You have recently been appointed as the financial manager of MiniStudy Ltd, a company listed on the Johannesburg Stock Exchange. You have been approached by the Board of Directors to assess a new capital project the company wishes to invest them. You have determined that the first step in this process would be to calculate MiniStudy Ltd's cost of capital. After a long meeting held with your finance team, you have determined the following: Capital structure MiniStudy Ltd has a target capital structure of 35% interest-bearing debt, 15% preference shares and the balance comprise equity. The current tax rate applicable to the company is 28%. Interest-bearing debt Interest-bearing debt consists of redeemable debentures. There are 150 000 debentures with a par value of R50 each. These debentures will mature in 10 years' time at a premium of 10%. The coupon rate of these debentures is 8% per annum while the pre-tax current yield on similar debentures is 12% per annum. Based on this information, you have determined that the total market value of debt is R while the cost of debt to be used in the weighted average cost of capital calculation is %. Preference shares There are 50 000 non-redeemable, non-convertible preference shares with a par value of R100 in issue. These preference shares pay a fixed dividend of 9% per annum. Historically, similar preference shares have had a required return of the prime interest rate plus a premium of 3 percentage point. You have determined the current prime interest rate as 8%. Based on this information, you have determined that the total market value of the preference shares is R while the cost of preference shares to be used in the weighted average cost of capital calculation is %. Equity The company has 2 million ordinary shares with no par value in issue. The company's most recent dividend amounted to RO.50. This dividend is expected to grow at 20% for the next year after which it will grow at the company's sustainable growth rate of 10% into the future. MiniStudy Ltd has a beta of 1.75. The current risk-free rate is 2% while the market risk premium is 8%. Based on this information, you have determined that the total market value of equity is R while the cost of equity to be used in the weighted average cost of capital calculation is Weighted average cost of capital Assuming that you have calculated the post-tax cost of interest-bearing debt to be 7%, the cost of preference shares to be 13% and the cost of equity to be 20%, you have calculated MiniStudy Ltd's target weighted average cost of capital to be

You have recently been appointed as the financial manager of MiniStudy Ltd, a company listed on the Johannesburg Stock Exchange. You have been approached by the Board of Directors to assess a new capital project the company wishes to invest them. You have determined that the first step in this process would be to calculate MiniStudy Ltd's cost of capital. After a long meeting held with your finance team, you have determined the following: Capital structure MiniStudy Ltd has a target capital structure of 35% interest-bearing debt, 15% preference shares and the balance comprise equity. The current tax rate applicable to the company is 28%. Interest-bearing debt Interest-bearing debt consists of redeemable debentures. There are 150 000 debentures with a par value of R50 each. These debentures will mature in 10 years' time at a premium of 10%. The coupon rate of these debentures is 8% per annum while the pre-tax current yield on similar debentures is 12% per annum. Based on this information, you have determined that the total market value of debt is R while the cost of debt to be used in the weighted average cost of capital calculation is %. Preference shares There are 50 000 non-redeemable, non-convertible preference shares with a par value of R100 in issue. These preference shares pay a fixed dividend of 9% per annum. Historically, similar preference shares have had a required return of the prime interest rate plus a premium of 3 percentage point. You have determined the current prime interest rate as 8%. Based on this information, you have determined that the total market value of the preference shares is R while the cost of preference shares to be used in the weighted average cost of capital calculation is %. Equity The company has 2 million ordinary shares with no par value in issue. The company's most recent dividend amounted to RO.50. This dividend is expected to grow at 20% for the next year after which it will grow at the company's sustainable growth rate of 10% into the future. MiniStudy Ltd has a beta of 1.75. The current risk-free rate is 2% while the market risk premium is 8%. Based on this information, you have determined that the total market value of equity is R while the cost of equity to be used in the weighted average cost of capital calculation is Weighted average cost of capital Assuming that you have calculated the post-tax cost of interest-bearing debt to be 7%, the cost of preference shares to be 13% and the cost of equity to be 20%, you have calculated MiniStudy Ltd's target weighted average cost of capital to be

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 63P: Mike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture...

Related questions

Question

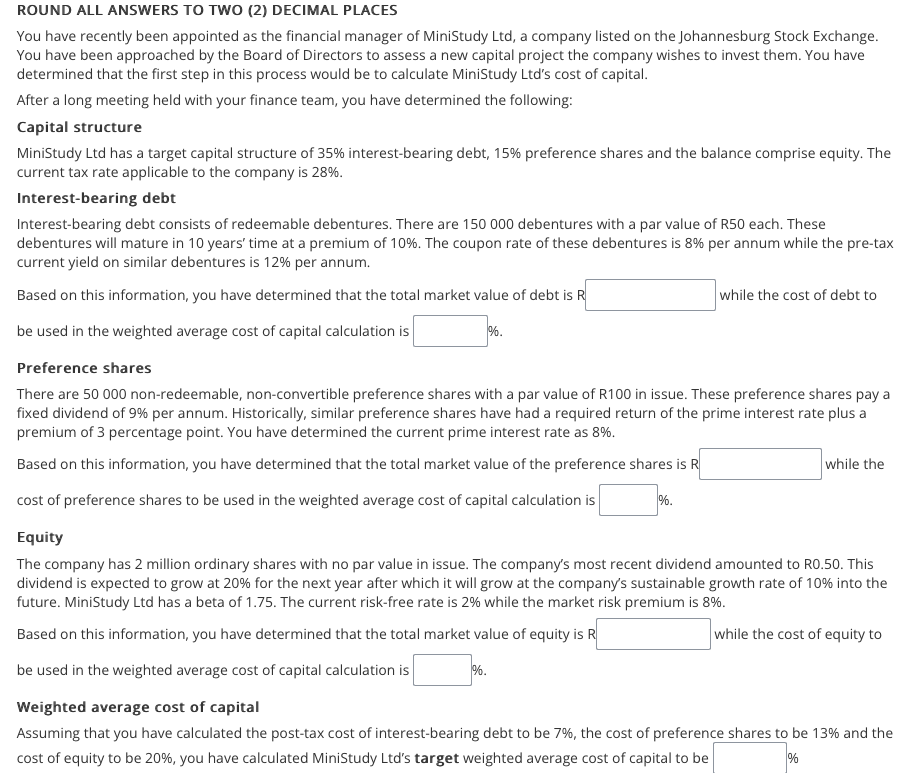

Transcribed Image Text:ROUND ALL ANSWERS TO TWO (2) DECIMAL PLACES

You have recently been appointed as the financial manager of MiniStudy Ltd, a company listed on the Johannesburg Stock Exchange.

You have been approached by the Board of Directors to assess a new capital project the company wishes to invest them. You have

determined that the first step in this process would be to calculate MiniStudy Ltd's cost of capital.

After a long meeting held with your finance team, you have determined the following:

Capital structure

MiniStudy Ltd has a target capital structure of 35% interest-bearing debt, 15% preference shares and the balance comprise equity. The

current tax rate applicable to the company is 28%.

Interest-bearing debt

Interest-bearing debt consists of redeemable debentures. There are 150 000 debentures with a par value of R50 each. These

debentures will mature in 10 years' time at a premium of 10%. The coupon rate of these debentures is 8% per annum while the pre-tax

current yield on similar debentures is 12% per annum.

Based on this information, you have determined that the total market value of debt is R

while the cost of debt to

be used in the weighted average cost of capital calculation is

%.

Preference shares

There are 50 000 non-redeemable, non-convertible preference shares with a par value of R100 in issue. These preference shares pay a

fixed dividend of 9% per annum. Historically, similar preference shares have had a required return of the prime interest rate plus a

premium of 3 percentage point. You have determined the current prime interest rate as 8%.

Based on this information, you have determined that the total market value of the preference shares is R

while the

cost of preference shares to be used in the weighted average cost of capital calculation is

%.

Equity

The company has 2 million ordinary shares with no par value in issue. The company's most recent dividend amounted to RO.50. This

dividend is expected to grow at 20% for the next year after which it will grow at the company's sustainable growth rate of 10% into the

future. MiniStudy Ltd has a beta of 1.75. The current risk-free rate is 2% while the market risk premium is 8%.

Based on this information, you have determined that the total market value of equity is R

while the cost of equity to

be used in the weighted average cost of capital calculation is

%.

Weighted average cost of capital

Assuming that you have calculated the post-tax cost of interest-bearing debt to be 7%, the cost of preference shares to be 13% and the

cost of equity to be 20%, you have calculated MiniStudy Ltd's target weighted average cost of capital to be

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 7 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning