Your answer is partially correct. An independent contractor for a transportation company needs to determine whether she should upgrade the vehicle she currently owns or trade her vehicle in to lease a new vehicle. If she keeps her vehicle, she will need to invest in immediate upgrades that cost $5,200 and it will cost $1,300 per year to operate at the end of year that follows. She will keep the vehicle for 5 years; at the end of this period, the upgraded vehicle will have a salvage value of $3,800. Alternatively, she could trade in her vehicle to lease a new vehicle. She estimates that her current vehicle has a trade-in value of $9,800 and that there will be $4,100 due at lease signing. She further estimates that it willl cost $2,900 per year to lease and operate the vehicle. The independent contractor's MARR is 11%. Compute the EUAC of both the upgrade and lease alternatives using the insider perspective. Click here to access the TVM Factor Table Calculator. 1943.56 EUAC(keep): 1981.61 EUAC(lease): Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is +5. Which alternative would you recommend to the independent contractor? Trade in her vehicle and lease a new one %24 %24

Your answer is partially correct. An independent contractor for a transportation company needs to determine whether she should upgrade the vehicle she currently owns or trade her vehicle in to lease a new vehicle. If she keeps her vehicle, she will need to invest in immediate upgrades that cost $5,200 and it will cost $1,300 per year to operate at the end of year that follows. She will keep the vehicle for 5 years; at the end of this period, the upgraded vehicle will have a salvage value of $3,800. Alternatively, she could trade in her vehicle to lease a new vehicle. She estimates that her current vehicle has a trade-in value of $9,800 and that there will be $4,100 due at lease signing. She further estimates that it willl cost $2,900 per year to lease and operate the vehicle. The independent contractor's MARR is 11%. Compute the EUAC of both the upgrade and lease alternatives using the insider perspective. Click here to access the TVM Factor Table Calculator. 1943.56 EUAC(keep): 1981.61 EUAC(lease): Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is +5. Which alternative would you recommend to the independent contractor? Trade in her vehicle and lease a new one %24 %24

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter11: Simulation Models

Section: Chapter Questions

Problem 47P

Related questions

Question

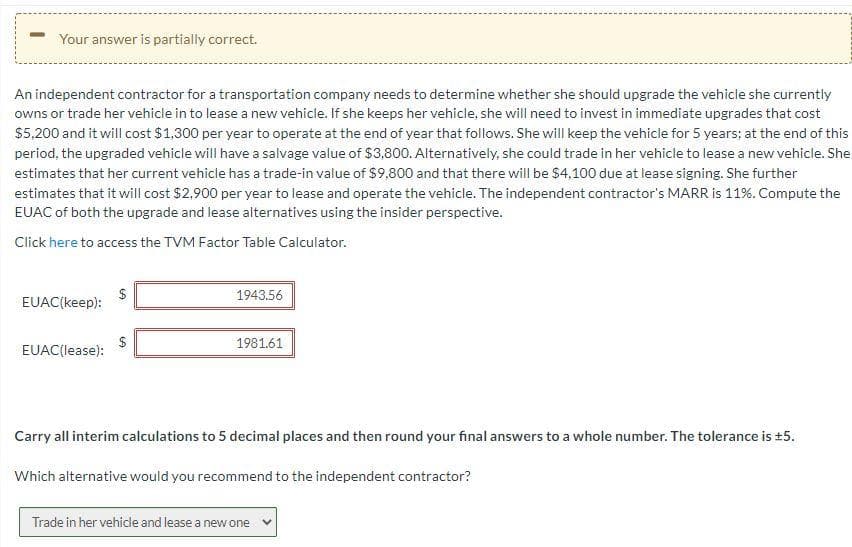

Transcribed Image Text:Your answer is partially correct.

An independent contractor for a transportation company needs to determine whether she should upgrade the vehicle she currently

owns or trade her vehicle in to lease a new vehicle. If she keeps her vehicle, she will need to invest in immediate upgrades that cost

$5,200 and it will cost $1,300 per year to operate at the end of year that follows. She will keep the vehicle for 5 years; at the end of this

period, the upgraded vehicle will have a salvage value of $3,800. Alternatively, she could trade in her vehicle to lease a new vehicle. She

estimates that her current vehicle has a trade-in value of $9,800 and that there will be $4,100 due at lease signing. She further

estimates that it will cost $2,900 per year to lease and operate the vehicle. The independent contractor's MARR is 11%. Compute the

EUAC of both the upgrade and lease alternatives using the insider perspective.

Click here to access the TVM Factor Table Calculator.

1943.56

EUAC(keep):

$

EUAC(lease):

1981.61

Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is +5.

Which alternative would you recommend to the independent contractor?

Trade in her vehicle and lease a new one

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning