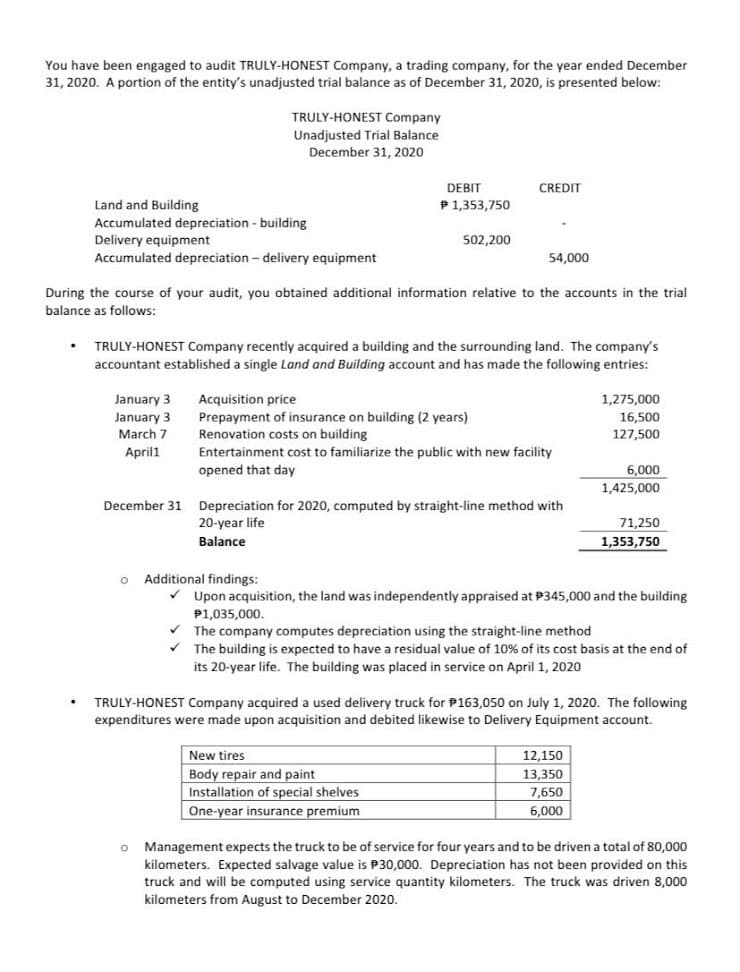

You have been engaged to audit TRULY-HONEST Company, a trading company, for the year ended December 31, 2020. A portion of the entity's unadjusted trial balance as of December 31, 2020, is presented below: TRULY-HONEST Company Unadjusted Trial Balance December 31, 2020 DEBIT CREDIT Land and Building Accumulated depreciation - building Delivery equipment Accumulated depreciation - delivery equipment P1,353,750 502,200 54,000 During the course of your audit, you obtained additional information relative to the accounts in the trial balance as follows: TRULY-HONEST Company recently acquired a building and the surrounding land. The company's accountant established a single Land and Building account and has made the following entries: January 3 January 3 March 7 Acquisition price Prepayment of insurance on building (2 years) Renovation costs on building Entertainment cost to familiarize the public with new facility opened that day 1,275,000 16,500 127,500 April1 6,000 1,425,000 December 31 Depreciation for 2020, computed by straight-line method with 71,250 1,353,750 20-year life Balance Additional findings: v Upon acquisition, the land was independently appraised at P345,000 and the building P1,035,000. The company computes depreciation using the straight-line method The building is expected to have a residual value of 10 % of its cost basis at the end of its 20-year life. The building was placed in service on April 1, 2020 TRULY-HONEST Company acquired a used delivery truck for P163,050 on July 1, 2020. The following expenditures were made upon acquisition and debited likewise to Delivery Equipment account. New tires Body repair and paint Installation of special shelves One-year insurance premium 12,150 13,350 7,650 6,000 Management expects the truck to be of service for four years and to be driven a total of 80,000 kilometers. Expected salvage value is P30,000. Depreciation has not been provided on this truck and will be computed using service quantity kilometers. The truck was driven 8,000 kilometers from August to December 2020.

You have been engaged to audit TRULY-HONEST Company, a trading company, for the year ended December 31, 2020. A portion of the entity's unadjusted trial balance as of December 31, 2020, is presented below: TRULY-HONEST Company Unadjusted Trial Balance December 31, 2020 DEBIT CREDIT Land and Building Accumulated depreciation - building Delivery equipment Accumulated depreciation - delivery equipment P1,353,750 502,200 54,000 During the course of your audit, you obtained additional information relative to the accounts in the trial balance as follows: TRULY-HONEST Company recently acquired a building and the surrounding land. The company's accountant established a single Land and Building account and has made the following entries: January 3 January 3 March 7 Acquisition price Prepayment of insurance on building (2 years) Renovation costs on building Entertainment cost to familiarize the public with new facility opened that day 1,275,000 16,500 127,500 April1 6,000 1,425,000 December 31 Depreciation for 2020, computed by straight-line method with 71,250 1,353,750 20-year life Balance Additional findings: v Upon acquisition, the land was independently appraised at P345,000 and the building P1,035,000. The company computes depreciation using the straight-line method The building is expected to have a residual value of 10 % of its cost basis at the end of its 20-year life. The building was placed in service on April 1, 2020 TRULY-HONEST Company acquired a used delivery truck for P163,050 on July 1, 2020. The following expenditures were made upon acquisition and debited likewise to Delivery Equipment account. New tires Body repair and paint Installation of special shelves One-year insurance premium 12,150 13,350 7,650 6,000 Management expects the truck to be of service for four years and to be driven a total of 80,000 kilometers. Expected salvage value is P30,000. Depreciation has not been provided on this truck and will be computed using service quantity kilometers. The truck was driven 8,000 kilometers from August to December 2020.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 17P: On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and...

Related questions

Question

Compute for the adjusted balance of "LAND".

Transcribed Image Text:You have been engaged to audit TRULY-HONEST Company, a trading company, for the year ended December

31, 2020. A portion of the entity's unadjusted trial balance as of December 31, 2020, is presented below:

TRULY-HONEST Company

Unadjusted Trial Balance

December 31, 2020

DEBIT

CREDIT

Land and Building

Accumulated depreciation - building

Delivery equipment

Accumulated depreciation - delivery equipment

P1,353,750

502,200

54,000

During the course of your audit, you obtained additional information relative to the accounts in the trial

balance as follows:

TRULY-HONEST Company recently acquired a building and the surrounding land. The company's

accountant established a single Land and Building account and has made the following entries:

January 3

January 3

March 7

1,275,000

16,500

127,500

Acquisition price

Prepayment of insurance on building (2 years)

Renovation costs on building

Entertainment cost to familiarize the public with new facility

opened that day

April1

6,000

1,425,000

December 31

Depreciation for 2020, computed by straight-line method with

20-year life

71,250

Balance

1,353,750

o Additional findings:

v Upon acquisition, the land was independently appraised at P345,000 and the building

P1,035,000.

The company computes depreciation using the straight-line method

The building is expected to have a residual value of 10% of its cost basis at the end of

its 20-year life. The building was placed in service on April 1, 2020

TRULY-HONEST Company acquired a used delivery truck for P163,050 on July 1, 2020. The following

expenditures were made upon acquisition and debited likewise to Delivery Equipment account.

New tires

12,150

Body repair and paint

13,350

Installation of special shelves

7,650

One-year insurance premium

6,000

Management expects the truck to be of service for four years and to be driven a total of 80,000

kilometers. Expected salvage value is P30,000. Depreciation has not been provided on this

truck and will be computed using service quantity kilometers. The truck was driven 8,000

kilometers from August to December 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning