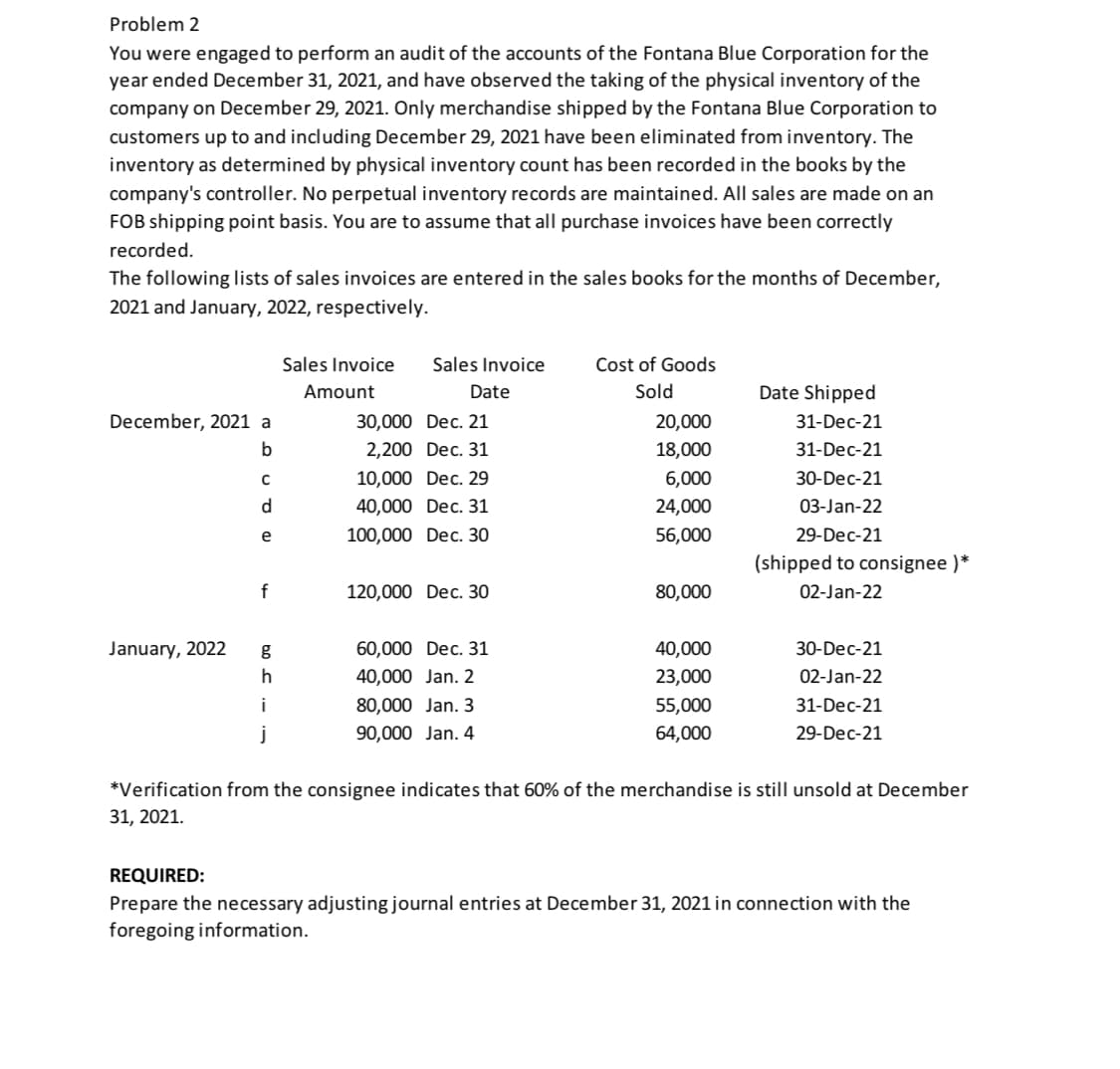

You were engaged to perform an audit of the accounts of the Fontana Blue Corporation for the year ended December 31, 2021, and have observed the taking of the physical inventory of the company on December 29, 2021. Only merchandise shipped by the Fontana Blue Corporation to customers up to and including December 29, 2021 have been eliminated from inventory. The inventory as determined by physical inventory count has been recorded in the books by the company's controller. No perpetual inventory records are maintained. All sales are made on an FOB shipping point basis. You are to assume that all purchase invoices have been correctly recorded. The following lists of sales invoices are entered in the sales books for the months of December, 2021 and January, 2022, respectively. Sales Invoice Sales Invoice Cost of Goods Amount Date Sold Date Shipped 20,000 18,000 December, 2021 a 30,000 Dec. 21 31-Dec-21 b 2,200 Dec. 31 31-Dec-21 10,000 Dec. 29 6,000 30-Dec-21 d 40,000 Dec. 31 24,000 03-Jan-22 e 100,000 Dec. 30 56,000 29-Dec-21 (shipped to consignee )* f 120,000 Dec. 30 80,000 02-Jan-22 January, 2022 60,000 Dec. 31 40,000 30-Dec-21 40,000 Jan. 2 23,000 02-Jan-22 i 80,000 Jan. 3 55,000 31-Dec-21 j 90,000 Jan. 4 64,000 29-Dec-21 *Verification from the consignee indicates that 60% of the merchandise is still unsold at December 31, 2021.

You were engaged to perform an audit of the accounts of the Fontana Blue Corporation for the year ended December 31, 2021, and have observed the taking of the physical inventory of the company on December 29, 2021. Only merchandise shipped by the Fontana Blue Corporation to customers up to and including December 29, 2021 have been eliminated from inventory. The inventory as determined by physical inventory count has been recorded in the books by the company's controller. No perpetual inventory records are maintained. All sales are made on an FOB shipping point basis. You are to assume that all purchase invoices have been correctly recorded. The following lists of sales invoices are entered in the sales books for the months of December, 2021 and January, 2022, respectively. Sales Invoice Sales Invoice Cost of Goods Amount Date Sold Date Shipped 20,000 18,000 December, 2021 a 30,000 Dec. 21 31-Dec-21 b 2,200 Dec. 31 31-Dec-21 10,000 Dec. 29 6,000 30-Dec-21 d 40,000 Dec. 31 24,000 03-Jan-22 e 100,000 Dec. 30 56,000 29-Dec-21 (shipped to consignee )* f 120,000 Dec. 30 80,000 02-Jan-22 January, 2022 60,000 Dec. 31 40,000 30-Dec-21 40,000 Jan. 2 23,000 02-Jan-22 i 80,000 Jan. 3 55,000 31-Dec-21 j 90,000 Jan. 4 64,000 29-Dec-21 *Verification from the consignee indicates that 60% of the merchandise is still unsold at December 31, 2021.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 23E

Related questions

Topic Video

Question

Transcribed Image Text:Problem 2

You were engaged to perform an audit of the accounts of the Fontana Blue Corporation for the

year ended December 31, 2021, and have observed the taking of the physical inventory of the

company on December 29, 2021. Only merchandise shipped by the Fontana Blue Corporation to

customers up to and including December 29, 2021 have been eliminated from inventory. The

inventory as determined by physical inventory count has been recorded in the books by the

company's controller. No perpetual inventory records are maintained. All sales are made on an

FOB shipping point basis. You are to assume that all purchase invoices have been correctly

recorded.

The following lists of sales invoices are entered in the sales books for the months of December,

2021 and January, 2022, respectively.

Sales Invoice

Sales Invoice

Cost of Goods

Amount

Date

Sold

Date Shipped

December, 2021 a

30,000 Dec. 21

20,000

31-Dec-21

2,200 Dec. 31

18,000

31-Dec-21

10,000 Dec. 29

6,000

30-Dec-21

d

40,000 Dec. 31

24,000

03-Jan-22

e

100,000 Dec. 30

56,000

29-Dec-21

(shipped to consignee )*

120,000 Dec. 30

80,000

02-Jan-22

January, 2022

60,000 Dec. 31

40,000

30-Dec-21

40,000 Jan. 2

23,000

02-Jan-22

80,000 Jan. 3

55,000

31-Dec-21

j

90,000 Jan. 4

64,000

29-Dec-21

*Verification from the consignee indicates that 60% of the merchandise is still unsold at December

31, 2021.

REQUIRED:

Prepare the necessary adjusting journal entries at December 31, 2021 in connection with the

foregoing information.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning