 10 * 2 cost…

Q: Barney exchanges an office building with an adjusted basis of $280,000 and a fair market value of…

A: The recognized gain or loss value of the asset is determined by comparing its carrying value with…

Q: During the current year, Alanna Co. had the following transactions pertaining to its new office…

A: Cost of Land = Purchase Price of Land + Legal Fees + Demolition of Old Building - Sale of scrap from…

Q: Enigma Inc. owns an apartment building that was originally purchased in 2014 for $1,200,000. Enigma…

A: Explanation: As per IAS 40 Investment property, When an Investment property is measured at the fair…

Q: Wanting to finalize a sale before year-end, on December 29, WR Outfitters sold to Bob a warehouse…

A: Appraised Value: It is an evaluation of a property's value (Eg:Land, Warehouse) based on a given…

Q: Barney Stinson purchased land and a building for his new men’s clothing store. The price paid was…

A: Historical cost of the building = Total Purchase cost for land and a building x fair value of the…

Q: Alan Meer inherits a hotel from his grandmother, Mary, on Feb 11 of the current year. Mary bought…

A: In case of inheritance, Adjusted basis for the receiver is fair market value of assets on the date…

Q: Don Camilo Company, a real estate entity, had a building in Legarda Rd. with a carrying amount of…

A: Carrying Amount of the Building = P20,000,000 Fair Value of the Building = P35,000,000 Useful life =…

Q: Opal, Inc. owns a delivery truck that initially cost $40,000. After a depreciation of $15,000 had…

A: Assets means the resources which is owned by business. Liability means the amount which is to be…

Q: On October 1, you purchased a residential home in which lo locale your professional office for…

A: The given information: Price of the building is $150,000. Price of the land is $30,000.

Q: Puerto Princesa Company sold its parking lot for P2,000,000. The lot has a zonal value of P2,500,000…

A: solution: given : sale price =P2,000,000 zonal value =P2,500,000 appraisal value…

Q: Which of the following shall be subject to VAT? * a. Sale of residential house and lot by the…

A: VAT is value added tax provide some exemption for publice interest. Following is the correct answer.

Q: rtgage value - P12,000,000 Independent appraiser's value BIR -P10,000,000 Commisioner's Zonql…

A: Capital gain tax refers to the mandatory tax levied by the government over the profit made by the…

Q: 2. Soft Oil Company has an ORI in an unproved property for which it paid $80,000. The ORI has not…

A: The gain on the sale of an asset arises when the selling price is more than the cost. When…

Q: Date Asset Cost 12-Jan Car 24,000 4-Feb Equipment 36,000 15-Mar Qualified…

A:

Q: Moran owns a building he bought during year O for $227,00O. He sold the building in year 6. During…

A: The question is based on the concept of Financial Accounting.

Q: Russell Corporation sold a parcel of land valued at $640,000. Its basis in the land was $441,600.…

A: As posted multiple question we are answering only one question. Kindly repost the unanswered…

Q: Van Industries and Frat Corporation trade land in 2021. Van has an adjusted basis of $740,000 in…

A: Realized value were the value that is adjustable . For Frat $740000 For Van $ 660000 Recognized…

Q: Hauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse…

A: Here discuss about the topic of Amount Realized on the sale of assets and any kind of amount…

Q: Lileth Adriano, who plans to go abroad, is selling her mini-donut business. Her friend, Benita…

A: The net worth of an business depends on the assets and liabilities the firm is having at a…

Q: n, the owner of the solar company, purchased a Mercedes car and will be used 100% for business…

A: The prime cost method is based on the assumption that the value of a depreciating item drops…

Q: On May 1st, 2015, Nancy Silva paid $870,000 for a commercial building. She later sold the building…

A: The GDS method of depreciation stands for General Depreciation System. It is one of the most…

Q: During 2009, URBAN Company sold 10 acres of prime commercial zoned land to a builder for $5,000,000.…

A: The installment system or method is the first of many methods utilized under US GAAP to consider…

Q: Alan Meer inherits a hotel from his grandmother, Mary, on February 11 of the current year. Mary…

A: An adjusted basis is the amount of gain or loss realized at the time of the sales of a property.

Q: On 25 August 1990, Lulu bought an investment property for $469090. Two days later she also paid…

A: $ 1,012,068

Q: f P2,500,000

A: The allocation cost is given as,

Q: Wanting to finalize a sale before year-end, on December 29, WR Outfitters sold to Bob a warehouse…

A: Total appraised value = appraised value of warehouse + appraised value of land = $94,500 + $138,000…

Q: Rhino Company, a real estate entity, had a building with a The building was used as offices of the…

A: Given information, Carrying amount of building =P20,000,000 Fair value of building =P35,000,000…

Q: On December 1, 20X0, AKE Pte Ltd paid $5,000 to a Real Estate consulting company for a market report…

A: Accounting Standards are the principles which are accepted and adapted by the users of accounting…

Q: Cattle Co. purchased cattle for P200, 000 on July 1, 2021. The cost of transporting the same to the…

A:

Q: Dorothy and John Hufffschneider listed their house and lot for sale with C. B. Property. The asking…

A:

Q: Sebastian purchases two pieces of equipment for $100,000. Appraisals of the equipment indicate that…

A: Equipment is the resource owned by an entity which can be used for the purpose of doing usual…

Q: At what value should the land be recorded in Carpet Barn Company's records?

A: A historical cost is a measure of value used in accounting in which the value of an asset on the…

Q: one for P1,800,000. The old residence cost Mr. Antonio P1,000,000 and had a fair value of P2,500,000…

A: The capital gain tax are imposed on the capital gain incurred during the year, the capital gains…

Q: On April 1, 20x1, ESCULENT EDIBLE Co. purchased land and building by paying ₱40,000,000 and assuming…

A: The total amount paid for purchasing the land and building is allocated based on their fair value.…

Q: Joy, a sole proprietor involved in AirBnB, needs to sell almost all of his apartments. The selling…

A: The process by which a business sells off its assets and ceases operations is known as liquidation…

Q: Shaun Pollok purchased a car wash for $480,000. If purchased separately, the land would have cost…

A: Separate value of asset = Actual value / Overall cost of all asset * Estimated cost of asset

Q: Evergreen Co. has a land which he has purchased at the cost of $85,000. Currently the value of the…

A: Income statement: It refers to a financial statement that presents all the income earned by the…

Q: If I have a machine that I purchased for $50,000. I'be recorded depreciation of $28,000. I sell the…

A: Book value of an asset is the Purchase price of the asset less accumulated depreciation. when the…

Step by step

Solved in 2 steps

- Ed owns investment land with an adjusted basis of 35,000. Polly has offered to purchase the land from Ed for 175,000 for use in a real estate development. The amount offered by Polly is 10,000 in excess of what Ed perceives as the fair market value of the land. Ed would like to dispose of the land to Polly but does not want to incur the tax liability that would result. He identifies an office building with a fair market value of 175,000 that he would like to acquire. Polly purchases the office building and then exchanges the office building for Eds land. a. Calculate Eds realized and recognized gain on the exchange and his basis for the office building. b. Calculate Pollys realized and recognized gain on the exchange and her basis in the land.Assume that A values his house at $90,000. B is willing to pay $110,000 for A’s house in order torelocate closer to work. After signing a contract, B’s employer announces that the company will moveto another city. In view of this fact, the value of the house to B is reduced to $75,000. From anefficiency viewpoint, who should own the house, A or B?How will the parties achieve efficiency in allocating the house if the court enforces the contract?Finley Co. is looking for a new office location and sees a building with a fair value of $400,000. Finley also notices that much of the equipment in the existing building would be useful to its own operations. Finley estimates the fair value of the equipment to be $80,000. Finley offers to buy both the building and the equipment for $450,000, and the offer is accepted. Determine the amounts Finley should record in the separate accounts for building and equipment.

- Kaye sold his residential house and lot located in Manila on January 5, 2018 for 8,000,000. The property was purchased in 2005 for 3,000,000. The current market value of the property at the time of sale was:BIR Commissioner’s zonal valuation 9,000,000City Assessor’s schedule of values 6,000,000What is the capital gains tax on the sale? 300,000 360,000 480,000 540,000What is the maximum price you would be willing to pay for the business? If an investor group purchased the restaurant near the campus for $255, 867 and the fair value of the assets they acquired was $202,000, identify the account along with its balance, that is used to record the additional amount paid over the fair value of the assets.Finley Company is looking for a new office location and sees a building with a fair value of $740,000. Finley also notices that much of the equipment in the existing building would be useful to its own operations. Finley estimates the fair value of the equipment to be $114,000. Finley offers to buy both the building and the equipment for $790,000, and the offer is accepted. Determine the amounts Finley should record in the separate accounts for building and equipment. (Do not round intermediate calculations.)

- Evergreen Co. has a land which he has purchased at the cost of $85,000. Currently the value of the land has been appreciated by $30,000. Should evergreen recognize any loss or gain in the income statement? Give your explanationsABC Company owns a condominium unit in “The XYZ Residences” which is near the factory and the plant’s administrative building. To make it convenient to its executive, it allowed the latter to use the said property as his residence. The Zonal Value of the property is P32,000,000 while its fair market value as shown in its current Real Property Tax Declaration amounts to P25,000,000. How much is the fringe benefit expense? Group of answer choices P0 P800,000 P32,000,000 P25,000,000Pelé Corp. owns a popular convenience store in Washington state. Messi Corp. is hoping to purchase the store from Pelé for $8,500,000. Messi has identified the land and building have a fair value of $7,000,000 while inventory has a fair value of $700,000. Because of the store’s popularity, excellent customer service, and customer loyalty, Messi is willing to pay $800,000 above the fair value of the assets acquired in the purchase. If Pelé Corp. decides it will not accept anything less than $8,500,000, which Messi Corp. agrees to pay, how is the excess $800,000 payment accounted for? Excess Contributed Capital Plant, & Equipment Property, Plant, & Equipment Accumulated Deprecitation Accumulated Deprecitation

- Lileth Adriano, who plans to go abroad, is selling her mini-donut business. Her friend, Benita Solido is interested to buy it but can only afford to pay P350,000. The following are the assets of Adriano’s business: Book Value Market Value Equipment (net of accumulateddepreciation of P25,000) P350,000 P300,000 Furniture and Fixtures (net ofaccumulated depreciation ofP5,000) 75,000 50,000 Raw Materials 35,000 25,000 Franchise Right 150,000 100,000 Total P610,000 P475,000 a. How much is the net worth assuming there is a mortgage note of P150,000 attached tothe equipment? b. Will Benita Solido be able to afford to buy the business? c. Make the entry in the books of Benita.Mr. Sandro, a real estate developer, enters a contract with Arnold Reyes to sell a building for P1 million. Arnold intends to open a warehouse in the building for his sticky rice products. The building is in an area where new buildings face high levels of competition and Arnold has little experience in the rice treading industry. As a result, the contract price of P 100,000,000 is not probable as to its collectability. From the details above, can we account for the contract as a contract revenue from the customer?Anton purchases a building on May 4, 2002, at a cost of $370,000. The land is properly allocated $40,000 of the cost (total cost $410,000). Anton sells the building on October 18, 2020, for $370,000. If an amount is zero, enter "0". a. What is the character of Anton's gain or loss on the sale if he uses the regular MACRS system and the building is an apartment building? Assume the accumulated depreciation at the time of the sale is $208,990. The total gain would be _____, of which ______is Section 1250 recapture and_______is unrecaptured Section 1250. Any balance is considered a long-term capital gain . b. What is the character of Anton's gain or loss on the sale if he uses the regular MACRS system and the building is an office building? Assume the accumulated depreciation at the time of the sale is $147,384. The total gain would be_____, of which _____ is Section 1250 recapture and ______ is unrecaptured Section 1250. Any balance is considered Section 1231 gain