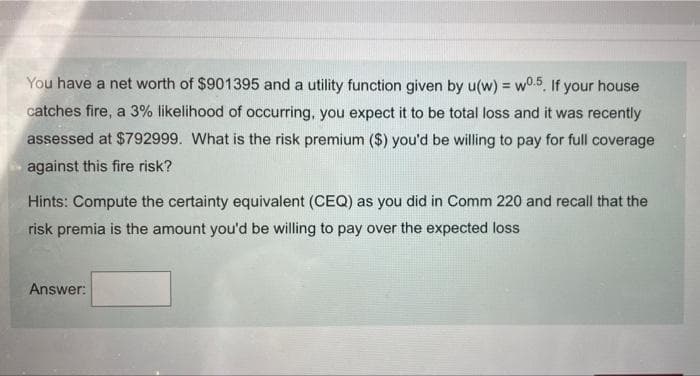

You have a net worth of $901395 and a utility function given by u(w) = w0.5. If your house %3D catches fire, a 3% likelihood of occurring, you expect it to be total loss and it was recently assessed at $792999. What is the risk premium ($) you'd be willing to pay for full coverage against this fire risk? Hints: Compute the certainty equivalent (CEQ) as you did in Comm 220 and recall that the risk premia is the amount you'd be willing to pay over the expected loss

Q: QUESTION 3 The 1928 Pact of Paris (the Kellogg-Briand Pact) a. unequivocally banned all wars,…

A: 3. The accord was multilateral.

Q: 1. The market price for tomatoes is $2/pound. Lynn is too small to influence the price of tomatoes.…

A: The labor market, sometimes known as the job market, is concerned with the supply and demand for…

Q: Commercial banks hold governments bonds of £71, reserves of £61, and currency of E48. The public…

A: Money Multiplier is the reciprocal of required reserves ratio on the other its also be determined by…

Q: Consider a perfectly competitive firm with the following production function: q=L025K0.25 a. Solve…

A: We have cost of labor = w and Cost of capital = r

Q: 3. Using aggregate demand and aggregate supply analysis, show the effects of the following (Assume…

A: Since you have asked a question with multiple sub-parts, we will solve the first three sub-parts for…

Q: If a country tries to maintain a fixed exchange rate, it must be Multiple Choice O willing to print…

A: Exchange rate refers to the rate at which currency of one nation can be exchanged by one…

Q: The Russia-Ukraine war triggers a surging of crude oil price to a record high that leads to a…

A: The question is based on the aggregate demand-aggregate supply model.

Q: PRICE (Dolars per ream) QUANTITY (Reams ofpaper) Refer to Figure 4-9. All else equal, an increase in…

A: Supply Curve: - supply curve is the graphical way of showing the relationship between the quantity…

Q: A new drill press is being considered to purchased. The estimated first cost is Php 200,000. The net…

A: Given the first cost = 200000 First year income = 75000 Per year decrease in income = 12500 Interest…

Q: Looking at the input hypothesis, explain, “We acquire by ‘going for meaning’ first and as a result,…

A: The Input Hypothesis basically attempts to answer the question, "How do humans learn to speak?"It's…

Q: In the market for euros, a decrease in U.S. real interest rates tends to Multiple Choice decrease…

A: An international exchange rate, also said as a foreign exchange rate. It is the price of a currency…

Q: Which of the following social movement strategies was used by the United Farm Workers to get…

A: Petition:- A petition can be explained as a written statement addressed to a specific person,…

Q: Consider the simple economy that produces only three products. Use the information in the folding…

A: The market basket consists of 1 haircut, 7 hamburgers, and 6 movies. Consumer price index (CPI) =…

Q: Audiences are not concerned with where media texts come from.’ To what extent do you agree with…

A: Generally, people prefer to watch or reach the media text from a reliable source. The Sources of…

Q: Which is a good fiscal policy when inflation is very low and unemployment is very high? Decrease the…

A: Fiscal policy is a policy used by the government to stabilize the economy. The tools are changes in…

Q: How did the U.S. emerge from World War Il as a superpower? O. Although the U.S. entered World War II…

A: With a global network of alliances and military bases, the United States is by far the most powerful…

Q: Make 2 IRR problems with a diagram and solution.

A: Answer is given below

Q: You and Going to the party is fun and gives a benefit of 4. If you go to the party, there is a 50%…

A: Expected Payoff of going to party = 50% (4 ) [No covid ] + 50% (-10) [Covid ] = -3 Expected…

Q: Consider a perfectly competitive firm with the following production |0.25,0.25 function: q=L' a.…

A: To find the long run supply function. We first find the cost function and then get the Marginal Cost…

Q: Joe has utility function is U = ln(x) + 2(ln(y)). He has 2 units of x and 8 units of y. Price of x…

A: Utility function : U = ln(x) + 2(ln(y)) Endowment : x = 2 , y = 8 Px = 1 , Py = P Therefore ,…

Q: You have a price of $5 per unit. Your total variable costs are $1 per unit and your fixed costs are…

A: break-even is at TR=TC TR=P*Q P=5 and Q=? TR=5Q

Q: Consider a small country with perfect K mobility in full eqm (ISXM-LM-BOP) with a recessionary gap,…

A: Recessionary Gap A recessionary gap in the economy refers to when the Real GDP level is below its…

Q: Consider this Preference Voting Table from 50 voters and 4 candidates Rank/Number of 19 14 10 7.…

A: In single-seat elections with more than two candidates, instant-runoff voting (IRV) is a form of…

Q: Both Romer and Solow develop models of economic growth sharing the following hypotheses: a. Economic…

A: Economic growth means consistent rise in GDP over period of time . In Romer growth model production…

Q: differences between the mainstream/New Keynesian and the Post-Keynesian theory of medium run…

A: New Keynesian Theory According to the New Keynesian Theory, prices and wages are closely related and…

Q: 9-15. A small high-speed commercial centrifuge has the following net cash flows and abandonment…

A: Given:- Rate of return=10% Current market value=$7,500 To determine:- Optimal time to abandon=?…

Q: D 5 E 5 Refer to the data. If Firm B merged with Firm E, the industry's four-firm concentration…

A: *Answer:

Q: 3) Suppose Joe's utility for lobster (L) and soda (S) can be represented as U = = L0.5 s MU =0,5…

A: Answer; For Joe, MRSL,S = MUL/MUS = S/L The equation of his budget line can be represented as…

Q: Suppose the liquidity preference function is given by: L.Y)=5 - 1,000 Calculate velocity for each…

A: Answer: Period 1:…

Q: Consider the production function of Firm Y below utilizing inputs labor (L) and capita firm faces…

A: *Answer:

Q: 1. Big game For the following game find all Nash equilibria. Find the Utilitarian and Rawlsian…

A: Since the question you have posted consists of multiple parts, we will answer the first two…

Q: Loans are classified "pass" when the full repayment of interest and principal is not in C. full A.…

A: Hi! thanks for the questions but as per the guidelines, we answer only one question at one time.…

Q: iv) Natural disasters increase the post-disaster Gross Domestic Product (GDP) and are good to long…

A: GDP (Gross domestic product) basically refers to the final value of all goods and service that…

Q: 2. Consider the following Stackelberg model with 2 firms. Let firm 1 be the incumbent and firm 2 the…

A: The Stackelberg leadership model basically refers to an economics strategic game in which the leader…

Q: Q)If the US economy is in the following situation in 2022, what fiscal policies do you recommend…

A: Fiscal policy basically refers to the process through which a government modifies its expenditure…

Q: cation systems are being con n China. Doing nothing is e data below and state yc ng this problem…

A: *Answer:

Q: Firm Market Share (%) A 40 B 30 C 20 D 5 E 5 Refer to the data. If Firm B merged with Firm E, the…

A: Four-firm concentration ratio and Herfindahl index are two tools used to make market analysis.

Q: A firm sells its output in a PCM. The finm's short-run cost function by given SC = q' -0.29 + 4q +…

A: In this question:- The short run cost function=q3300-0.2q2+4q+10 Here the short run supply curve…

Q: Refer to Table 23.1, Real Gross Domestic Product (RGDP) is about $ billion -for 2018. O 19,140.10…

A: Answer: The following formula will be used here: Price index=Nominal GDPRGDP×100 Nominal GDP in 2018…

Q: Dizon Farms Inc. is a specialist in ethically sourcing and producing fresh produce and food…

A: Since you have posted multiple questions, as per the guidelines, we will solve the first one for…

Q: Suppose we let: S: TF or P = 1 + 0.5 Q D: TF or P = 15 – 2Q a. Solve for the equilibrium price and…

A: We are going to find equilibrium price and quantity to answer this question.. Note: as per the…

Q: Break-Even Point The break-even point for a company is where costs equal revenues. Therefore the…

A: In short run, each and every firm focus to recover variable cost and ready to bear fixed cost .

Q: 29) Suppose a basket of goods and services has been selected to calculate the CPI and 2014 has been…

A: CPI is used to measure change in the general price level in the economy.

Q: 1. If Alice wants to construct a hedging strategy via optimization, which of the following…

A: Answer - Hedging:- Hedging is a strategy where investors diversify their investments to reduce the…

Q: What is domestic price and what is world price? How does it connect with international trade and in…

A: The domestic price can be defined as the price which is the current price for a specific good or…

Q: 2. Suppose the total cost function of a firm that produces hotdogs is C= 150q - 4q° + 29' where q is…

A: Answer to the question is as follows:

Q: 15. Lorenzo lives on x and y alone. His utility function is U(x, y) = min{3x + 4y, 7y}. The prices…

A: Complementary goods refers to the goods that can be used together. These goods have a minimum…

Q: 9. Which of the following will result in expansionary monetary or fiscal policy being the LEAST…

A: Real GDP=Nominal GDP/Deflator

Q: The figure shows the trade-off between consumption and quality of the environment. Which of the…

A: The varying amounts of two different things that society may utilize are represented by a…

Q: If intersection between AD and AS is much higher than the natural rate of output, how would the…

A: Demand and supply In perfect market competition the optimum quantity is produced where the demand…

Step by step

Solved in 4 steps

- A ten-year term insurance is be issued to a life aged 50. The sum insured is $200,000 and payable immediately upon death. Premium payments are annual in advance. a) Using the SOA Standard Ultimate Life Table at i = 5% and UDD, compute the net annual premium determined by the equivalence principle. b) Find the probability that this contract makes a profit. c) Compute the gross premium determined by the equivalence principle if the initial expense is $500 plus 10% of the first premium, and if there is a renewal expense of 2% of the annual premium payment for the second and all subsequent premium payments.Suppose Real Option Inc. has a product that generates the following cash flow. At t=1, the demand can be high or low. There is a probability of 0.6 that demand is high. If demand is high (low) the cash flow is CFH=400 (CFL=200). At t=2, the demand can also be high or low. If demand was high at t=1, then a high demand at t=2 arises with probability 0.7. If demand was low at t=1, then a high demand at t=2 arises with probability 0.2. If demand is high (low) at t=2 then CFH=400 (CFL=200). The interest rate for this project is 20%. (a) Draw the event and decision tree. (b) What is the market price (expected value) of Real Option Inc. at t=0? Now suppose Real Option Inc. can rent a platform to run a marketing campaign. For this purpose Real Option Inc. must sign a two year contract with the platform provider. The costs for using the platform are 180 per period. Marketing itself does not cost anything and has the following effect. In the high demand state, marketing doubles the demand. In…You are considering a $500,000 investment in the fast-food industry and have narrowed your choice to either a McDonald’s or a Penn Station East Coast Subs franchise. McDonald’s indicates that, based on the location where you are proposing to open a new restaurant, there is a 25 percent probability that aggregate 10-year profits (net of the initial investment) will be $16 million, a 50 percent probability that profits will be $8 million, and a 25 percent probability that profits will be −$1.6 million. The aggregate 10-year profit projections (net of the initial investment) for a Penn Station East Coast Subs franchise is $48 million with a 2.5 percent probability, $8 million with a 95 percent probability, and −$48 million with a 2.5 percent probability. Considering both the risk and expected profitability of these two investment opportunities, which is the better investment? Explain carefully.

- You live in an area where there is a possibility of a massive earthquake, so consider purchasing earthquake insurance for your home at an annual cost of $180. The probability of an earthquake damaging your home in the course of a year is 0.001. If this occurs, you estimate that the cost of the damage (fully covered by insurance) will be $160,000. Your total assets (including the house) are worth $250,000. a) Apply the maximum expected value decision rule to determine the alternative (to buy insurance or not) that maximizes the value of your assets after one year. b) You developed a utility function that measures the value of your assets in x dollars (x ≥ 0). This utility function is U(x) = √x. Compare the utility of reducing the total of your assets for the next year by a value equal to the value of the insurance, with the expected utility next year of not purchasing tremor insurance. Should you purchase the insurance?Find the expected value assuming the risk factor is 30 % and the interest rate is 15%, if you will receive $20,000 one year from today. Find the expected value assuming the risk factor is 30 % and the interest rate is 15%, if you will receive $20,000 two years from today.You live in an area that has a possibility of incurring a massive earthquake, so you are considering buyingearthquake insurance on your home at an annual cost of $180. The probability of an earthquake damagingyour home during one year is 0.001. If this happens, you estimate that the cost of the damage (fully coveredby earthquake insurance) will be $160,000. Your total assets (including your home) are worth $250,000.

- Consider two investors A and B.If the Certainty-Equivalent end-of-period wealth of A is less than the Certainty-Equivalent end-of-period wealth of B for the same portfolio choice,then A. Risk aversion of A > Risk aversion of B B. Risk aversion of A = Risk aversion of B C. Risk aversion of A< Risk aversion of B D. Not enough Information Justify your choice in a sentence or two:Find the Pratt - Arrow risk - aversion function for a utility function U(W) = log(0.5-W + 500), where W is the amount of wealth in €. Suppose that an investor's wealth is subject to outcomes -800 €, 500 €, 500 € and 1, 000 € which affect the initial amount of 2,500 € with probabilities of their occurrence 40%, 15%, 15% and 30%, respectively. a) Using the Taylor approximation to certainty equivalent, calculate an approximate expected utility value. b) Calculate the certain equivalent of the investor's uncertain wealth. Interpret.Suppose your utility function for money is a square-root function of its value in US dollars. So, for instance, $400 is worth 20 utils for you, $961 is worth 31 utils for you, and $62.5K is worth 250 utils for you. Now, let’s say your annual salary is $90K, although there is a small risk (p = 0.05) that something catastrophic will happen and reduce your income for the year to $14.4K. An insurance company comes along and offers to insure you against the loss of your salary. The cost of the insurance is $4,736. If you buy the policy and catastrophe strikes, the insurance company will pay out the $75,600 that you would otherwise have lost. From the standpoint of maximizing expected utility, would buying this insurance be a good deal for you? What would be the insurance company’s expected monetary value of selling you the policy?

- Angie owns an endive farm that will be worth $90,000 or $0 with equal probability. Her Bernouilli utility function is u(w) =√w, where w is her wealth level (sum of initial wealth and the worth of the endive farm). 1. Suppose her firm is the only asset she has, that is, she has no initial wealth. What is the lowest price P at which she will agree to sell her endive farm before she knows how much it will be worth? 2. Redo part (1) assuming that she has $160,000 in her bank safe. 3. Compare and discuss your results in parts (1) and (2). What relationship can you find between Angie’s initial wealth level (zero versus $160,000) and her risk aversion?Tess and Lex earn $40,000 per year and all earnings are spent on consumption (c). Tess and Lex both have the utility function c. Both could experience an adverse event that results in earnings of $0 per year. Tess has a 1% chance of experiencing an adverse event and Lex has a 12% chance of experiencing an adverse event. Tess and Lex are both aware of their risk of an adverse event. 1. Suppose the actuarially fair premium charge is 2600, Calculate Tess’ expected utility with full insurance if she is charged the premium. Round to two decimal places. 2. What is the premium that private insurance companies will charge for full insurance? Round to two decimal places. 3.Assume the social welfare function is the sum of the Tess’ and Lex’s utility functions. Select the correct statement regarding the explanation for what has happened in the private market and the role of social insurance. a.Adverse section has lead to market failure. The government could improve social welfare by…A drug company is considering investing $100 million today to bring a weight loss pill to the market. At the end of one year, the firm will know the payoff; there is a 0.50 probability that the pill will sell at a high price and generate $37 million per year of profit forever and a 0.50 probability that the pill will sell at a low price and generate $I million per year of profit forever. The interest rate is 10%. Suppose the firm decides to wait one year to determine whether the pill will sell at a high or low price. The firm will not invest if it learns that the pill will sell at a low price. What is the net present value of waiting one year to make the investment?O $88 millionO$122.72 millionO $201.22 millionO $64.5 million