Your association is thinking about running a venture which will $1000,000. The item from the venture is determined to make ince primary year after the end of the venture and of $420,000 in each of is valid for the net present estimation of the venture over the three yo of 10%? A. The net present value is positive, which makes the project attracti B. The net present value is positive, which makes the project unattra C. The net present value is negative, which makes the project attract

Your association is thinking about running a venture which will $1000,000. The item from the venture is determined to make ince primary year after the end of the venture and of $420,000 in each of is valid for the net present estimation of the venture over the three yo of 10%? A. The net present value is positive, which makes the project attracti B. The net present value is positive, which makes the project unattra C. The net present value is negative, which makes the project attract

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter5: Business And Economic Forecasting

Section: Chapter Questions

Problem 2E

Related questions

Question

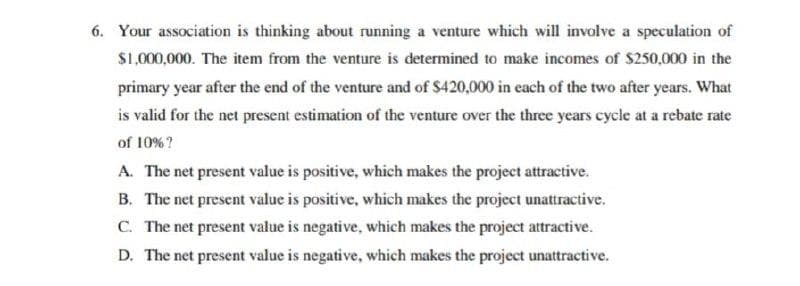

Transcribed Image Text:6. Your association is thinking about running a venture which will involve a speculation of

$1,000,000. The item from the venture is determined to make incomes of $250,000 in the

primary year after the end of the venture and of $420,000 in each of the two after years. What

is valid for the net present estimation of the venture over the three years cycle at a rebate rate

of 10%?

A. The net present value is positive, which makes the project attractive.

B. The net present value is positive, which makes the project unattractive.

C. The net present value is negative, which makes the project attractive.

D. The net present value is negative, which makes the project unattractive.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning