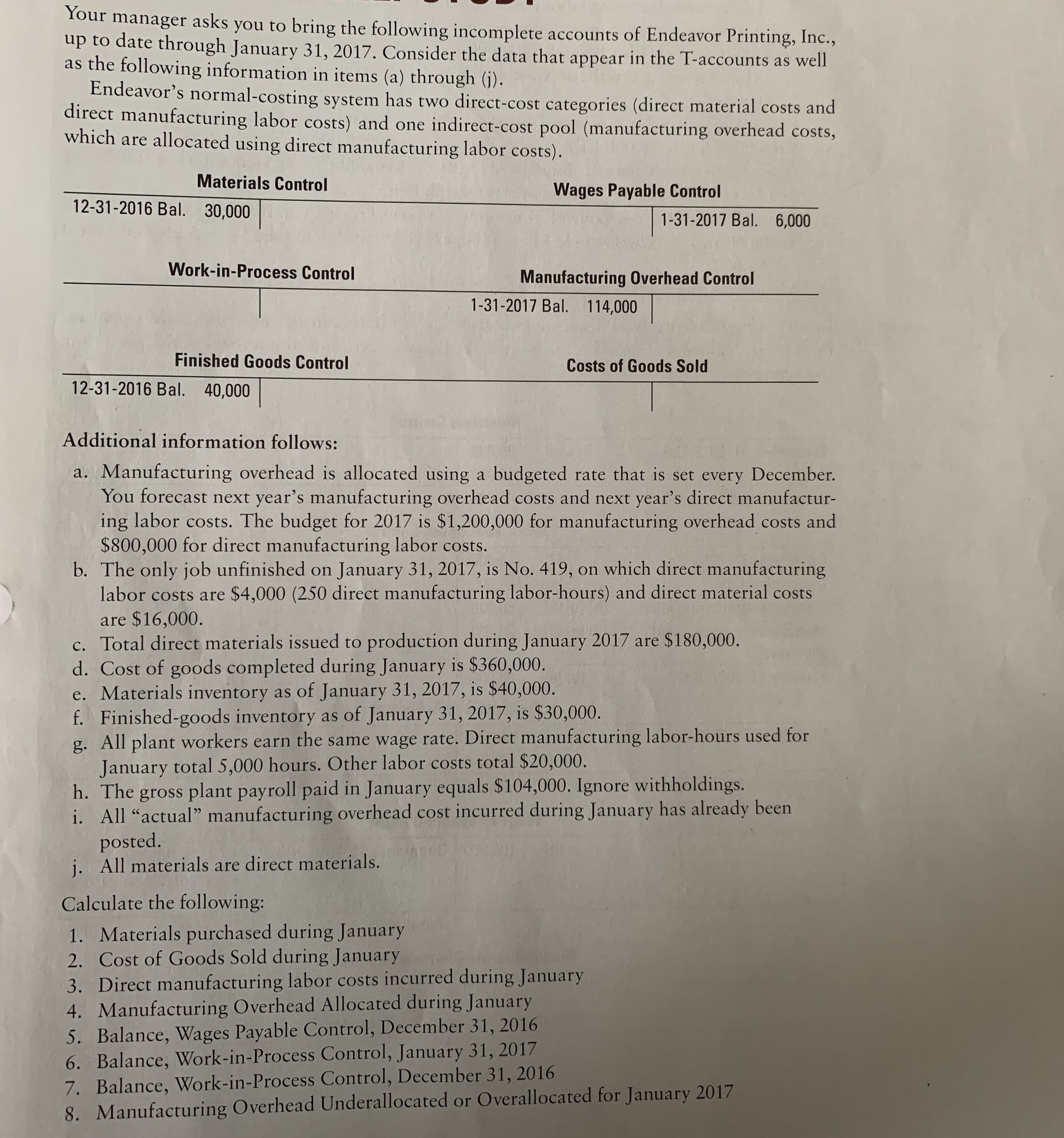

Your manager asks you to bring the following incomplete accounts of Endeavor Printing, Inc., up to date through January 31, 2017. Consider the data that appear in the T-accounts as well as the following information in items (a) through (j). Endeavor's normal-costing system has two direct-cost categories (direct material costs and direct manufacturing labor costs) and one indirect-cost pool (manufacturing overhead costs, which are allocated using direct manufacturing labor costs). Materials Control Wages Payable Control 12-31-2016 Bal. 30,000 1-31-2017 Bal. 6,000 Work-in-Process Control Manufacturing Overhead Control 1-31-2017 Bal. 114,000 Finished Goods Control Costs of Goods Sold 12-31-2016 Bal. 40,000 Additional information follows: a. Manufacturing overhead is allocated using a budgeted rate that is set every December. You forecast next year's manufacturing overhead costs and next year's direct manufactur- ing labor costs. The budget for 2017 is $1,200,000 for manufacturing overhead costs and $800,000 for direct manufacturing labor costs. b. The only job unfinished on labor costs are $4,000 (250 direct manufacturing labor-hours) and direct material costs $16,000. January 31, 2017, is No. 419, on which direct manufacturing are production during January 2017 are $180,000. c. Total direct materials issued to d. Cost of goods completed during January is $360,000. e. Materials inventory as of January 31, 2017, is $40,000. f. Finished-goods inventory as of January 31, 2017, is $30,000. g. All plant workers earn the same wage rate. Direct manufacturing labor-hours used for January total 5,000 hours. Other labor costs total $20,000. h. The gross plant payroll paid in January equals $104,000. Ignore withholdings. i. All "actual" manufacturing overhead cost incurred during January has already been posted. j. All materials are direct materials. Calculate the following: 1. Materials purchased during January 2. Cost of Goods Sold during January 3. Direct manufacturing labor costs incurred during January 4. Manufacturing Overhead Allocated during January 5. Balance, Wages Payable Control, December 31, 2016 6. Balance, Work-in-Process Control, January 31, 2017 7. Balance, Work-in-Process Control, December 31, 2016 8. Manufacturing Overhead Underallocated or Overallocated for January 2017

Your manager asks you to bring the following incomplete accounts of Endeavor Printing, Inc., up to date through January 31, 2017. Consider the data that appear in the T-accounts as well as the following information in items (a) through (j). Endeavor's normal-costing system has two direct-cost categories (direct material costs and direct manufacturing labor costs) and one indirect-cost pool (manufacturing overhead costs, which are allocated using direct manufacturing labor costs). Materials Control Wages Payable Control 12-31-2016 Bal. 30,000 1-31-2017 Bal. 6,000 Work-in-Process Control Manufacturing Overhead Control 1-31-2017 Bal. 114,000 Finished Goods Control Costs of Goods Sold 12-31-2016 Bal. 40,000 Additional information follows: a. Manufacturing overhead is allocated using a budgeted rate that is set every December. You forecast next year's manufacturing overhead costs and next year's direct manufactur- ing labor costs. The budget for 2017 is $1,200,000 for manufacturing overhead costs and $800,000 for direct manufacturing labor costs. b. The only job unfinished on labor costs are $4,000 (250 direct manufacturing labor-hours) and direct material costs $16,000. January 31, 2017, is No. 419, on which direct manufacturing are production during January 2017 are $180,000. c. Total direct materials issued to d. Cost of goods completed during January is $360,000. e. Materials inventory as of January 31, 2017, is $40,000. f. Finished-goods inventory as of January 31, 2017, is $30,000. g. All plant workers earn the same wage rate. Direct manufacturing labor-hours used for January total 5,000 hours. Other labor costs total $20,000. h. The gross plant payroll paid in January equals $104,000. Ignore withholdings. i. All "actual" manufacturing overhead cost incurred during January has already been posted. j. All materials are direct materials. Calculate the following: 1. Materials purchased during January 2. Cost of Goods Sold during January 3. Direct manufacturing labor costs incurred during January 4. Manufacturing Overhead Allocated during January 5. Balance, Wages Payable Control, December 31, 2016 6. Balance, Work-in-Process Control, January 31, 2017 7. Balance, Work-in-Process Control, December 31, 2016 8. Manufacturing Overhead Underallocated or Overallocated for January 2017

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter6: Process Cost Accounting—additional Procedures; Accounting For Joint Products And By-products

Section: Chapter Questions

Problem 3E: The following data appeared in the accounting records of Craig Manufacturing Inc., which uses the...

Related questions

Question

Transcribed Image Text:Your manager asks you to bring the following incomplete accounts of Endeavor Printing, Inc.,

up to date through January 31, 2017. Consider the data that appear in the T-accounts as well

as the following information in items (a) through (j).

Endeavor's normal-costing system has two direct-cost categories (direct material costs and

direct manufacturing labor costs) and one indirect-cost pool (manufacturing overhead costs,

which are allocated using direct manufacturing labor costs).

Materials Control

Wages Payable Control

12-31-2016 Bal. 30,000

1-31-2017 Bal. 6,000

Work-in-Process Control

Manufacturing Overhead Control

1-31-2017 Bal. 114,000

Finished Goods Control

Costs of Goods Sold

12-31-2016 Bal. 40,000

Additional information follows:

a. Manufacturing overhead is allocated using a budgeted rate that is set every December.

You forecast next year's manufacturing overhead costs and next year's direct manufactur-

ing labor costs. The budget for 2017 is $1,200,000 for manufacturing overhead costs and

$800,000 for direct manufacturing labor costs.

b. The only job unfinished on

labor costs are $4,000 (250 direct manufacturing labor-hours) and direct material costs

$16,000.

January 31, 2017, is No. 419, on which direct manufacturing

are

production during January 2017 are $180,000.

c. Total direct materials issued to

d. Cost of goods completed during January is $360,000.

e. Materials inventory as of January 31, 2017, is $40,000.

f. Finished-goods inventory as of January 31, 2017, is $30,000.

g. All plant workers earn the same wage rate. Direct manufacturing labor-hours used for

January total 5,000 hours. Other labor costs total $20,000.

h. The gross plant payroll paid in January equals $104,000. Ignore withholdings.

i. All "actual" manufacturing overhead cost incurred during January has already been

posted.

j. All materials are direct materials.

Calculate the following:

1. Materials purchased during January

2. Cost of Goods Sold during January

3. Direct manufacturing labor costs incurred during January

4. Manufacturing Overhead Allocated during January

5. Balance, Wages Payable Control, December 31, 2016

6. Balance, Work-in-Process Control, January 31, 2017

7. Balance, Work-in-Process Control, December 31, 2016

8. Manufacturing Overhead Underallocated or Overallocated for January 2017

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning