You were engaged to audit the financial statements of the Philippine Refining Company for the year ended December 31, 2021 with comparative figures for the year ended December 31, 2020. One of your concern regarding material risk is on their long-term liabilities related to the acquisition of machinery. Your examination of their books revealed that on December 31, 2019, Philippine Refining Company purchased machinery having a cash selling price of P85,933.75. The company paid P10,000 down and agreed to finance the remainder by making four equal payments each December 31 at the implicit interest rate of 12%.

You were engaged to audit the financial statements of the Philippine Refining Company for the year ended December 31, 2021 with comparative figures for the year ended December 31, 2020. One of your concern regarding material risk is on their long-term liabilities related to the acquisition of machinery. Your examination of their books revealed that on December 31, 2019, Philippine Refining Company purchased machinery having a cash selling price of P85,933.75. The company paid P10,000 down and agreed to finance the remainder by making four equal payments each December 31 at the implicit interest rate of 12%.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 3P

Related questions

Question

Transcribed Image Text:PHILIPPINE REFINING COMPANY

You were engaged to audit the financial statements of the Philippine Refining Company for

the year ended December 31, 2021 with comparative figures for the year ended December 31,

2020. One of your concern regarding material risk is on their long-term liabilities related to

the acquisition of machinery.

Your examination of their books revealed that on December 31, 2019, Philippine Refining

Company purchased machinery having a cash selling price of P85,933.75. The company paid

P10,000 down and agreed to finance the remainder by making four equal payments each

December 31 at the implicit interest rate of 12%.

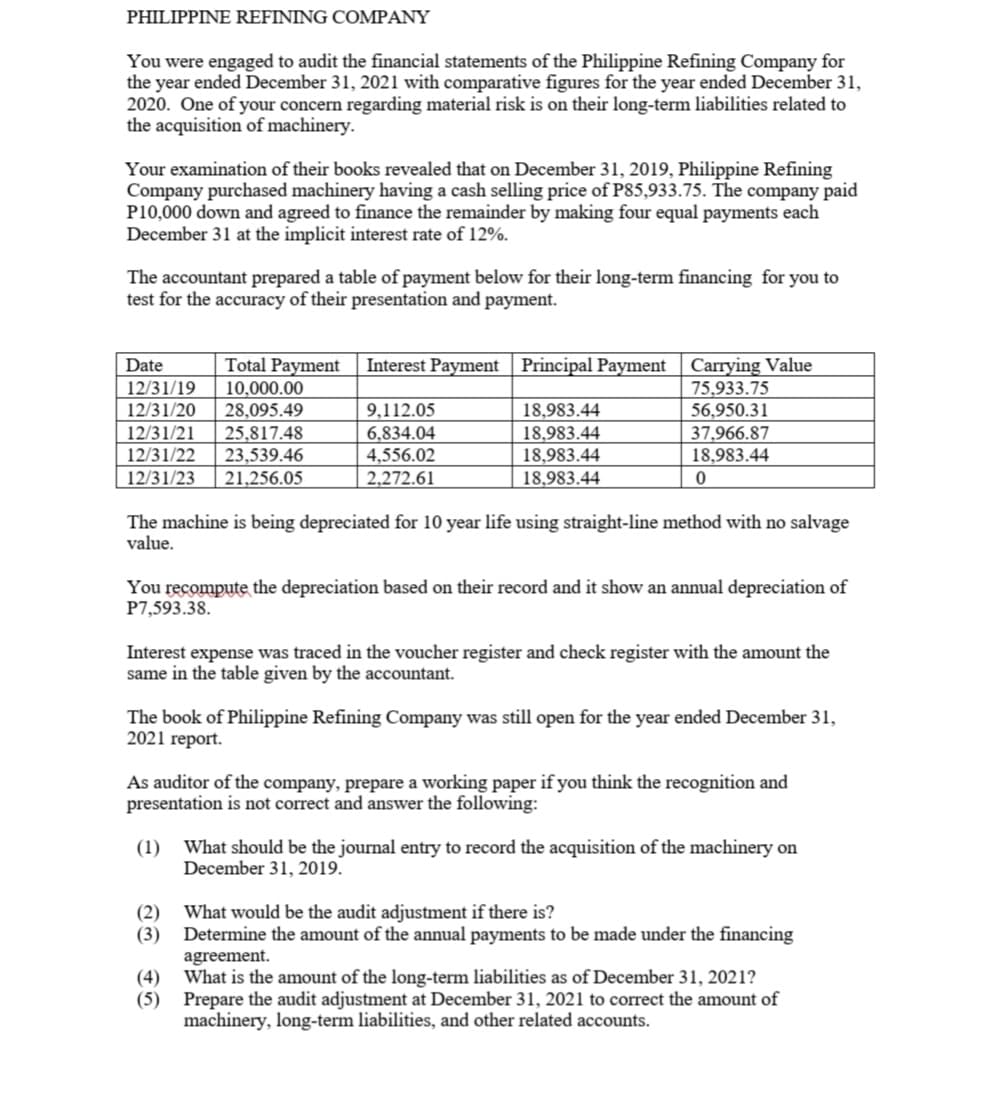

The accountant prepared a table of payment below for their long-term financing for you to

test for the accuracy of their presentation and payment.

Carrying Value

75,933.75

56,950.31

37,966.87

18,983.44

Interest Payment | Principal Payment

Total Payment

10,000.00

28,095.49

Date

12/31/19

12/31/20

12/31/21

9,112.05

18,983.44

25,817.48

23,539.46

21,256.05

6,834.04

4,556.02

18,983.44

18,983.44

18,983.44

12/31/22

12/31/23

2,272.61

The machine is being depreciated for 10 year life using straight-line method with no salvage

value.

You recompute the depreciation based on their record and it show an annual depreciation of

P7,593.38.

Interest expense was traced in the voucher register and check register with the amount the

same in the table given by the accountant.

The book of Philippine Refining Company was still open for the year ended December 31,

2021 report.

As auditor of the company, prepare a working paper if you think the recognition and

presentation is not correct and answer the following:

(1) What should be the journal entry to record the acquisition of the machinery on

December 31, 2019.

(2) What would be the audit adjustment if there is?

(3) Determine the amount of the annual payments to be made under the financing

agreement.

(4) What is the amount of the long-term liabilities as of December 31, 2021?

(5) Prepare the audit adjustment at December 31, 2021 to correct the amount of

machinery, long-term liabilities, and other related accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning