You are the CEO of a manufactory firm based in the Country of Eldorado. Suppose the corporate tax rate in Eldorado is 30%, your company Eamings before Interest and Taxes (EBIT) is £450million in 2018 and you have interest expenses of £125million. a. What is your firm's 2018 net income? b. What is the sum of your firm's 2018 net income and interest payments? c. Assume now your firm had no interest expenses, what would its 2018 net income be? Compare the result with your answer in part b. d. Calculate your firm's interest tax shield in 2018. e. "The total value of the unlevered firm exceeds the value of the firm with leverage due to the present value of the tax savings from debt." Is this statement true or false? Explain.

You are the CEO of a manufactory firm based in the Country of Eldorado. Suppose the corporate tax rate in Eldorado is 30%, your company Eamings before Interest and Taxes (EBIT) is £450million in 2018 and you have interest expenses of £125million. a. What is your firm's 2018 net income? b. What is the sum of your firm's 2018 net income and interest payments? c. Assume now your firm had no interest expenses, what would its 2018 net income be? Compare the result with your answer in part b. d. Calculate your firm's interest tax shield in 2018. e. "The total value of the unlevered firm exceeds the value of the firm with leverage due to the present value of the tax savings from debt." Is this statement true or false? Explain.

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter27: Investment, The Capital Market, And The Wealth Of Nations

Section: Chapter Questions

Problem 9CQ

Related questions

Question

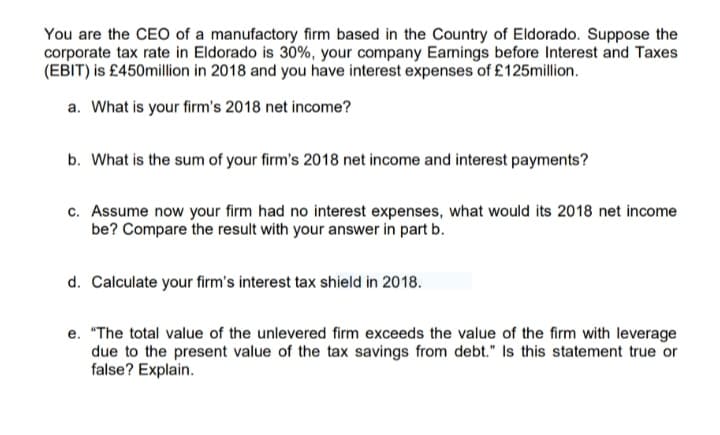

Transcribed Image Text:You are the CEO of a manufactory firm based in the Country of Eldorado. Suppose the

corporate tax rate in Eldorado is 30%, your company Earnings before Interest and Taxes

(EBIT) is £450million in 2018 and you have interest expenses of £125million.

a. What is your firm's 2018 net income?

b. What is the sum of your firm's 2018 net income and interest payments?

c. Assume now your firm had no interest expenses, what would its 2018 net income

be? Compare the result with your answer in part b.

d. Calculate your firm's interest tax shield in 2018.

e. "The total value of the unlevered firm exceeds the value of the firm with leverage

due to the present value of the tax savings from debt." Is this statement true or

false? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning