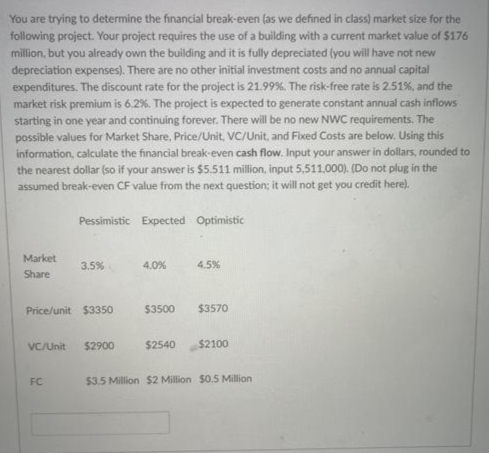

You are trying to determine the financial break-even (as we defined in class) market size for the following project. Your project requires the use of a building with a current market value of $176 million, but you already own the building and it is fully depreciated (you will have not new depreciation expenses). There are no other initial investment costs and no annual capital expenditures. The discount rate for the project is 21.99 %. The risk-free rate is 2.51%, and the market risk premium is 6.2%. The project is expected to generate constant annual cash inflows starting in one year and continuing forever. There will be no new NWC requirements. The possible values for Market Share, Price/Unit, VC/Unit, and Fixed Costs are below. Using this information, calculate the financial break-even cash flow. Input your answer in dollars, rounded to the nearest dollar (so if your answer is $5.511 million, input 5,511,000). (Do not plug in the assumed break-even CF value from the next question; it will not get you credit here). Market Share Pessimistic Expected Optimistic 3.5% Price/unit $3350 FC 4.0% 4.5% $3500 $3570 VC/Unit $2900 $2540 $2100 $3.5 Million $2 Million $0.5 Million

You are trying to determine the financial break-even (as we defined in class) market size for the following project. Your project requires the use of a building with a current market value of $176 million, but you already own the building and it is fully depreciated (you will have not new depreciation expenses). There are no other initial investment costs and no annual capital expenditures. The discount rate for the project is 21.99 %. The risk-free rate is 2.51%, and the market risk premium is 6.2%. The project is expected to generate constant annual cash inflows starting in one year and continuing forever. There will be no new NWC requirements. The possible values for Market Share, Price/Unit, VC/Unit, and Fixed Costs are below. Using this information, calculate the financial break-even cash flow. Input your answer in dollars, rounded to the nearest dollar (so if your answer is $5.511 million, input 5,511,000). (Do not plug in the assumed break-even CF value from the next question; it will not get you credit here). Market Share Pessimistic Expected Optimistic 3.5% Price/unit $3350 FC 4.0% 4.5% $3500 $3570 VC/Unit $2900 $2540 $2100 $3.5 Million $2 Million $0.5 Million

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter5: Investment Decisions: Look Ahead And Reason Back

Section: Chapter Questions

Problem 5.4IP

Related questions

Question

Answer in typing other wise downvote you

Transcribed Image Text:You are trying to determine the financial break-even (as we defined in class) market size for the

following project. Your project requires the use of a building with a current market value of $176

million, but you already own the building and it is fully depreciated (you will have not new

depreciation expenses). There are no other initial investment costs and no annual capital

expenditures. The discount rate for the project is 21.99 %. The risk-free rate is 2.51%, and the

market risk premium is 6.2%. The project is expected to generate constant annual cash inflows

starting in one year and continuing forever. There will be no new NWC requirements. The

possible values for Market Share, Price/Unit, VC/Unit, and Fixed Costs are below. Using this

information, calculate the financial break-even cash flow. Input your answer in dollars, rounded to

the nearest dollar (so if your answer is $5.511 million, input 5,511,000). (Do not plug in the

assumed break-even CF value from the next question; it will not get you credit here).

Pessimistic Expected Optimistic

Market

Share

3.5%

Price/unit $3350

VC/Unit $2900

FC

4.0%

4.5%

$3500 $3570

$2540 $2100

$3.5 Million $2 Million $0.5 Million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning