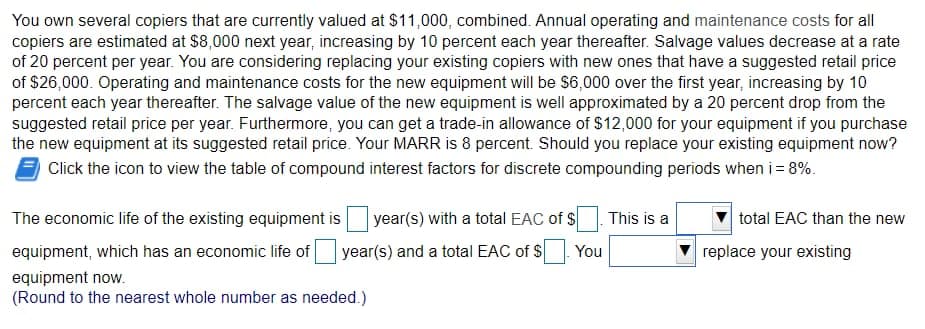

You own several copiers that are currently valued at $11,000, combined. Annual operating and maintenance costs for all copiers are estimated at $8,000 next year, increasing by 10 percent each year thereafter. Salvage values decrease at a rate of 20 percent per year. You are considering replacing your existing copiers with new ones that have a suggested retail price of $26,000. Operating and maintenance costs for the new equipment will be $6,000 over the first year, increasing by 10 percent each year thereafter. The salvage value of the new equipment is well approximated by a 20 percent drop from the suggested retail price per year. Furthermore, you can get a trade-in allowance of $12,000 for your equipment if you purchase the new equipment at its suggested retail price. Your MARR is 8 percent. Should you replace your existing equipment now? Click the icon to view the table of compound interest factors for discrete compounding periods when i = 8%. year(s) with a total EAC of $ year(s) and a total EAC of $ You The economic life of the existing equipment is equipment, which has an economic life of equipment now. (Round to the nearest whole number as needed.) This is a total EAC than the new replace your existing

You own several copiers that are currently valued at $11,000, combined. Annual operating and maintenance costs for all copiers are estimated at $8,000 next year, increasing by 10 percent each year thereafter. Salvage values decrease at a rate of 20 percent per year. You are considering replacing your existing copiers with new ones that have a suggested retail price of $26,000. Operating and maintenance costs for the new equipment will be $6,000 over the first year, increasing by 10 percent each year thereafter. The salvage value of the new equipment is well approximated by a 20 percent drop from the suggested retail price per year. Furthermore, you can get a trade-in allowance of $12,000 for your equipment if you purchase the new equipment at its suggested retail price. Your MARR is 8 percent. Should you replace your existing equipment now? Click the icon to view the table of compound interest factors for discrete compounding periods when i = 8%. year(s) with a total EAC of $ year(s) and a total EAC of $ You The economic life of the existing equipment is equipment, which has an economic life of equipment now. (Round to the nearest whole number as needed.) This is a total EAC than the new replace your existing

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

Don't upload this solution I vill give 10 downvotes

Plz give only correct solution

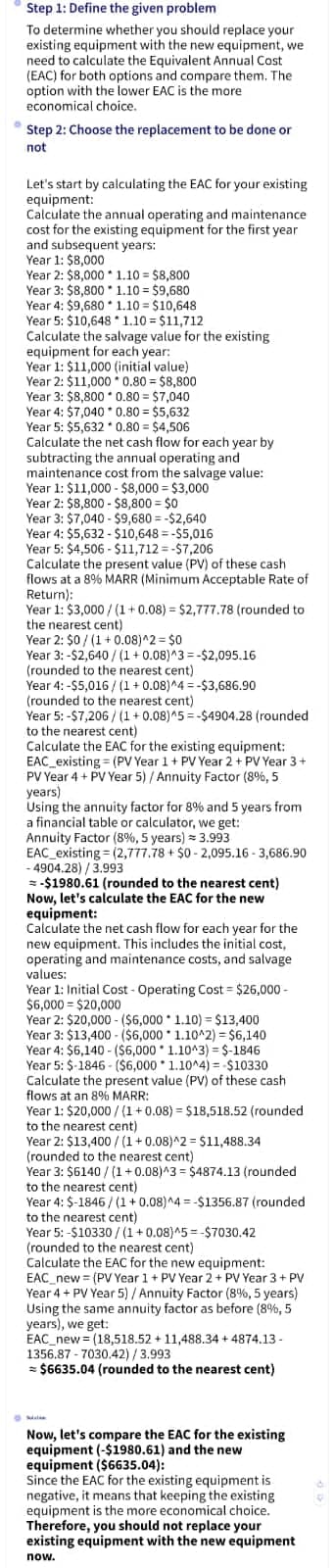

Transcribed Image Text:Step 1: Define the given problem

To determine whether you should replace your

existing equipment with the new equipment, we

need to calculate the Equivalent Annual Cost

(EAC) for both options and compare them. The

option with the lower EAC is the more

economical choice.

Step 2: Choose the replacement to be done or

not

Let's start by calculating the EAC for your existing

equipment:

Calculate the annual operating and maintenance

cost for the existing equipment for the first year

and

and subsequent years:

Year 1: $8,000

Year 2: $8,000

1.10 $8,800

Year 3: $8,800

1.10 = $9,680

Year 4: $9,680 1.10 = $10,648

Year 5: $10,648*1.10 = $11,712

Calculate the salvage value for the existing

equipment for each year:

Year 1: $11,000 (initial value)

Year 2: $11,000 0.80 = $8,800

Year 3: $8,800 0.80 = $7,040

Year 4: $7,040 * 0.80 = $5,632

Year 5: $5,632 * 0.80 = $4,506

Calculate the net cash flow for each year by

subtracting the annual operating and

maintenance cost from the salvage value:

Year 1: $11,000 - $8,000 $3,000

real 1.

Year 2: $8,800-$8,800 = $0

Year 3: $7,040 - $9,680=-$2,640

Year 4: $5,632-$10,648=-$5,016

Wear

Year 5: $4,506-$11,712=-$7,206

Calculate the present value (PV) of these cash

Flore

flows at a 8% MARR (Minimum Acceptable Rate of

Return):

Year 1

Year 1: $3,000/(1+0.08) = $2,777.78 (rounded to

the nearest cent)

the near

Year 2: $0/(1+0.08)^2 = $0

Year 3:-$2,640/(1+0.08)^3=-$2,095.16

(rounded to the nearest cent)

Year 4:-$5,016/(1+0.08)^4 =-$3,686.90

(rounded to the nearest cent)

Year 5:-$7,206/(1+0.08)^5=-$4904.28 (rounded

to the nearest cent)

Calculate the EAC for the existing equipment:

EAC existing (PV Year 1 + PV Year 2 + PV Year 3+

PV Year

Year 4 + PV Year 5) / Annuity Factor (8%, 5

years)

years)

Using the annuity factor for 8% and 5 years from

a financial table or calculator, we get:

Annuity Factor (8%, 5 years) = 3.993

EAC existing (2,777.78 + $0-2,095.16-3,686.90

-4904.28)/3.993

=-$1980.61 (rounded to the nearest cent)

Now, let's calculate the EAC for the new

equipment:

Calculate the net cash flow for each year for the

cance

new equipment. This includes the initial cost,

operating and maintenance costs, and salvage

values:

Year 1: Initial Cost - Operating Cost-$26,000-

$6,000-$20,000

Year 2: $20,000 - ($6,000

Year 3: $13,400 - ($6,000

Year 4: $6,140- ($6,000

Year 5: $-1846-($6,000 1.10^4) = -$10330

Calculate the present value (PV) of these cash

flows at an 8% MARR:

1.10) = $13,400

1.10^2) = $6,140

1.10^3) =$-1846

MAN

Year 1: $20,000/(1+0.08) = $18,518.52 (rounded.

real 1.920,000

to the nearest cent)

Year 2: $13,400/(1+0.08)^2 = $11,488.34

(rounded to the nearest cent)

Year 3: $6140/(1+0.08)^3 = $4874.13 (rounded

to the nearest cent)

Year 4: $-1846/(1+0.08)^4 =-$1356.87 (rounded

to the nearest cent)

Year 5:-$10330/(1+0.08)^5=-$7030.42

(rounded to the nearest cent).

Calculate the EAC for the new equipment:

EAC new (PV Year 1 + PV Year 2 + PV Year 3 + PV

Year 4+ PV Year 5) / Annuity Factor (8%, 5 years)

Using the same annuity factor as before (8%, 5

years), we get:

EAC new (18,518.52 + 11,488.34 +4874.13 -

1356.87-7030.42)/3.993

= $6635.04 (rounded to the nearest cent)

Now, let's compare the EAC for the existing

equipment (-$1980.61) and the new

equipment ($6635.04):

Since the EAC for the existing equipment is

negative, it means that keeping the existing

equipment is the more economical choice.

Therefore, you should not replace your

existing equipment with the new equipment

now.

Transcribed Image Text:You own several copiers that are currently valued at $11,000, combined. Annual operating and maintenance costs for all

copiers are estimated at $8,000 next year, increasing by 10 percent each year thereafter. Salvage values decrease at a rate

of 20 percent per year. You are considering replacing your existing copiers with new ones that have a suggested retail price

of $26,000. Operating and maintenance costs for the new equipment will be $6,000 over the first year, increasing by 10

percent each year thereafter. The salvage value of the new equipment is well approximated by a 20 percent drop from the

suggested retail price per year. Furthermore, you can get a trade-in allowance of $12,000 for your equipment if you purchase

the new equipment at its suggested retail price. Your MARR is 8 percent. Should you replace your existing equipment now?

Click the icon to view the table of compound interest factors for discrete compounding periods when i = 8%.

The economic life of the existing equipment is

equipment, which has an economic life of

equipment now.

(Round to the nearest whole number as needed.)

year(s) with a total EAC of $

year(s) and a total EAC of $ You

This is a

total EAC than the new

replace your existing

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education